The Australian market recently experienced a brief surge following the Reserve Bank of Australia's decision to hold interest rates steady, though it settled into a slightly negative territory by the day's end. In such fluctuating conditions, identifying promising investments requires a keen eye for companies with strong financial foundations. Penny stocks, although an older term, remain relevant as they often represent smaller or newer companies that can offer unique opportunities for growth and value. In this article, we will explore three penny stocks that may present compelling prospects due to their solid balance sheets and potential for future success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.385 | A$110.34M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.605 | A$75.71M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$49.19M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$444.16M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.21 | A$237.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.98M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.74 | A$3.13B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.90 | A$129.54M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.44 | A$639.96M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 421 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology, with a market cap of A$232.90 million.

Operations: The company generates revenue of NZ$90.40 million from its operations in developing, manufacturing, and selling products for soft tissue repair.

Market Cap: A$232.9M

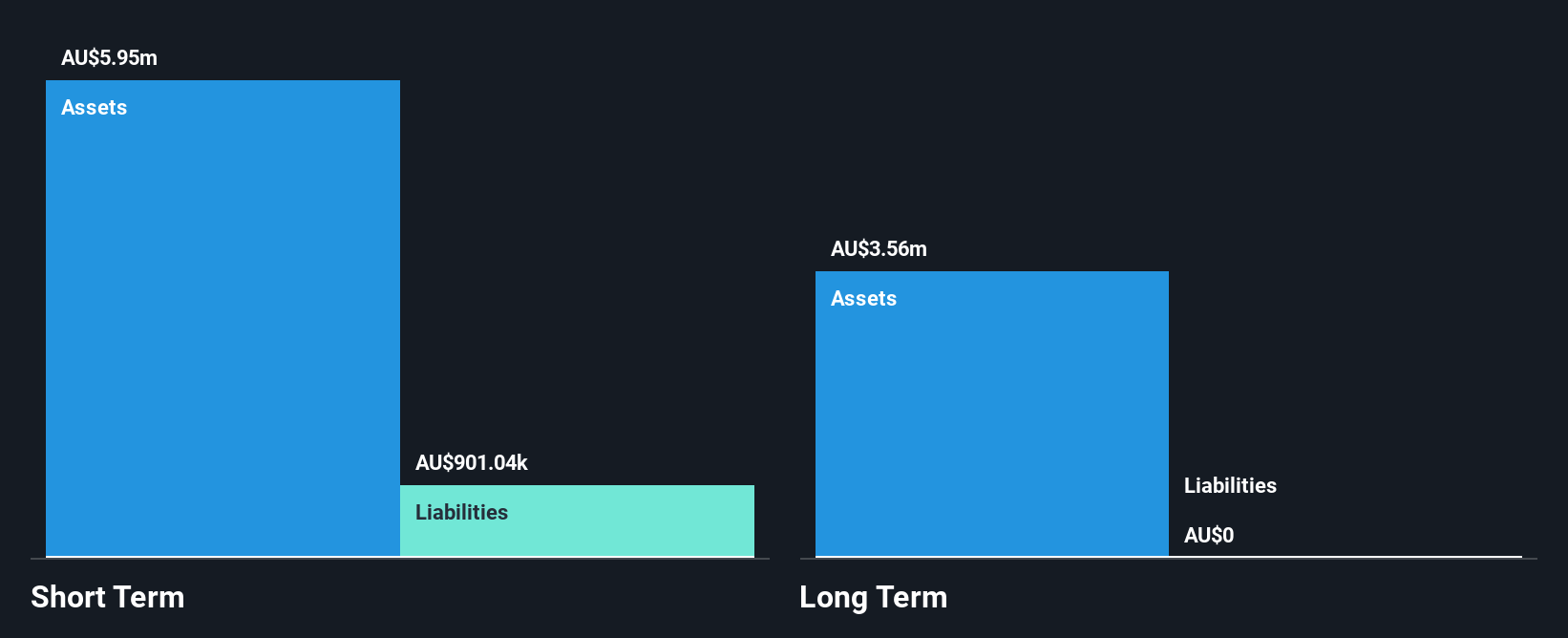

Aroa Biosurgery Limited, with a market cap of A$232.90 million, has demonstrated resilience despite being unprofitable. The company reported NZ$44.86 million in sales for the half year ending September 2025, reducing its net loss to NZ$1.3 million from NZ$3.29 million the previous year. Its short-term assets comfortably cover liabilities, and it remains debt-free with a sufficient cash runway exceeding three years. Analysts expect earnings to grow significantly, while recent revenue guidance indicates continued growth driven by strong product performance. Recent board changes include appointing Paul Shearer as a Non-Executive Director, enhancing leadership with his extensive industry experience.

- Navigate through the intricacies of Aroa Biosurgery with our comprehensive balance sheet health report here.

- Examine Aroa Biosurgery's earnings growth report to understand how analysts expect it to perform.

Caravel Minerals (ASX:CVV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Caravel Minerals Limited, with a market cap of A$148.07 million, explores for mineral tenements in Western Australia through its subsidiaries.

Operations: Caravel Minerals Limited does not report any revenue segments.

Market Cap: A$148.07M

Caravel Minerals Limited, with a market cap of A$148.07 million, is pre-revenue and currently unprofitable, reporting a net loss of A$7.45 million for the year ending June 30, 2025. Despite having no long-term liabilities and being debt-free, the company faces financial challenges with less than one year of cash runway based on current free cash flow. The management team and board are experienced but face doubts about the company's ability to continue as a going concern according to their auditor's recent report. Shareholders have not faced significant dilution in the past year despite ongoing losses.

- Click to explore a detailed breakdown of our findings in Caravel Minerals' financial health report.

- Understand Caravel Minerals' earnings outlook by examining our growth report.

Electro Optic Systems Holdings (ASX:EOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Electro Optic Systems Holdings Limited develops, manufactures, and sells telescopes and dome enclosures, laser satellite tracking systems, and remote weapon systems with a market cap of A$881.79 million.

Operations: The company generates revenue from two primary segments: Defence, contributing A$103.13 million, and Space, accounting for A$11.99 million.

Market Cap: A$881.79M

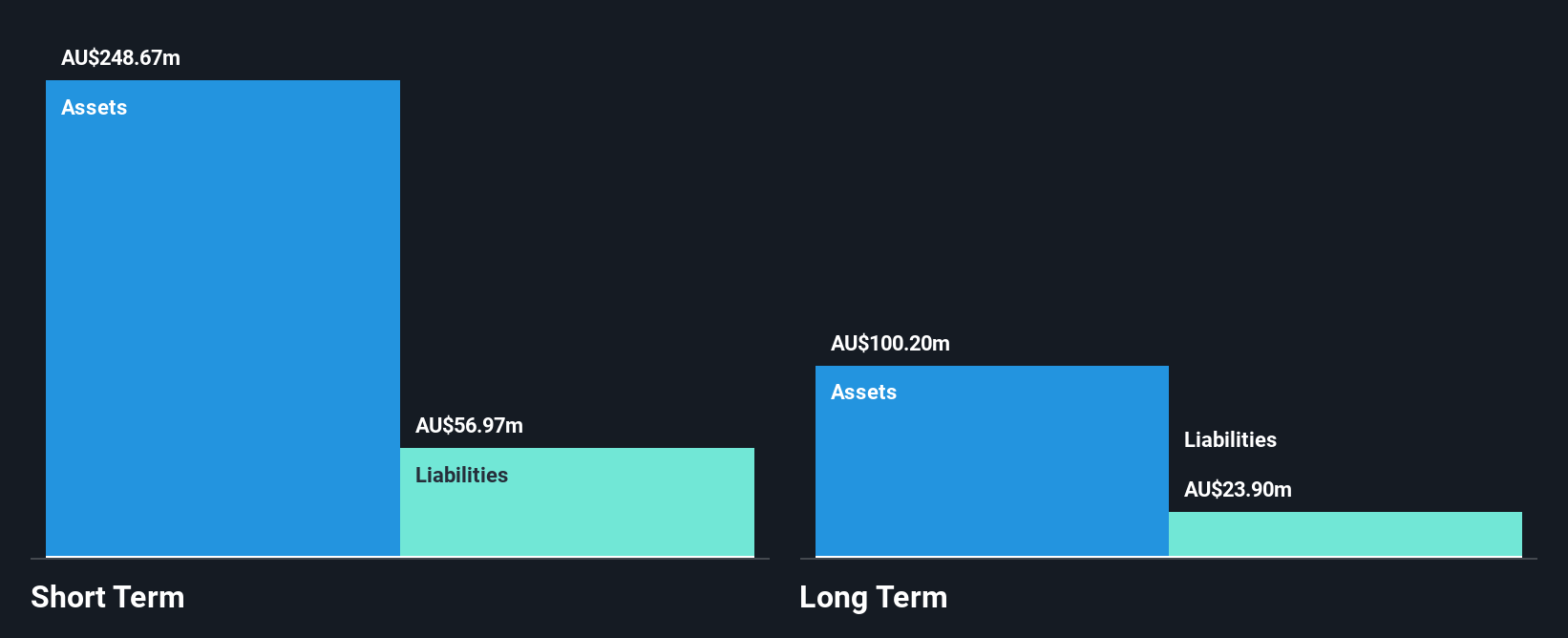

Electro Optic Systems Holdings, with a market cap of A$881.79 million, operates in the defense and space sectors, generating revenues of A$103.13 million and A$11.99 million respectively. The company is debt-free and has a cash runway exceeding three years based on its current free cash flow. Despite being unprofitable with increasing losses over the past five years, EOS's short-term assets significantly cover both short- and long-term liabilities. Recently added to the S&P/ASX Small Ordinaries and 300 Indexes, EOS remains undervalued at 66.6% below estimated fair value while maintaining stable weekly volatility over the past year.

- Jump into the full analysis health report here for a deeper understanding of Electro Optic Systems Holdings.

- Learn about Electro Optic Systems Holdings' future growth trajectory here.

Seize The Opportunity

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 418 more companies for you to explore.Click here to unveil our expertly curated list of 421 ASX Penny Stocks.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARX

Aroa Biosurgery

Develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix (ECM) technology in the United States and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026