- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

DroneShield (ASX:DRO): Valuation Perspective Following Key Leadership Appointments and Global Expansion Plans

Reviewed by Simply Wall St

DroneShield (ASX:DRO) just announced major leadership moves, naming Angus Harris as Chief Technology Officer and Angus Bean as Chief Product Officer. These appointments come at a time when the company is working to keep pace with growing defence and government demand worldwide.

See our latest analysis for DroneShield.

Momentum around DroneShield has been tough to ignore this year, with the share price up a staggering 446% year-to-date and a one-year total shareholder return of 326%. Short-term volatility has been evident, as shares recently dipped 13% over the week. However, the longer-term story is hard to overlook, especially with management doubling down on product innovation ahead of upcoming earnings.

If you’re exploring where defence sector momentum could go next, it’s a great time to discover See the full list for free.

With such impressive gains and executive changes on deck, the central question for investors is clear: is DroneShield trading at a discount ahead of its growth, or is the market already factoring in its future potential?

Most Popular Narrative: 8.5% Undervalued

The current narrative pegs DroneShield's fair value at A$4.45, just above its recent closing price of A$4.07, reflecting a modest upside. This suggests the market's current pricing is trailing consensus future growth assumptions and fueling debate on whether upside remains.

Surging demand for counter-drone technologies is being driven by ongoing geopolitical instability and heightened security threats, as evidenced by record global and NATO-aligned defense spending and an escalating number of large procurement contracts in DroneShield's pipeline. This is positioning the company for robust, sustained revenue growth.

What exactly is fueling this optimistic outlook? Behind the price target lie ultra-ambitious growth rates and profit margins more commonly seen in tech juggernauts. Want to see which expansion levers analysts are betting on to justify that premium? Dive deeper for the financial drivers behind this valuation.

Result: Fair Value of $4.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on unpredictable defense contracts and rapidly rising R&D spending could quickly challenge the bullish growth story for DroneShield.

Find out about the key risks to this DroneShield narrative.

Another View: Caution From Market Comparisons

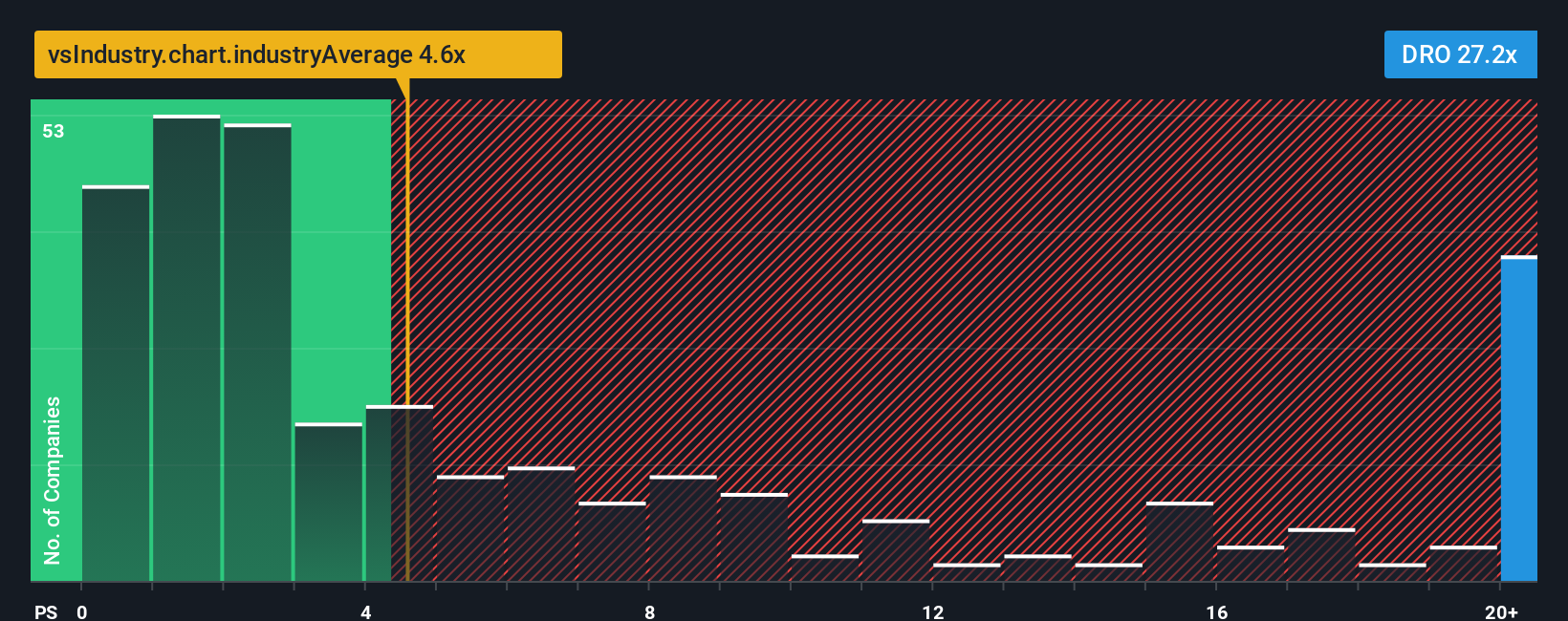

Looking from a market comparisons angle, DroneShield's price-to-sales ratio stands at 33.2x, which is far above both the industry average of 4.7x and the peer average of 3.7x. In comparison, the fair ratio for DroneShield, calculated at 19.2x, is much lower. This wide gap signals that the stock is priced at a significant premium, introducing more risk if the high-growth story stumbles. Could the market recalibrate closer to those benchmarks if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DroneShield Narrative

If you see things differently or want to dig into the numbers on your own terms, you’re welcome to craft a fresh take in under three minutes, using the data at hand. Do it your way.

A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

If you want to stay a step ahead in the markets, don’t wait for the crowd to catch on. Unlock unique ideas tailored to your strategy with these powerful tools:

- Boost your search for tomorrow’s financial standouts by targeting strong cash flow and attractive prices with these 848 undervalued stocks based on cash flows.

- Catch the wave of healthcare innovation and pinpoint real-world breakthroughs with these 34 healthcare AI stocks.

- Start building a portfolio with endless yield potential by finding steady earners through these 21 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives