- Australia

- /

- Aerospace & Defense

- /

- ASX:HCL

HighCom Limited's (ASX:HCL) Shares Climb 40% But Its Business Is Yet to Catch Up

HighCom Limited (ASX:HCL) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 53% share price drop in the last twelve months.

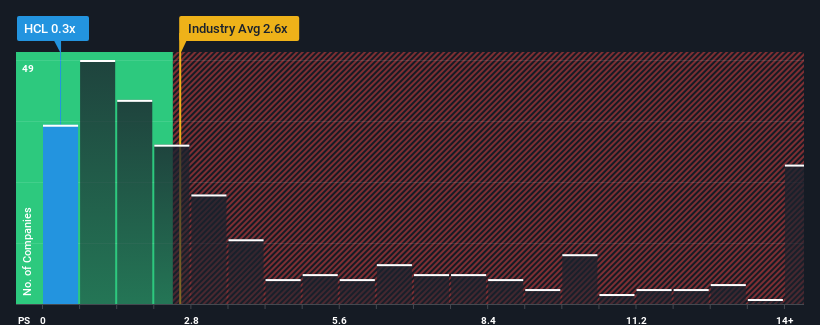

In spite of the firm bounce in price, there still wouldn't be many who think HighCom's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Australia's Aerospace & Defense industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for HighCom

What Does HighCom's Recent Performance Look Like?

HighCom hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think HighCom's future stacks up against the industry? In that case, our free report is a great place to start.How Is HighCom's Revenue Growth Trending?

In order to justify its P/S ratio, HighCom would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 41%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 43% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 8.8% during the coming year according to the sole analyst following the company. Meanwhile, the broader industry is forecast to expand by 7.0%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that HighCom's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From HighCom's P/S?

HighCom's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of HighCom's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with HighCom, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HighCom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HCL

HighCom

Provides armors and technologies for defense sectors in Australia, the Asia Pacific, North America, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026