The ASX 200 traded flat today after inflation data came in below forecasts at 2.1%, with Financials leading the sectors and Materials lagging significantly. In such a mixed market landscape, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and growth potential. Penny stocks, though an older term, still represent smaller or newer companies that can offer surprising value when backed by robust financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.49 | A$117.46M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.34M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.73 | A$420.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.795 | A$474.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.74 | A$881.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$352.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.645 | A$806.18M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$225.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.28 | A$155.64M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.75 | A$140.95M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 472 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Duratec (ASX:DUR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Duratec Limited, with a market cap of A$371.01 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: The company's revenue is primarily derived from its Defence segment at A$193.48 million, followed by Mining & Industrial at A$144.05 million, Buildings & Facades at A$113.64 million, and Energy at A$62.54 million.

Market Cap: A$371.01M

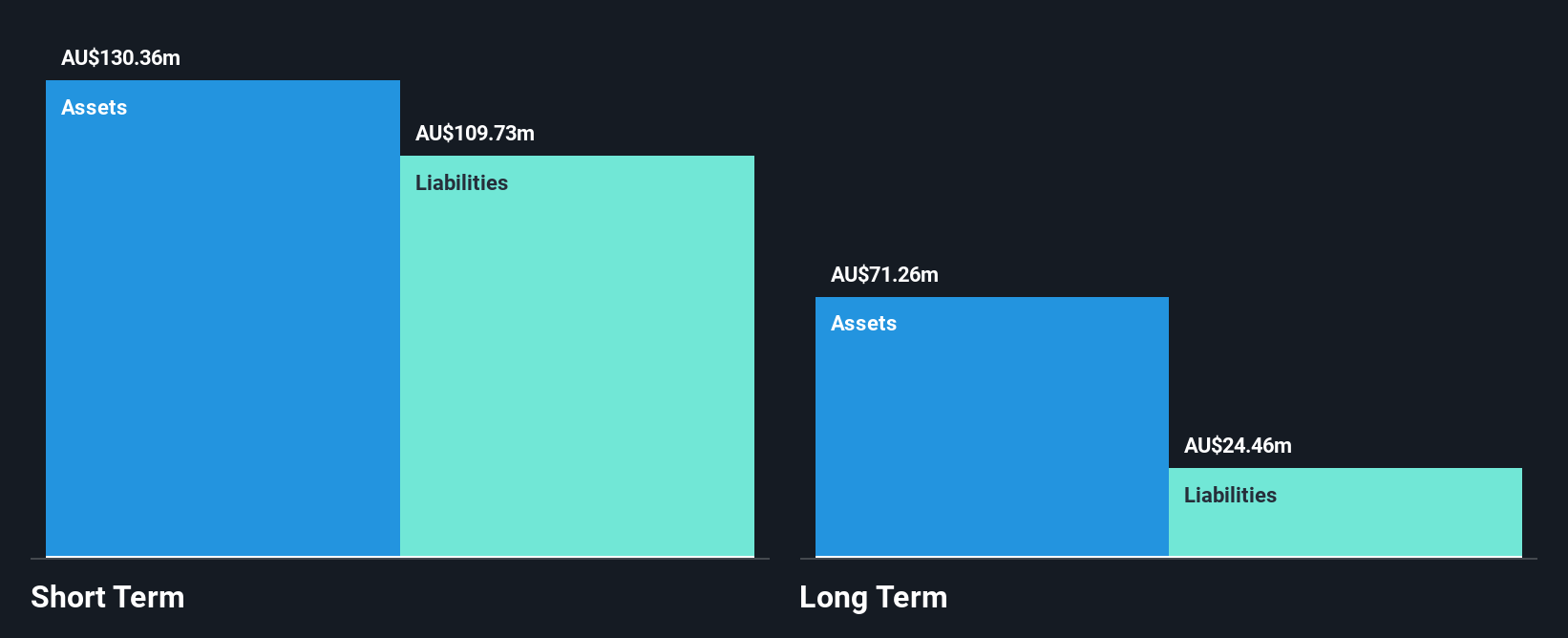

Duratec Limited, with a market cap of A$371.01 million, has shown significant earnings growth over the past five years at 26.7% annually, although it experienced negative earnings growth in the last year. The company maintains high-quality earnings and a strong financial position, with short-term assets exceeding both short-term and long-term liabilities. Its debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT. Despite stable weekly volatility and an experienced management team, Duratec's net profit margins have slightly declined to 4%, and its stock trades below estimated fair value by 22.8%.

- Click here to discover the nuances of Duratec with our detailed analytical financial health report.

- Evaluate Duratec's prospects by accessing our earnings growth report.

Johns Lyng Group (ASX:JLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Johns Lyng Group Limited is a company offering integrated building services across Australia, New Zealand, and the United States with a market capitalization of A$855 million.

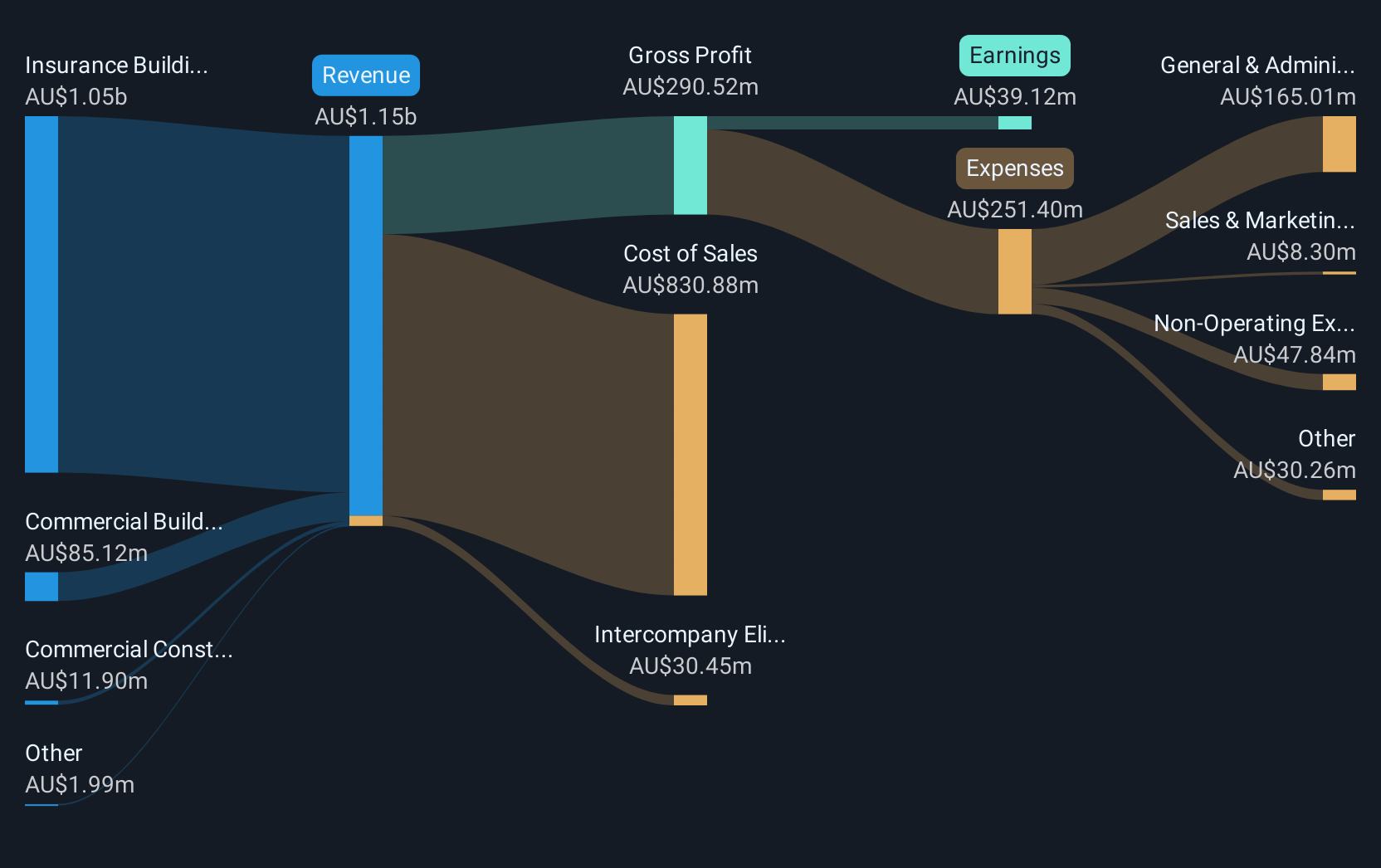

Operations: The company's revenue is primarily driven by Insurance Building and Restoration Services at A$1.05 billion, complemented by Commercial Building Services generating A$85.12 million, and a smaller contribution from Commercial Construction totaling A$11.90 million.

Market Cap: A$855M

Johns Lyng Group, with a market cap of A$855 million, primarily generates revenue from its Insurance Building and Restoration Services. Despite experiencing negative earnings growth last year, its earnings have grown significantly over the past five years. The company trades at a substantial discount to estimated fair value but faces challenges such as low return on equity and increased debt levels over time. While short-term assets exceed liabilities, operating cash flow does not sufficiently cover debt. Recent M&A interest from PEP advisory services highlights potential strategic shifts. The management team and board are experienced, though dividend coverage by free cash flow is weak.

- Get an in-depth perspective on Johns Lyng Group's performance by reading our balance sheet health report here.

- Assess Johns Lyng Group's future earnings estimates with our detailed growth reports.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia and has a market cap of A$282.14 million.

Operations: The company generates revenue through three main segments: Workforce Solutions (A$32.30 million), Government and Justice (A$43.21 million), and Education and Work Pathways (A$41.90 million).

Market Cap: A$282.14M

ReadyTech Holdings, with a market cap of A$282.14 million, is experiencing financial challenges despite its stable weekly volatility. The company is currently unprofitable and has a negative return on equity of -11.19%. While its net debt to equity ratio is satisfactory at 22.3%, short-term assets do not cover either short or long-term liabilities, posing liquidity concerns. Analysts suggest the stock trades significantly below fair value, with expectations for substantial growth in earnings at 60.28% per year. Recent executive changes include the planned departure of CFO Nimesh Shah as the company seeks a successor globally.

- Navigate through the intricacies of ReadyTech Holdings with our comprehensive balance sheet health report here.

- Learn about ReadyTech Holdings' future growth trajectory here.

Where To Now?

- Click through to start exploring the rest of the 469 ASX Penny Stocks now.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RDY

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives