- Australia

- /

- Medical Equipment

- /

- ASX:PNV

ASX Stocks Estimated Below Fair Value To Watch In May 2025

Reviewed by Simply Wall St

The Australian market has recently experienced a boost, with the ASX200 closing up 0.58% following a rate cut by the Reserve Bank of Australia, highlighting strength in sectors such as IT and Real Estate. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities to capitalize on potential gains, especially when certain sectors are showing resilience and growth prospects amidst broader economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$0.975 | A$1.76 | 44.6% |

| Lynas Rare Earths (ASX:LYC) | A$7.62 | A$13.43 | 43.3% |

| Austal (ASX:ASB) | A$5.02 | A$9.20 | 45.4% |

| Charter Hall Group (ASX:CHC) | A$17.98 | A$34.25 | 47.5% |

| SciDev (ASX:SDV) | A$0.36 | A$0.68 | 47.1% |

| Polymetals Resources (ASX:POL) | A$0.79 | A$1.52 | 48% |

| Genesis Minerals (ASX:GMD) | A$3.89 | A$6.75 | 42.4% |

| Pantoro Gold (ASX:PNR) | A$3.15 | A$5.42 | 41.9% |

| PointsBet Holdings (ASX:PBH) | A$1.095 | A$2.08 | 47.3% |

| Superloop (ASX:SLC) | A$2.57 | A$4.52 | 43.1% |

Let's explore several standout options from the results in the screener.

Duratec (ASX:DUR)

Overview: Duratec Limited, with a market cap of A$396.25 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: The company's revenue segments are comprised of Energy (A$62.54 million), Defence (A$193.48 million), Buildings & Facades (A$113.64 million), and Mining & Industrial (A$144.05 million).

