- Australia

- /

- Specialty Stores

- /

- ASX:CTT

ASX Growth Stocks With Insider Ownership Up To 33%

Reviewed by Simply Wall St

In the last week, the Australian market has stayed flat while the Materials sector gained 6.9%. Over the past 12 months, the market has risen by 15% with earnings forecasted to grow by 12% annually. In this environment, companies with strong insider ownership can be particularly appealing as they often indicate confidence from those closest to the business. Here are three ASX growth stocks that boast insider ownership of up to 33%.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's explore several standout options from the results in the screener.

Cettire (ASX:CTT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cettire Limited operates an online luxury goods retailing business in Australia, the United States, and internationally, with a market cap of A$731.98 million.

Operations: Cettire's revenue from online retail sales amounts to A$742.26 million.

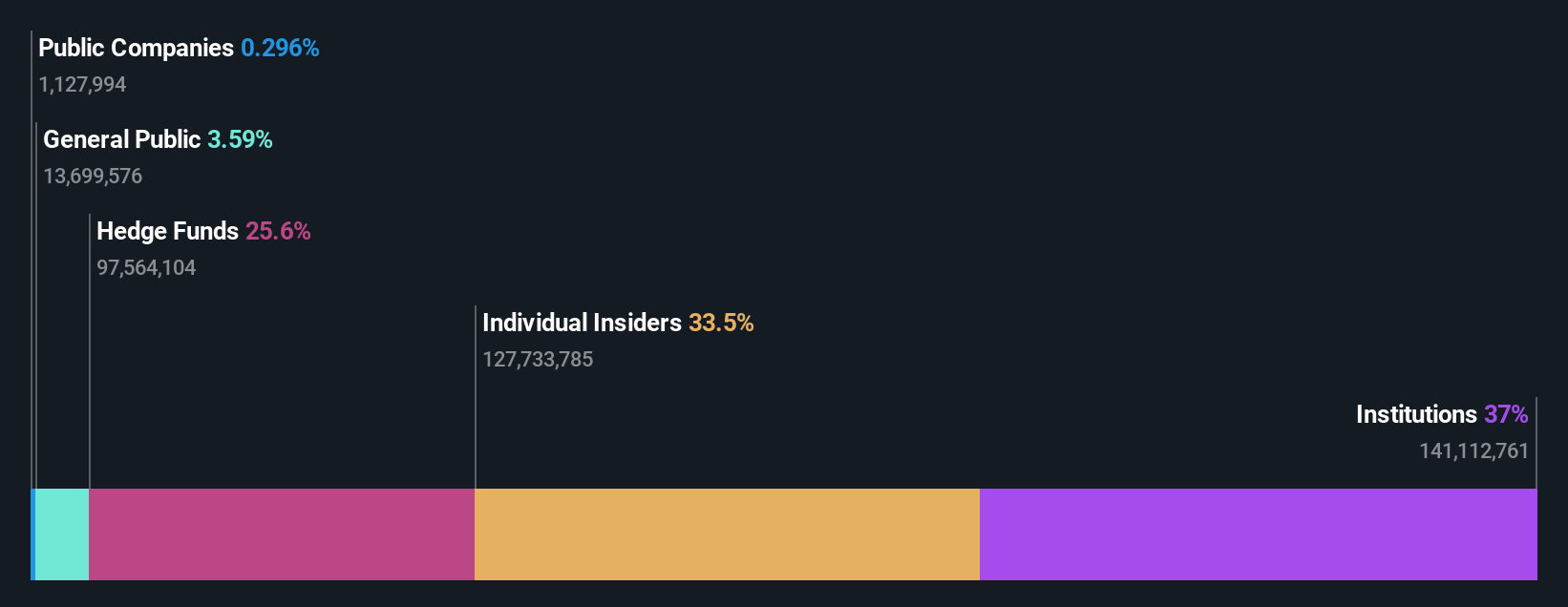

Insider Ownership: 33.8%

Cettire Limited, a growth company with high insider ownership, recently appointed Caroline Elliott and Jon Gidney as independent non-executive directors. The company reported A$742.26 million in sales for FY2024, up from A$416.23 million the previous year, although net income decreased to A$10.47 million from A$15.97 million. Despite volatile share prices and lower profit margins (1.4%), Cettire's earnings are forecast to grow 29% annually, outpacing the Australian market's 12.2%.

- Get an in-depth perspective on Cettire's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Cettire is trading beyond its estimated value.

Duratec (ASX:DUR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Duratec Limited (ASX:DUR) provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure in Australia and has a market cap of A$365.11 million.

Operations: Duratec's revenue segments include Energy (A$46.64 million), Defence (A$220.16 million), Buildings & Facades (A$111.33 million), and Mining & Industrial (A$155.64 million).

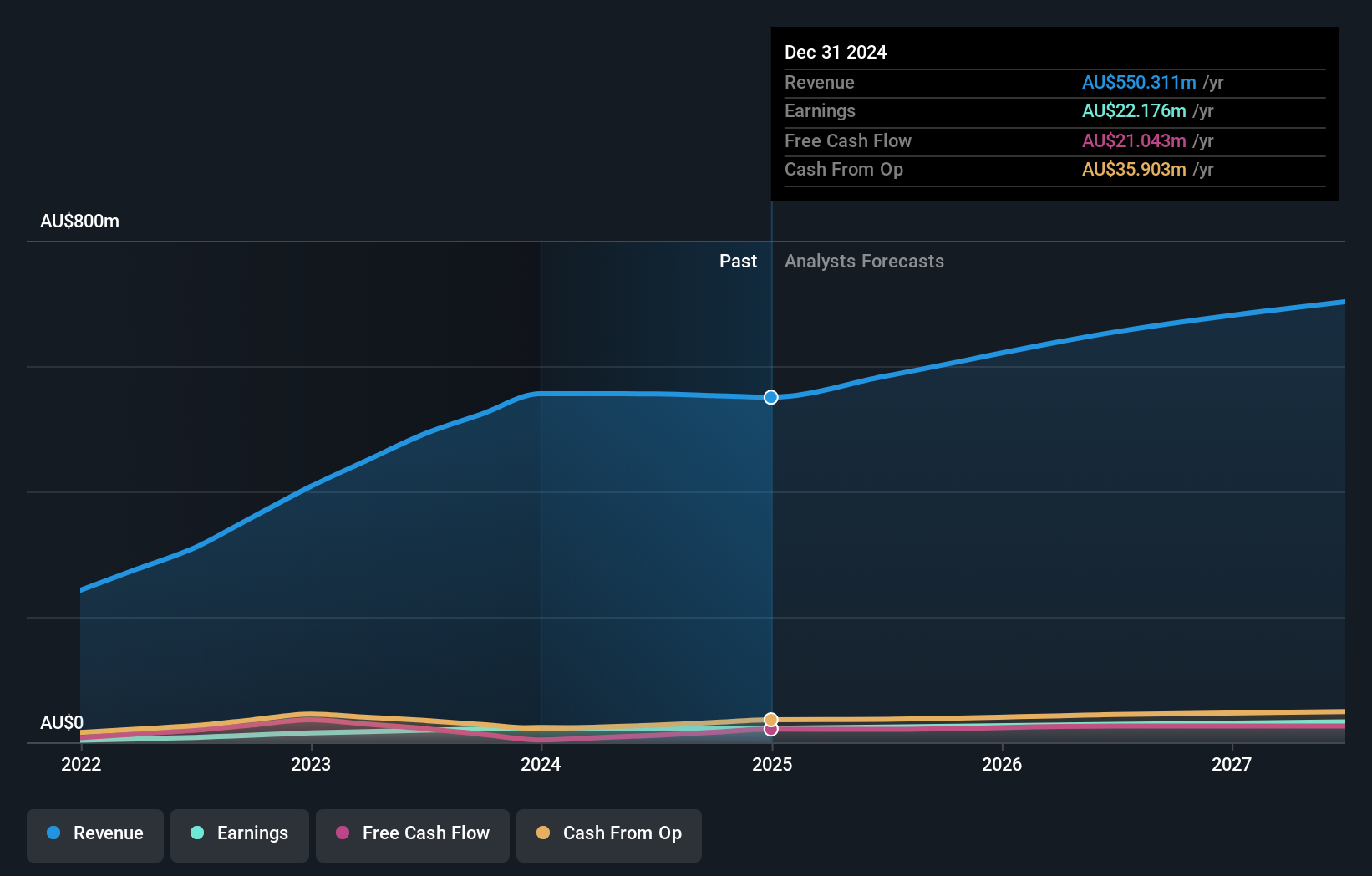

Insider Ownership: 31.8%

Duratec has shown consistent earnings growth, with a 24.8% annual increase over the past five years and forecasted 13.22% annual growth, surpassing the Australian market's 12.2%. Despite trading at 43.5% below its estimated fair value, revenue is expected to grow at a slower rate of 7.3%. Recent inclusion in the S&P Global BMI Index and solid revenue guidance for FY2025 support its growth trajectory. However, dividend sustainability remains a concern due to inadequate free cash flow coverage.

- Take a closer look at Duratec's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Duratec is trading behind its estimated value.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$8.41 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: The company's revenue segments include Energy (A$16 million), Lithium (A$1.41 billion), Iron Ore (A$2.58 billion), Mining Services (A$3.38 billion), and Other Commodities (A$19 million).

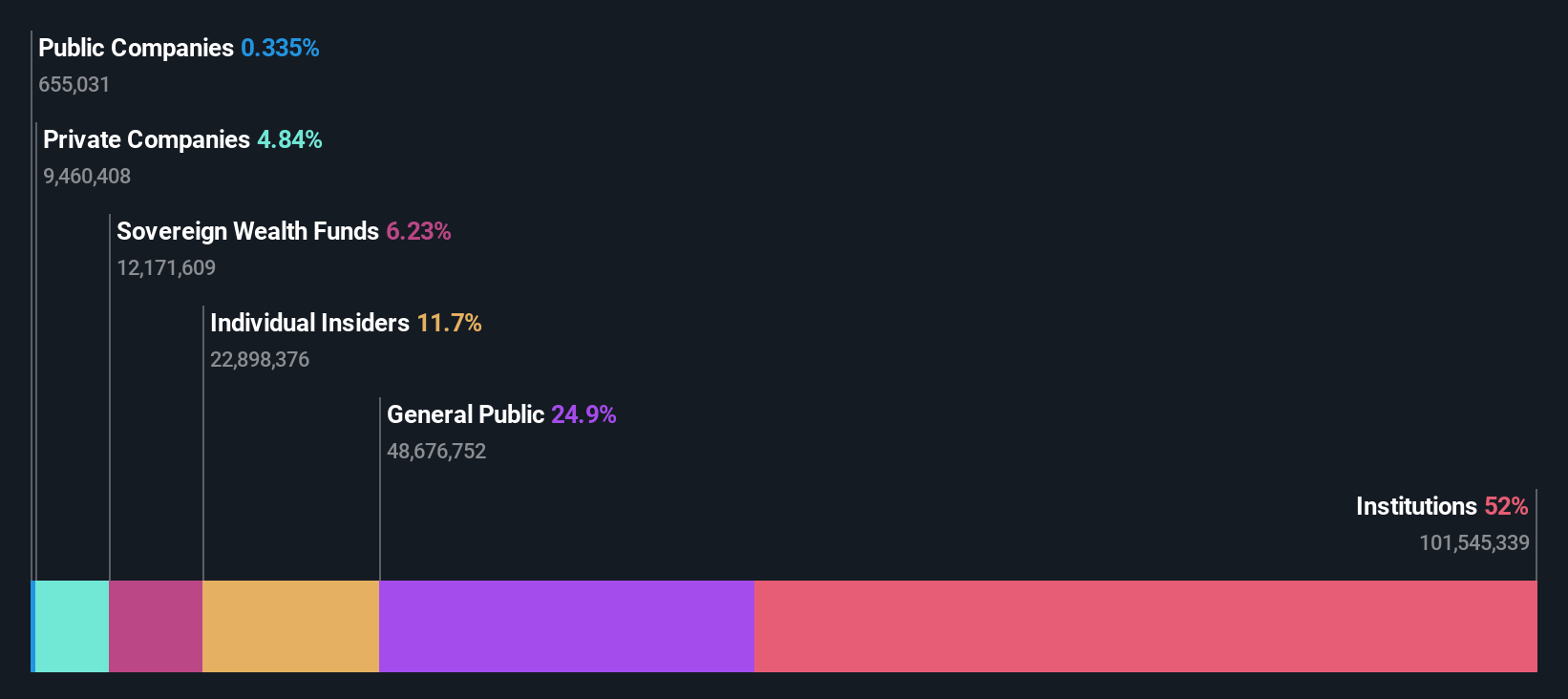

Insider Ownership: 11.7%

Mineral Resources reported A$5.28 billion in sales for FY2024, up from A$4.78 billion the previous year, though net income fell to A$125 million from A$243 million. Despite lower profit margins and earnings per share, the company is forecasted to grow its earnings by 38.29% annually over the next three years, outpacing market expectations. Insider activity shows more buying than selling recently, indicating confidence in future prospects despite some financial challenges like low return on equity and high non-cash earnings.

- Dive into the specifics of Mineral Resources here with our thorough growth forecast report.

- Our valuation report here indicates Mineral Resources may be overvalued.

Summing It All Up

- Dive into all 101 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Flawless balance sheet with high growth potential.