- Australia

- /

- Healthcare Services

- /

- ASX:SIG

Unveiling Australia's Hidden Stock Gems For September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has risen 2.1%, driven by gains in every sector, and has climbed 13% over the past year. In light of these strong performances and expected annual earnings growth of 12%, identifying stocks with solid fundamentals and growth potential is crucial for capitalizing on this momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| SKS Technologies Group | NA | 34.65% | 47.39% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$1.12 billion.

Operations: DroneShield generates revenue primarily from its Aerospace & Defense segment, totaling A$67.52 million. The company has a market cap of A$1.12 billion.

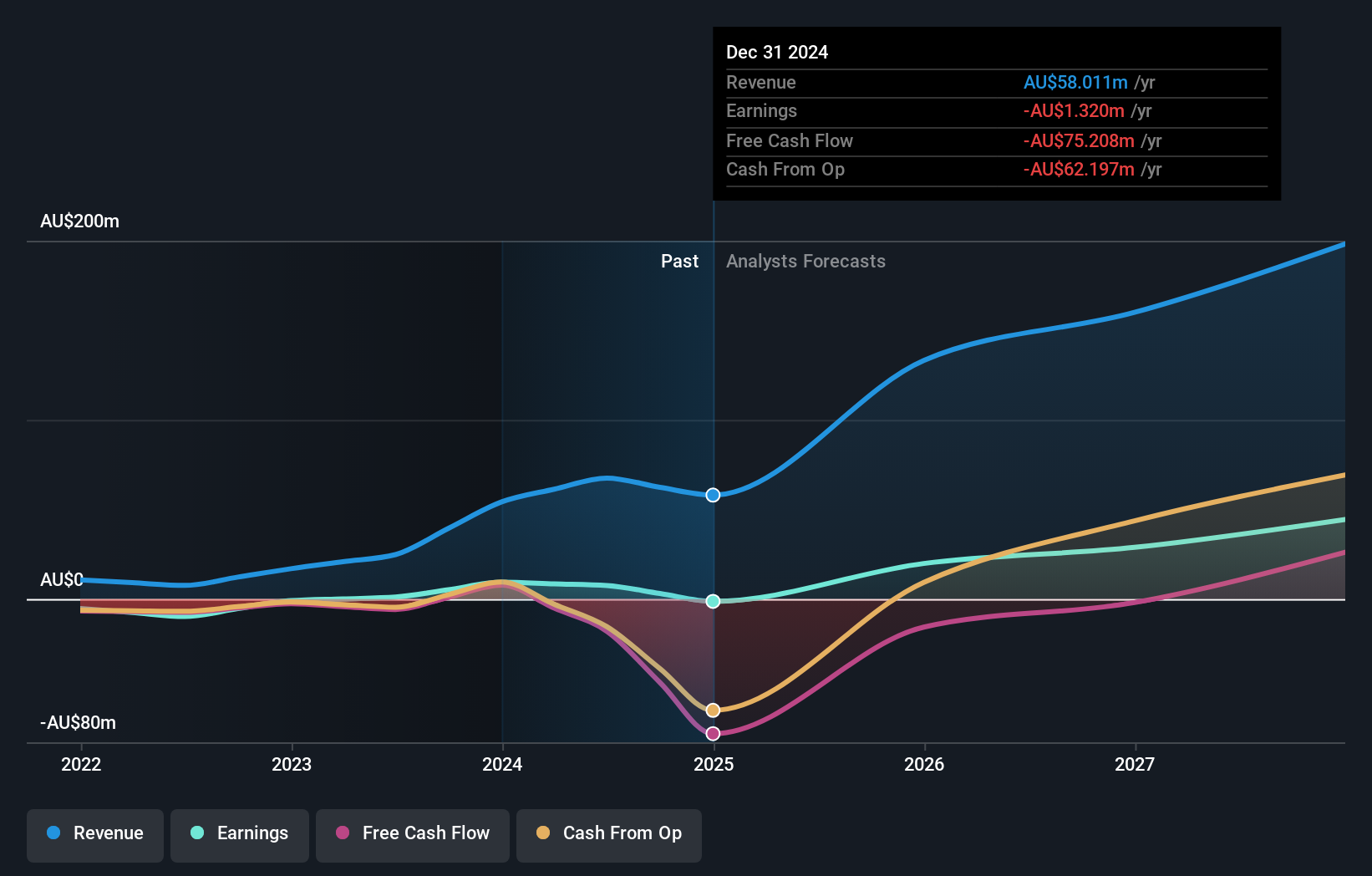

DroneShield, a small-cap Australian company, has shown remarkable earnings growth of 612.7% over the past year, outpacing the Aerospace & Defense industry’s 13.8%. Despite being debt-free now compared to a debt-to-equity ratio of 41.5% five years ago, shareholders have faced dilution recently. The firm reported A$23.99 million in sales for H1 2024 but incurred a net loss of A$4.8 million, with basic loss per share at A$0.0078 from continuing operations.

- Unlock comprehensive insights into our analysis of DroneShield stock in this health report.

Evaluate DroneShield's historical performance by accessing our past performance report.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.34 billion.

Operations: MFF Capital Investments generates revenue primarily through equity investments, amounting to A$659.96 million. The firm operates with a market cap of A$2.34 billion.

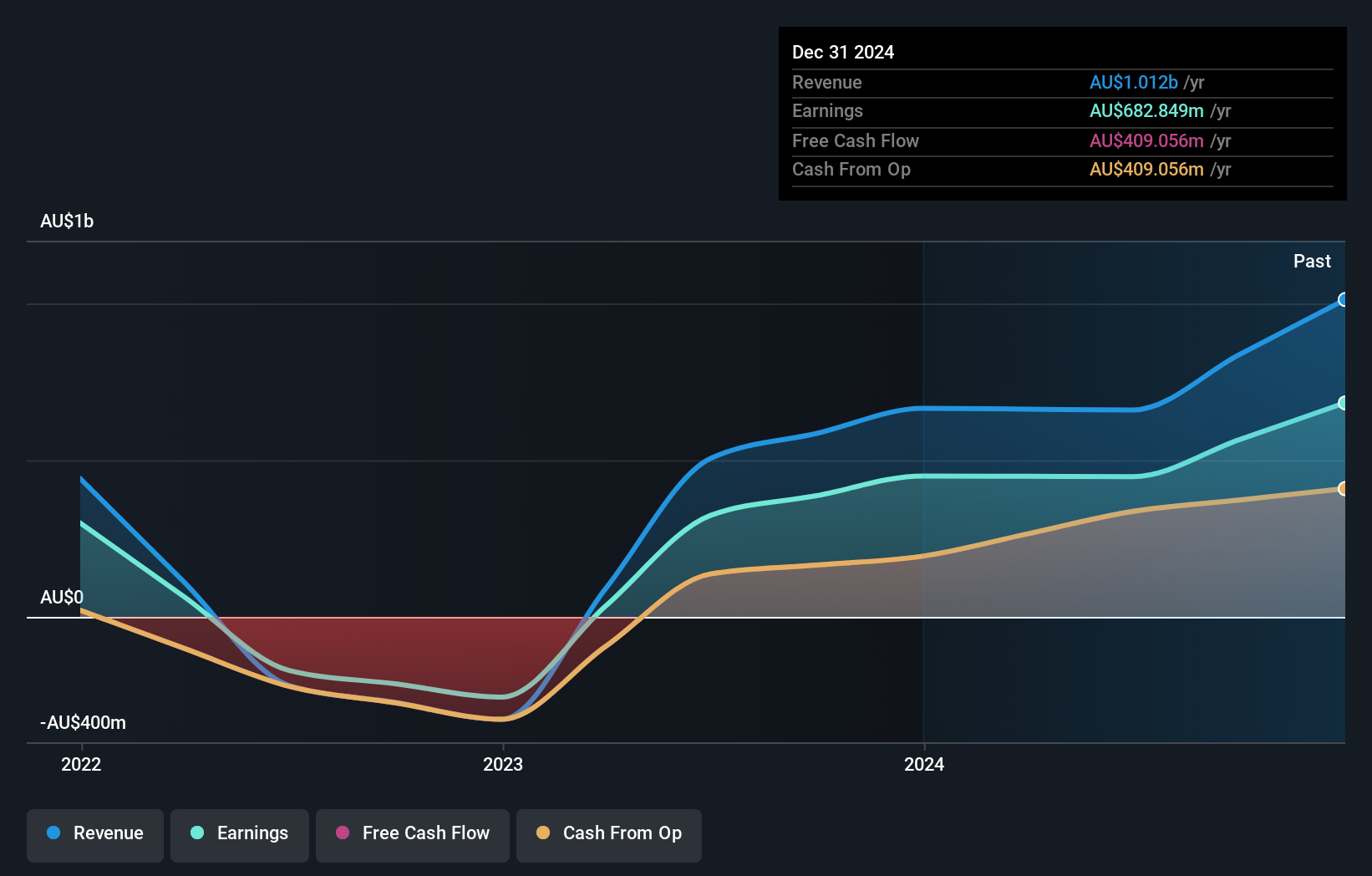

MFF Capital Investments has demonstrated robust financial health, with earnings growing by 38.3% over the past year, significantly outpacing the Capital Markets industry average of 17.7%. The company reported a net income of A$447.36 million for the full year ending June 30, 2024, up from A$323.58 million in the previous year. Additionally, MFF's interest payments are well covered by EBIT at a ratio of 28.2x and it trades at 43.1% below its estimated fair value.

Sigma Healthcare (ASX:SIG)

Simply Wall St Value Rating: ★★★★★★

Overview: Sigma Healthcare Limited, with a market cap of A$2.21 billion, engages in the wholesale distribution of pharmaceutical goods and medical consumables to community pharmacies primarily in Australia.

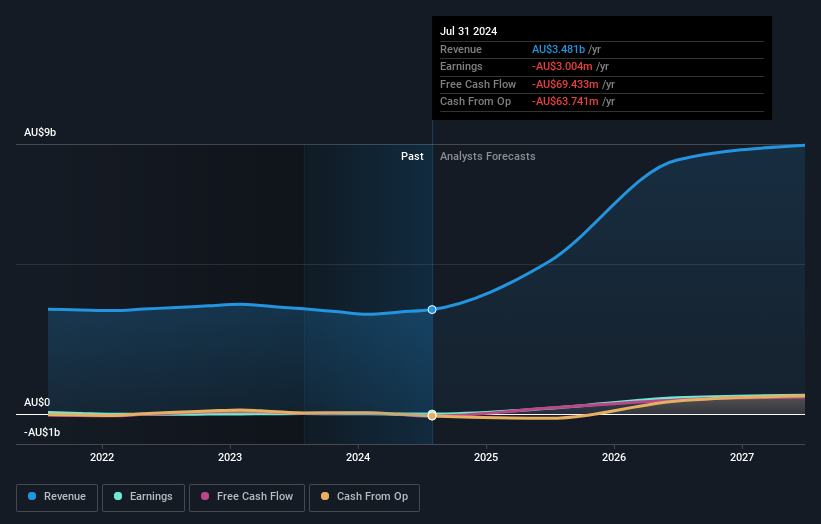

Operations: Sigma Healthcare generates revenue primarily from its healthcare segment, amounting to A$3.32 billion. The company's gross profit margin is 8.5%.

Sigma Healthcare, a notable player in the Australian healthcare sector, has shown impressive earnings growth of 149% over the past year, significantly outpacing the industry average of -14.8%. The company is trading at an attractive value, currently 85.6% below its estimated fair value. Despite a one-off loss of A$8.2M impacting recent financial results, Sigma remains debt-free and well-positioned for future growth with forecasted annual earnings growth of 42.51%.

Summing It All Up

- Reveal the 55 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SIG

Sigma Healthcare

Engages in the wholesale distribution of pharmaceutical goods and medical consumables to community pharmacies primarily in Australia.

Flawless balance sheet with high growth potential.