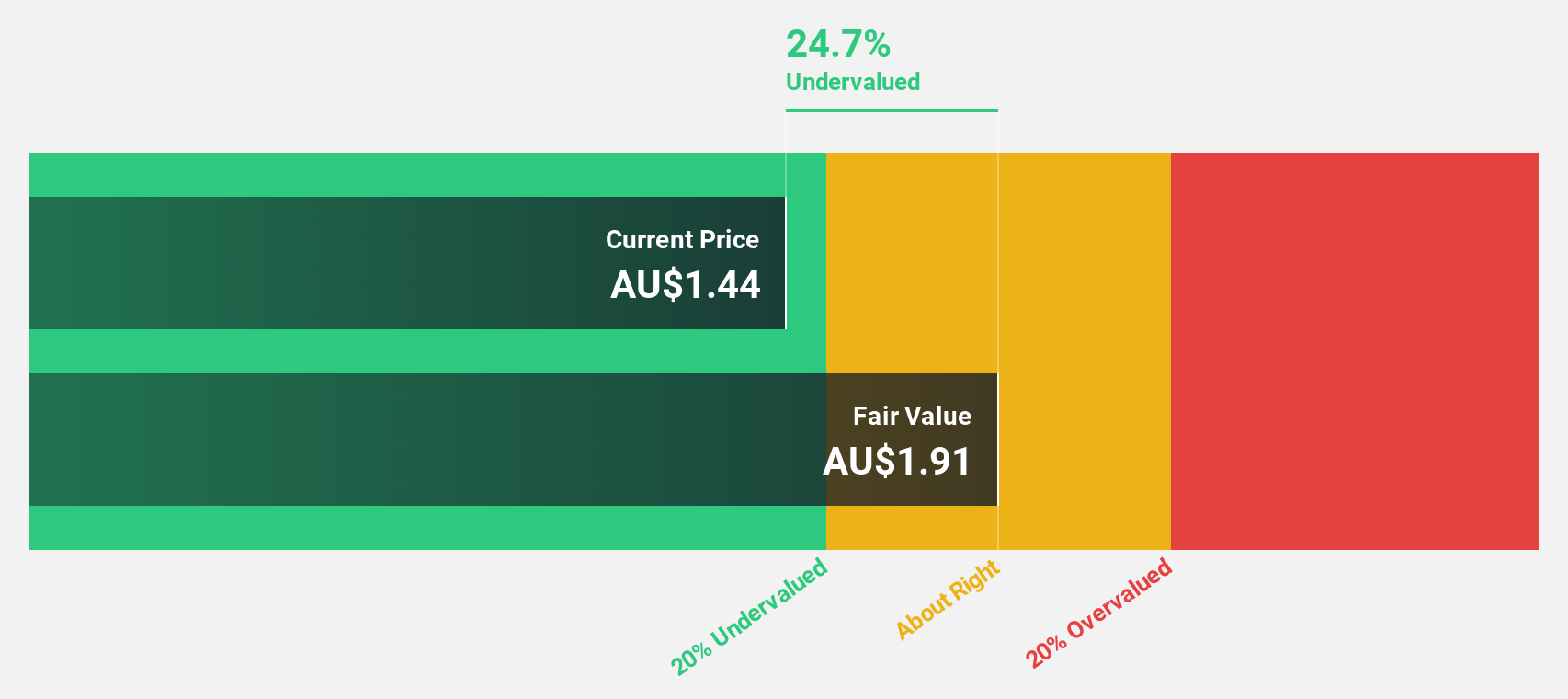

Estimated Discount To Fair Value: 23.4%

Duratec is trading at A$1.57, significantly below its estimated fair value of A$2.05, indicating potential undervaluation based on cash flows. Analysts expect the stock price to rise by 22.7%, supported by forecasted earnings growth of 15.46% annually, outpacing the Australian market's 11.7%. Revenue growth is projected at 9.4% per year, exceeding the market average of 5.5%. Duratec's return on equity is anticipated to be high in three years at 34.8%.

- Insights from our recent growth report point to a promising forecast for Duratec's business outlook.

- Take a closer look at Duratec's balance sheet health here in our report.

Mader Group (ASX:MAD)

Overview: Mader Group Limited is a contracting company offering specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of A$1.24 billion.

Operations: The company's revenue primarily comes from its Staffing & Outsourcing Services segment, which generated A$811.54 million.

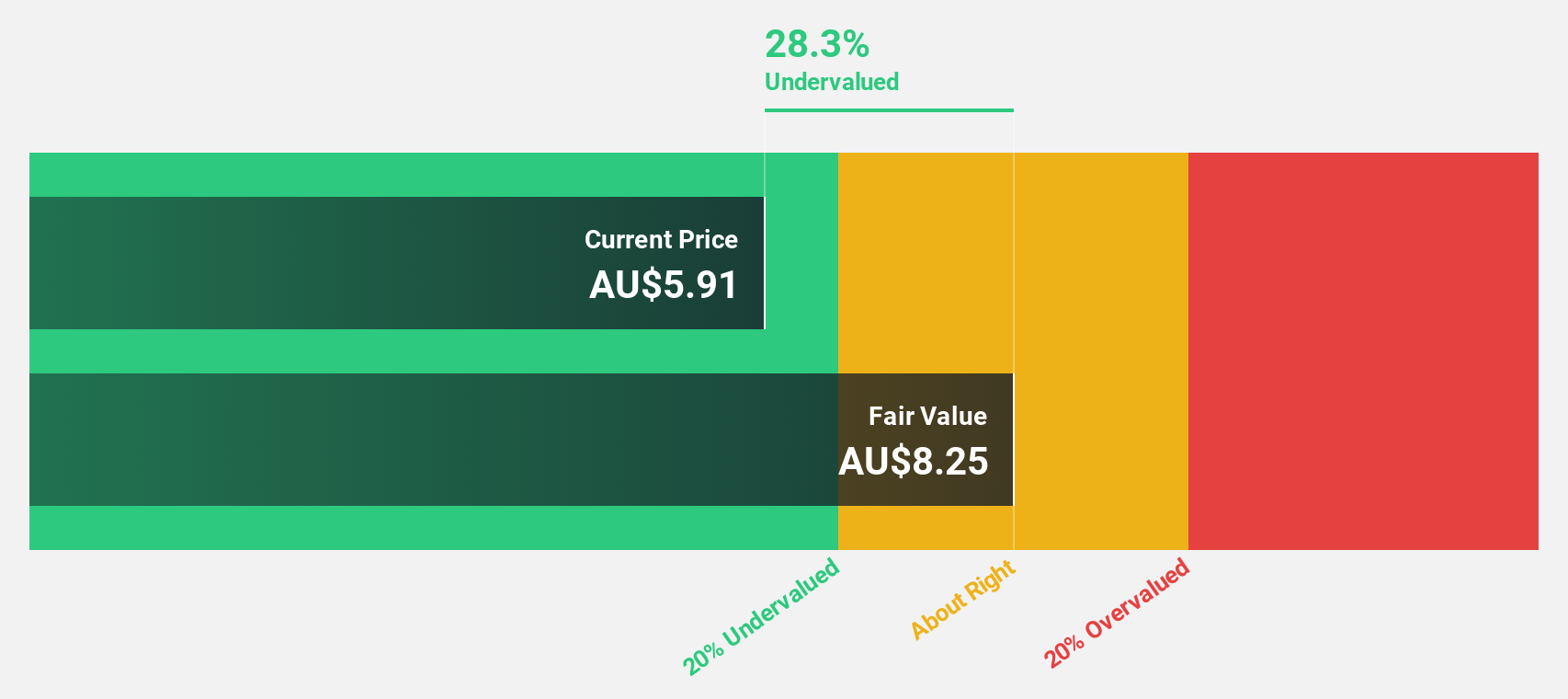

Estimated Discount To Fair Value: 23.8%

Mader Group is trading at A$6.15, below its estimated fair value of A$8.07, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 13.48% annually, surpassing the Australian market's 11.7%. Despite significant insider selling recently, Mader reaffirmed its fiscal year 2025 guidance with expected revenue of at least A$870 million and NPAT of at least A$57 million, supporting a robust financial outlook amidst strong past earnings growth.

- The analysis detailed in our Mader Group growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Mader Group.

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of A$949.91 million.

Operations: The company's revenue primarily comes from the development, manufacturing, and commercialization of the NovoSorb technology, amounting to A$115.58 million.

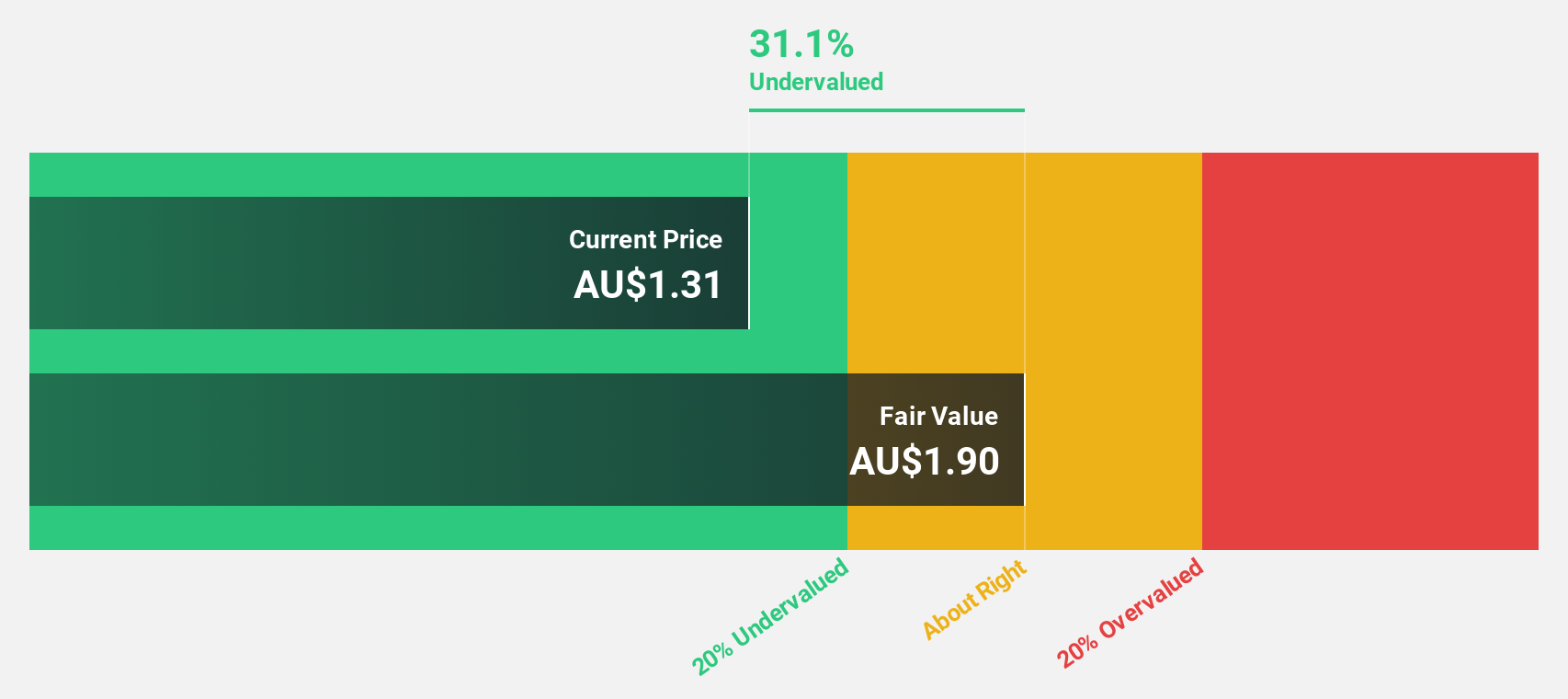

Estimated Discount To Fair Value: 28.0%

PolyNovo, trading at A$1.38, is below its estimated fair value of A$1.91, suggesting undervaluation based on cash flows. The company's earnings have grown significantly by 270.2% over the past year and are forecast to increase by 39.6% annually, outpacing the Australian market's growth rate of 11.7%. Recent unaudited results show strong revenue growth with A$91.6 million reported for the year to date as of March 31, 2025.

- Our expertly prepared growth report on PolyNovo implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in PolyNovo's balance sheet health report.

Key Takeaways

- Discover the full array of 39 Undervalued ASX Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNV

PolyNovo

Designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally.

High growth potential with proven track record.

Market Insights

Community Narratives