- Australia

- /

- Construction

- /

- ASX:DUR

3 ASX Stocks Estimated To Be Undervalued By Up To 30.9%

Reviewed by Simply Wall St

In the last week, the Australian market has been flat, but it is up 20% over the past year with earnings forecasted to grow by 12% annually. In this environment, identifying stocks that are potentially undervalued can offer investors opportunities to capitalize on growth while maintaining a margin of safety.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Westgold Resources (ASX:WGX) | A$3.13 | A$6.25 | 49.9% |

| Telix Pharmaceuticals (ASX:TLX) | A$21.46 | A$41.66 | 48.5% |

| Ansell (ASX:ANN) | A$31.43 | A$58.31 | 46.1% |

| IDP Education (ASX:IEL) | A$13.70 | A$27.37 | 50% |

| Ingenia Communities Group (ASX:INA) | A$4.94 | A$9.40 | 47.5% |

| Genesis Minerals (ASX:GMD) | A$2.44 | A$4.78 | 48.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Megaport (ASX:MP1) | A$7.15 | A$13.42 | 46.7% |

| Structural Monitoring Systems (ASX:SMN) | A$0.65 | A$1.27 | 48.7% |

| Energy One (ASX:EOL) | A$5.53 | A$11.05 | 50% |

Let's dive into some prime choices out of the screener.

Life360 (ASX:360)

Overview: Life360, Inc. operates a technology platform for locating people, pets, and things across North America, Europe, the Middle East, Africa, and internationally with a market cap of A$4.91 billion.

Operations: The company generates revenue of $328.68 million from its Software & Programming segment.

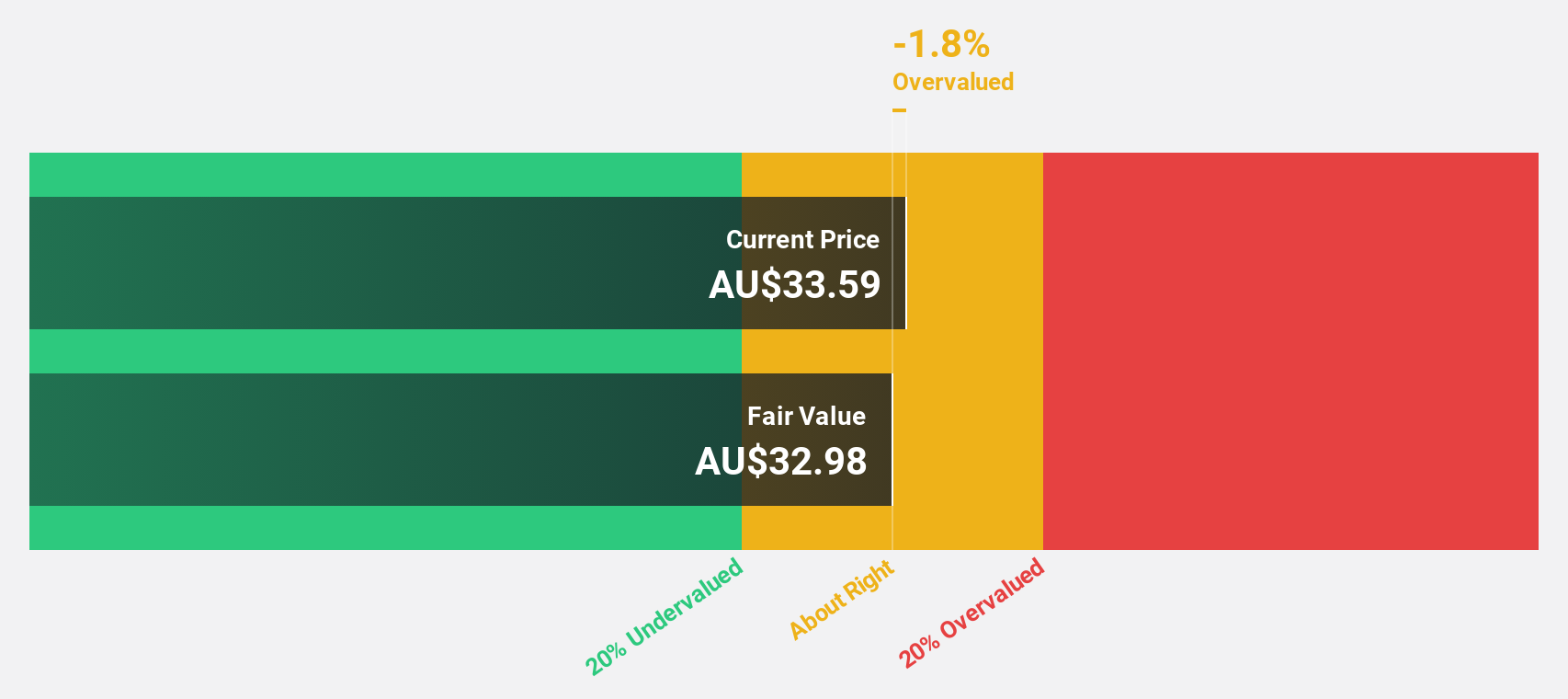

Estimated Discount To Fair Value: 24.7%

Life360 is trading at A$21.9, approximately 24.7% below its estimated fair value of A$29.09, suggesting it may be undervalued based on cash flows. Despite recent insider selling and past shareholder dilution, the company is expected to achieve profitability within three years with earnings projected to grow significantly annually. Recent product innovations and expanded partnerships are anticipated to enhance revenue streams, supporting Life360's strategic growth trajectory in the competitive market landscape.

- Upon reviewing our latest growth report, Life360's projected financial performance appears quite optimistic.

- Dive into the specifics of Life360 here with our thorough financial health report.

Cettire (ASX:CTT)

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$815.85 million.

Operations: The company's revenue primarily comes from online retail sales, amounting to A$742.26 million.

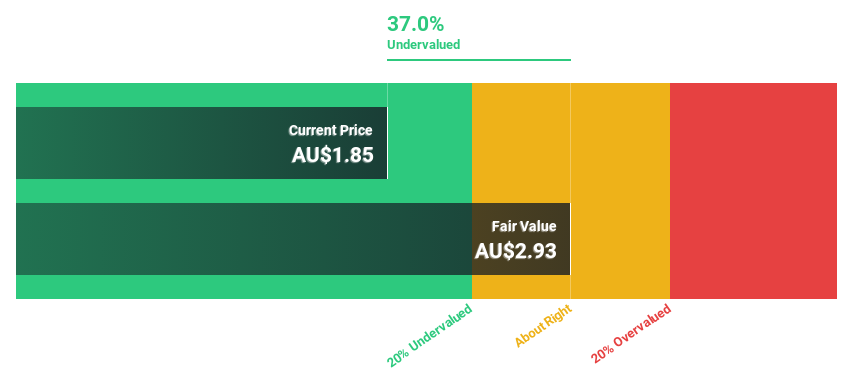

Estimated Discount To Fair Value: 27.5%

Cettire, trading at A$2.14, is approximately 27.5% below its estimated fair value of A$2.95, highlighting potential undervaluation based on cash flows. Despite a decline in net profit margin from 3.8% to 1.4%, earnings are forecast to grow significantly at 29% annually over the next three years, outpacing the Australian market's growth rate. Recent board changes and robust revenue guidance for fiscal Q1 2025 further underscore Cettire's strategic positioning in the market.

- Our comprehensive growth report raises the possibility that Cettire is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Cettire's balance sheet health report.

Duratec (ASX:DUR)

Overview: Duratec Limited, along with its subsidiaries, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia and has a market cap of A$410.83 million.

Operations: The company's revenue segments include Energy (A$46.64 million), Defence (A$220.16 million), Buildings & Facades (A$111.33 million), and Mining & Industrial (A$155.64 million).

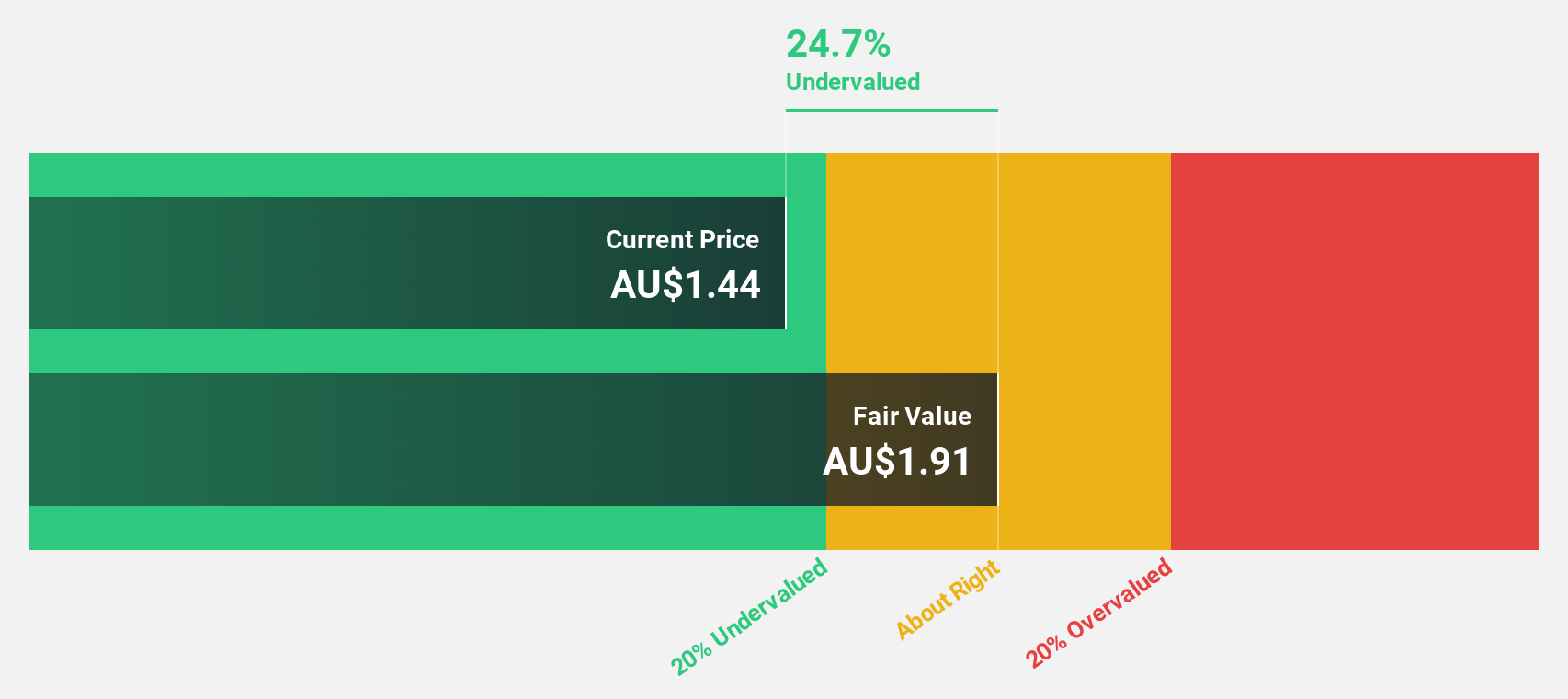

Estimated Discount To Fair Value: 30.9%

Duratec, priced at A$1.63, trades 30.9% below its estimated fair value of A$2.36, indicating potential undervaluation based on cash flows. The company reported increased annual sales of A$555.79 million and net income of A$21.43 million for fiscal year 2024, with earnings growth forecasted at 13.6% annually—faster than the Australian market average. Recent inclusion in the S&P Global BMI Index and positive revenue guidance for fiscal year 2025 support its growth trajectory.

- Our growth report here indicates Duratec may be poised for an improving outlook.

- Navigate through the intricacies of Duratec with our comprehensive financial health report here.

Summing It All Up

- Navigate through the entire inventory of 43 Undervalued ASX Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUR

Duratec

Engages in the provision of assessment, protection, remediation, and refurbishment services to a range of assets, primarily steel and concrete infrastructure in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives