- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

DroneShield (ASX:DRO): Reassessing Valuation After Governance Overhaul and Board Refresh Plans

Reviewed by Simply Wall St

DroneShield (ASX:DRO) is back in focus after its board moved to tighten governance, rolling out mandatory minimum shareholdings for insiders and overhauling trading and disclosure policies to better match ASX 200 benchmarks.

See our latest analysis for DroneShield.

The governance reset is landing just as momentum returns to the stock, with the share price at A$3.00 and a 30 day share price return of roughly 75 percent following a sharp year to date gain, even after a softer 90 day patch, while multi year total shareholder returns remain exceptionally strong.

If DroneShield’s run has you rethinking your watchlist, it could be worth scanning the broader defence theme and seeing which other names are popping up across aerospace and defense stocks.

With earnings surging, a hefty discount to analyst targets and a powerful defence tailwind, investors now face the key question: is DroneShield still undervalued, or is the market already pricing in years of growth ahead?

Most Popular Narrative: 41.7% Undervalued

With DroneShield last closing at A$3.00 against a narrative fair value of A$5.15, the spread suggests the market is discounting a very different future path.

Substantial ongoing investment in proprietary AI driven detection, sensor fusion, and subscription based (SaaS) offerings fortifies DroneShield's margin profile and earnings quality, enabling premium pricing and recurring revenue streams as the business pivots beyond hardware only sales.

Curious how a hardware heavy defence contractor ends up with a valuation more often seen in fast growth software names? The narrative leans on aggressive revenue expansion, expanding margins and a future earnings multiple that only makes sense if those forecasts actually land. Want to see which assumptions really carry this upside story and how sensitive that fair value is if growth slows even a little?

Result: Fair Value of $5.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on lumpy defence contracts and escalating R&D spend could easily derail the growth, margin and valuation assumptions that underpin this upside.

Find out about the key risks to this DroneShield narrative.

Another View: Rich On Sales, Not On Story

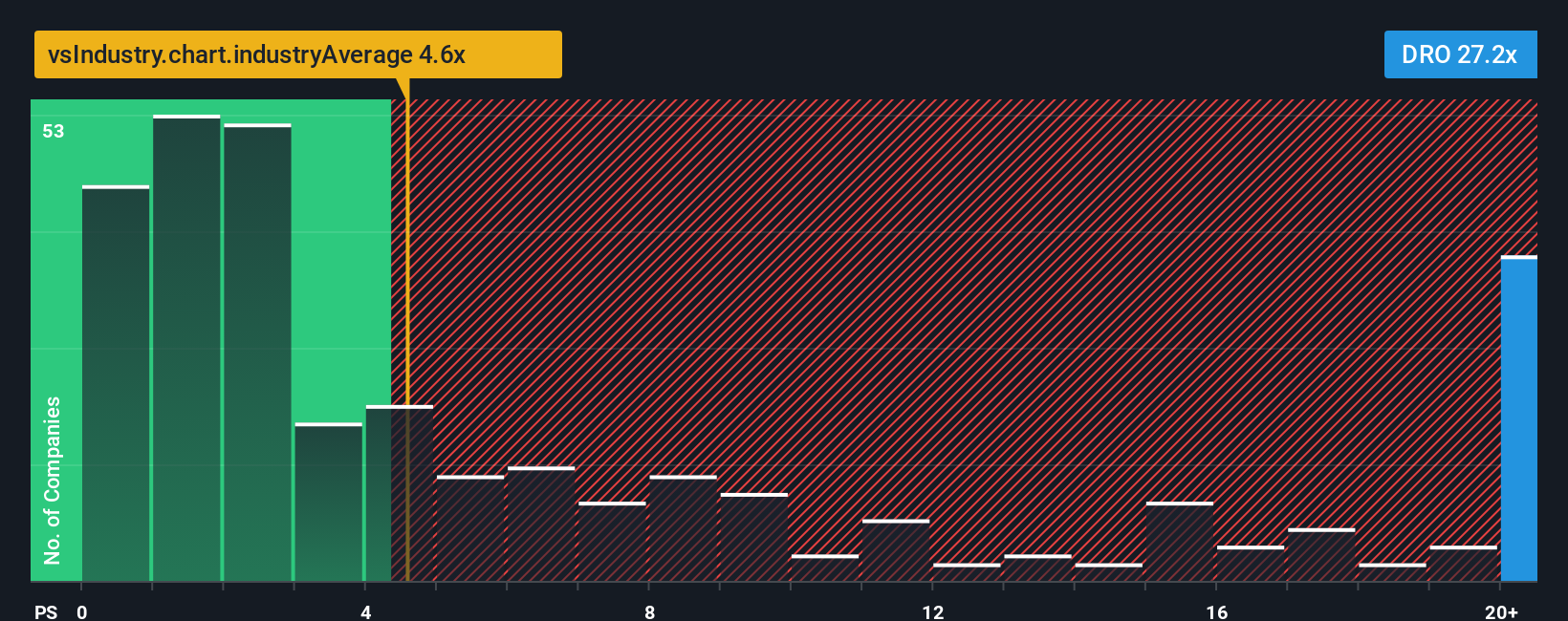

Look past the narrative fair value and the picture gets trickier. On a sales basis, DroneShield trades at 25.6 times revenue, far above its 4.6 times peer average and even its 18.4 times fair ratio. This means a lot of success is already priced in if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DroneShield Narrative

If you are not convinced by this view or would rather rely on your own due diligence, you can build a fresh narrative in just a few minutes: Do it your way

A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover fresh stocks that match your strategy and risk profile.

- Capture early growth stories by scanning these 3629 penny stocks with strong financials that already show robust financial underpinnings instead of fragile hype.

- Position yourself at the forefront of machine learning breakthroughs with these 24 AI penny stocks powering automation, productivity gains, and next generation digital infrastructure.

- Secure potential bargains by filtering for these 898 undervalued stocks based on cash flows where current prices still lag their cash flow strength and long term prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion