As the Australian market shows resilience with the ASX200 closing up 0.57% at 8,447 points and trimmed mean inflation easing to an annual rate of 3.2%, investors are closely watching for potential interest rate cuts anticipated as soon as February. In this environment of shifting economic indicators and sector performances, identifying promising small-cap stocks requires a keen eye on companies that demonstrate robust growth potential and adaptability amidst changing market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| K&S | 16.07% | 0.09% | 33.40% | ★★★★☆☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited focuses on developing and selling hardware and software technologies for drone detection and security in Australia and the United States, with a market cap of A$536.35 million.

Operations: DroneShield Limited generates revenue primarily from its Aerospace & Defense segment, reporting A$67.52 million in this category. The company has a market capitalization of A$536.35 million.

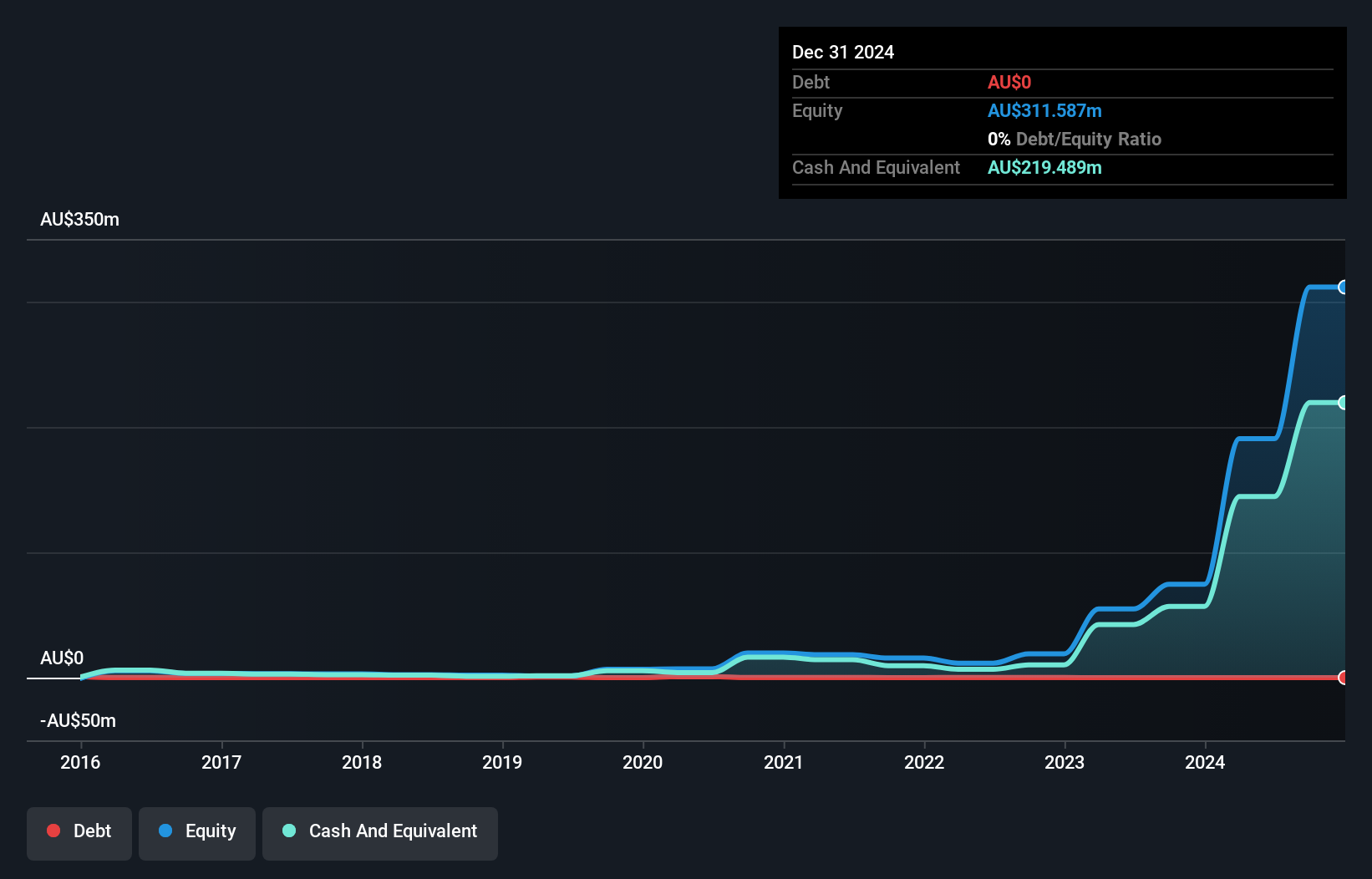

DroneShield, a small player in the aerospace and defense sector, has shown impressive earnings growth of 612.7% over the past year, outpacing its industry peers at 18.4%. Despite being debt-free now, it had a debt-to-equity ratio of 41.5% five years ago, indicating significant financial improvement. Trading at 82.2% below its estimated fair value suggests potential for undervaluation recognition in the market. The company is not free cash flow positive yet but remains profitable with no immediate concerns about cash runway or interest coverage due to lack of debt obligations. Recent strategic appointments further strengthen its governance and government affairs capabilities.

- Get an in-depth perspective on DroneShield's performance by reading our health report here.

Evaluate DroneShield's historical performance by accessing our past performance report.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments, trading as HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of A$759.62 million.

Operations: HFA Holdings Limited generates revenue primarily from its Lighthouse segment, amounting to $95.93 million. The company has a market capitalization of A$759.62 million.

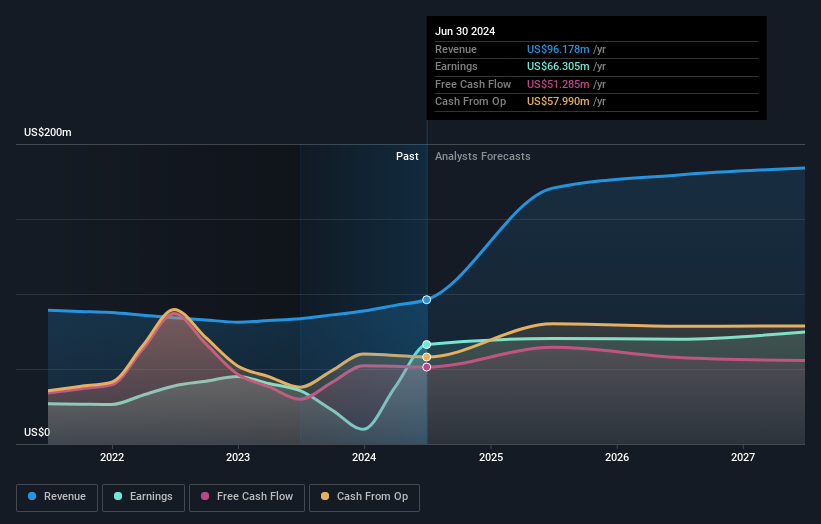

Navigator Global Investments, a nimble player in the financial sector, has shown impressive earnings growth of 86.7% over the past year, outpacing its industry peers' 17.7% rise. Despite a significant A$17.7M one-off gain impacting recent results, it trades at an attractive 52.2% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. The company remains debt-free and boasts positive free cash flow of A$51.29M as of June 2024, indicating robust financial health and flexibility for future endeavors or strategic investments without the burden of interest payments or debt obligations affecting its operations.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Value Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited specializes in developing and providing mining software solutions across various regions including Australia, Asia, the Americas, Africa, and Europe with a market capitalization of A$591.39 million.

Operations: RPMGlobal Holdings generates revenue primarily from its Software segment, contributing A$72.67 million, and its Advisory segment, adding A$31.41 million.

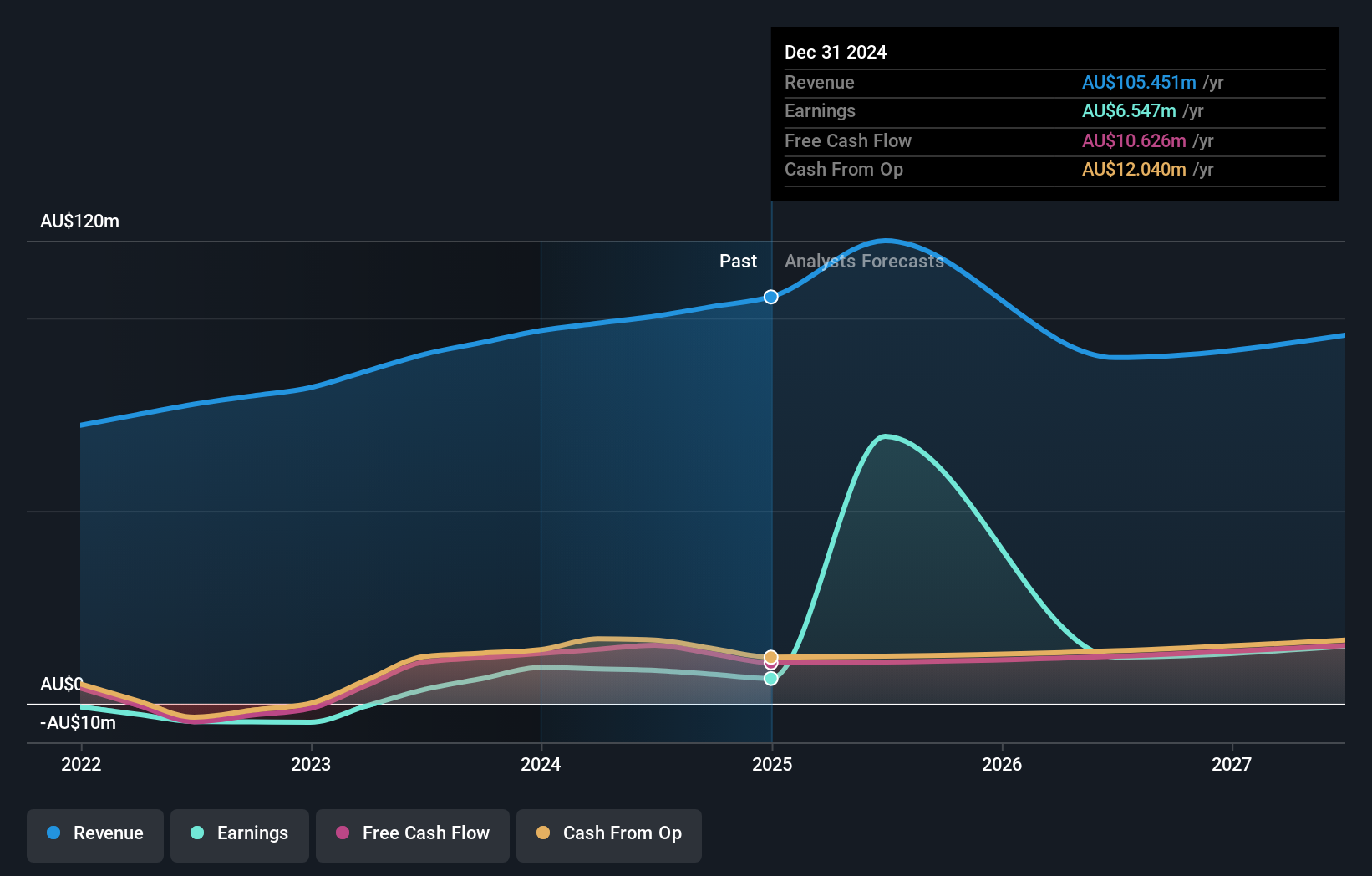

RPMGlobal Holdings has been making waves in the software industry with its impressive earnings growth of 134.6% over the past year, outpacing the sector's average of 6.8%. The company operates without debt, which means interest coverage isn't an issue, and this financial health is complemented by a price-to-earnings ratio of 68.3x, slightly below the industry norm of 69.9x. Free cash flow is positive at A$15.16 million as of June 2024, indicating robust operational efficiency. Recent participation in industry conferences suggests RPMGlobal is actively engaging with its sector peers and stakeholders to drive future growth prospects forward.

Seize The Opportunity

- Gain an insight into the universe of 49 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives