- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

DroneShield (ASX:DRO): Evaluating Valuation After Insider Sales and Contract Withdrawal Shake Market Confidence

Reviewed by Simply Wall St

DroneShield (ASX:DRO) shares have captured attention following a wave of insider selling by its CEO and directors, along with the withdrawal of a previously announced multi-million dollar contract. This has resulted in heightened volatility and fresh scrutiny from investors.

See our latest analysis for DroneShield.

The wave of insider selling sparked a rapid shift in sentiment, with DroneShield's 1-week share price return plunging 27.6% and its 30-day return down more than 54%. Despite this volatility, it is hard to ignore that the total shareholder return over the past year is still an impressive 204%, and the five-year gain exceeds 1,100%. Momentum has faded sharply for now, but the long-term trajectory highlights the market’s ongoing belief in the company’s underlying growth story and global defence ambitions.

If recent volatility has you rethinking your watchlist, this could be the perfect opportunity to discover See the full list for free.

With shares still trading at a notable discount to analyst targets despite recent turmoil, investors are left wondering if the current valuation understates DroneShield’s global ambitions or if the market has already factored in future growth.

Most Popular Narrative: 54.8% Undervalued

With DroneShield’s fair value estimate at A$5.15 and a last close of A$2.33, the narrative sets an ambitious stage for future returns, prompted by expectations of robust global demand and boosted margins.

Proprietary AI technology, SaaS offerings, and global manufacturing capacity boost margins, recurring income, and operational scalability as adoption accelerates worldwide.

Want to know what’s powering this remarkable upside? This narrative is anchored to a blueprint of steep revenue gains, rapidly expanding profit margins, and a leap in earnings that would put tech giants to shame. Curious what financial forecasts back up such a bullish view? Uncover the hidden numbers behind this aggressive fair value projection and you’ll be surprised what’s driving sentiment.

Result: Fair Value of $5.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reliance on unpredictable defense contracts and intensifying competition could quickly disrupt DroneShield’s impressive growth trajectory and valuation thesis.

Find out about the key risks to this DroneShield narrative.

Another View: Multiples Tell a Different Story

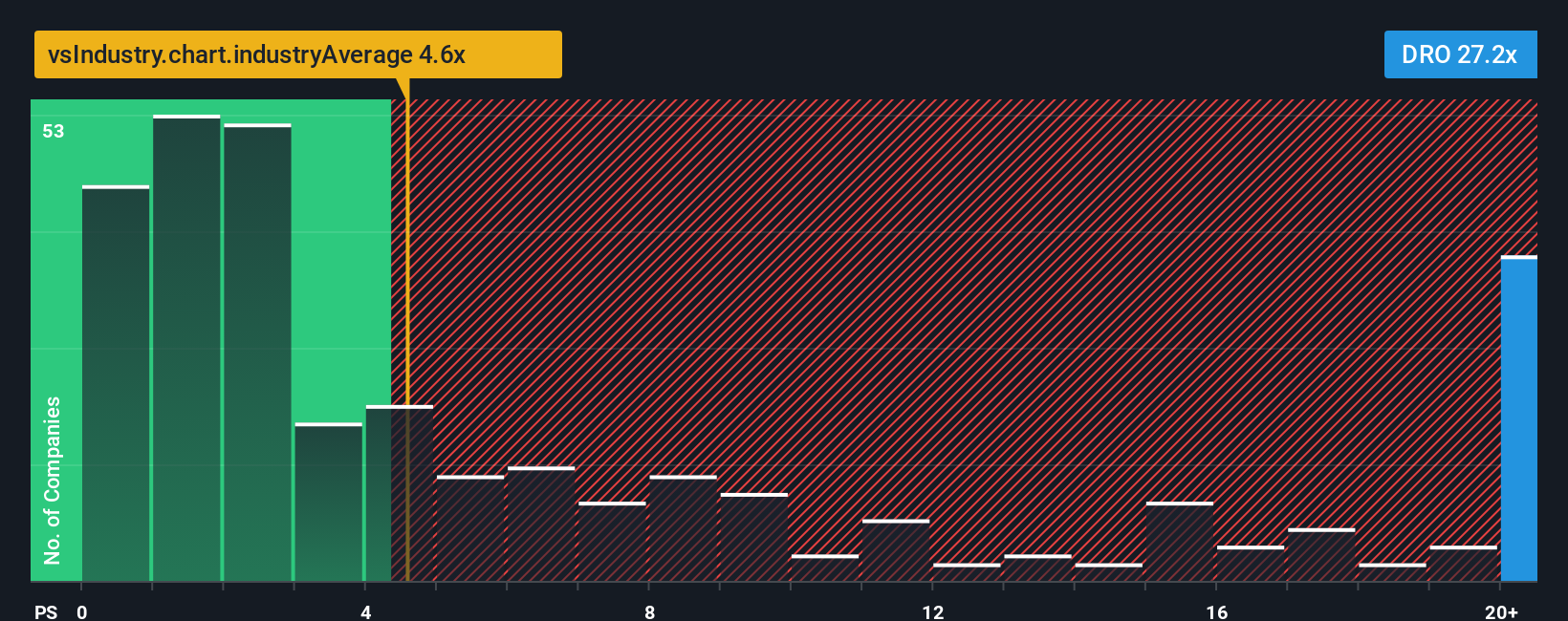

Looking at how DroneShield is valued using sales multiples paints a more cautious picture. Its price-to-sales ratio stands at 19.7x, which is much higher than the global industry average of 4.5x and above its fair ratio of 18x. This premium means expectations are already sky-high, so what happens if the business stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DroneShield Narrative

If you want a fresh perspective or have your own take on DroneShield's story, you can dive into the data and shape your own analysis in just a few minutes. Do it your way

A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunities never wait. If you want to catch the next big move before the crowd, these carefully selected stock ideas could spark your portfolio’s growth:

- Boost your income potential by tapping into steady companies with yields above 3% in these 16 dividend stocks with yields > 3%.

- Unlock the future of healthcare by scanning these 31 healthcare AI stocks, which features advancements in medical technology and artificial intelligence.

- Fuel your gains with these 879 undervalued stocks based on cash flows, highlighting companies with strong cash flows and hidden value the market has not priced in yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives