- Australia

- /

- Capital Markets

- /

- ASX:NGI

3 Undiscovered Gems In Australia To Enhance Your Portfolio

Reviewed by Simply Wall St

As the Australian market faces a downturn with the ASX200 dipping by 0.9% to its lowest level since September, sectors like Financials and Health Care have been leading the decline, while Energy stands as the sole sector in positive territory. In this challenging environment, identifying undiscovered gems within small-cap stocks can offer unique opportunities for diversification and growth potential amid broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited focuses on developing and commercializing hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$797.99 million.

Operations: DroneShield Limited's revenue is primarily derived from its Aerospace & Defense segment, amounting to A$67.52 million.

DroneShield, a nimble player in the Aerospace & Defense sector, has seen its earnings skyrocket by 612% over the past year, outpacing industry growth of 14%. Despite reporting a net loss of A$4.8 million for the half-year ending June 2024, sales nearly doubled to A$23.99 million from A$11.55 million previously. The company operates debt-free and trades at approximately 74% below its estimated fair value, suggesting potential undervaluation. Recent board appointments bring strategic expertise that could bolster future performance as DroneShield continues to navigate its position within key market indices like the S&P/ASX Small Ordinaries Index.

- Click here to discover the nuances of DroneShield with our detailed analytical health report.

Gain insights into DroneShield's historical performance by reviewing our past performance report.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments (ASX:NGI) is a fund management company based in Australia with a market cap of A$828.23 million.

Operations: Navigator Global Investments generates revenue primarily from its Lighthouse segment, amounting to $95.93 million. The company has a market capitalization of A$828.23 million.

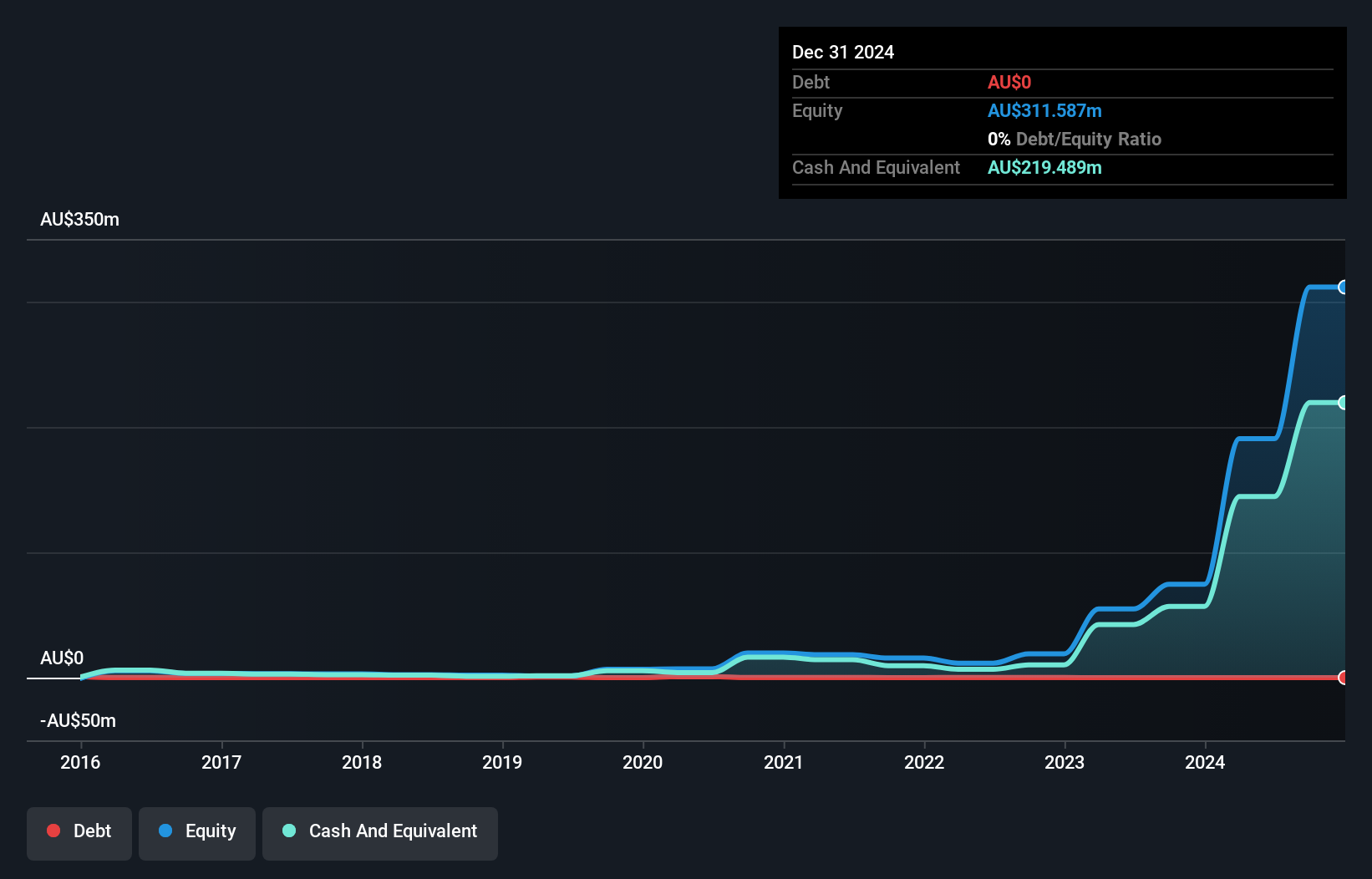

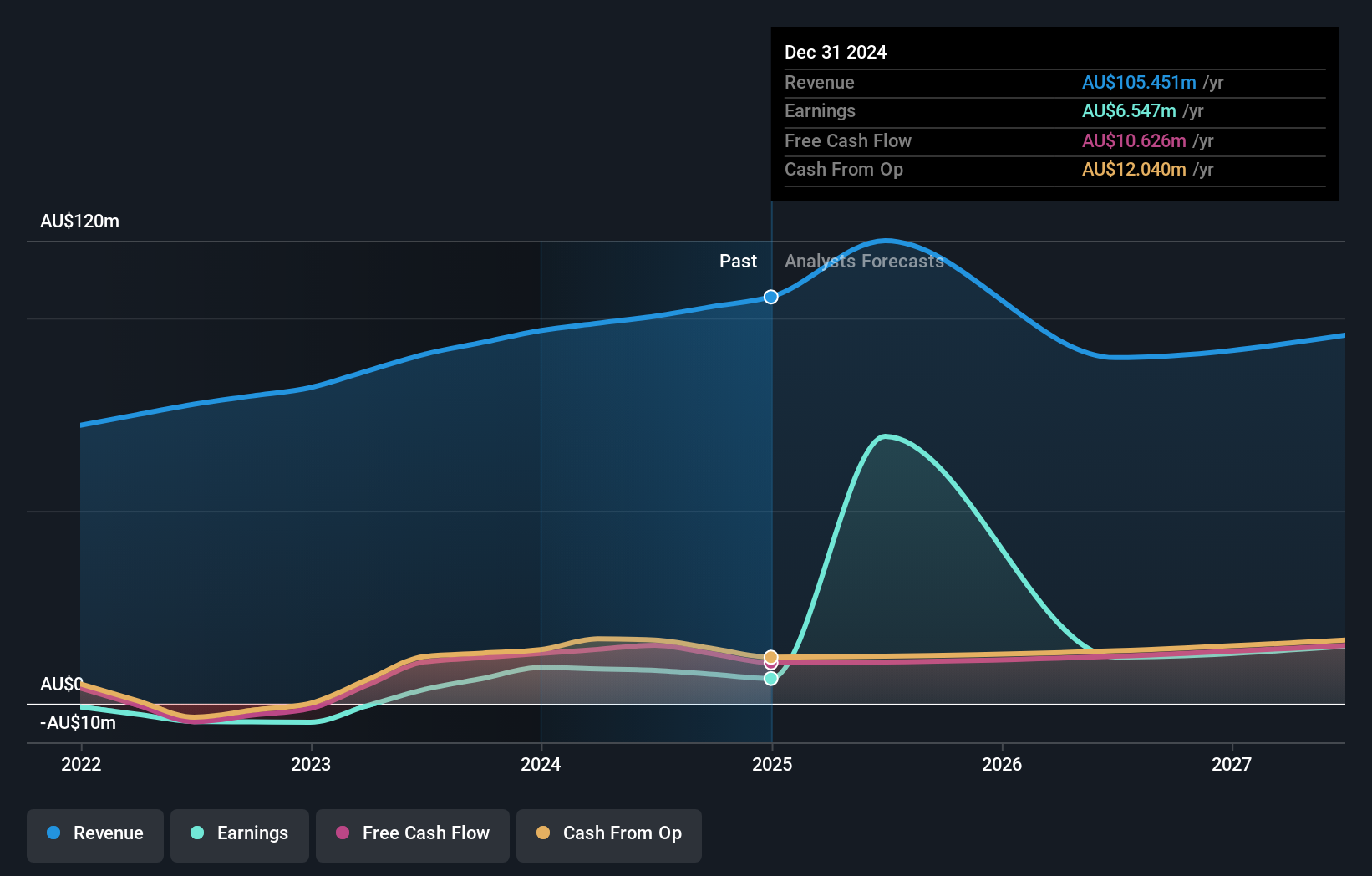

Navigator Global Investments, a notable player in the investment management sector, has shown impressive growth with earnings jumping by 86.7% over the past year, significantly outpacing the industry average of 15.6%. Trading at a substantial discount of 47.4% to its estimated fair value, NGI offers an attractive proposition relative to peers. Despite being debt-free for five years and maintaining positive free cash flow, shareholders faced dilution recently due to large one-off gains impacting financial results by A$17.7 million as of June 30, 2024. The recent inclusion in the S&P Global BMI Index further underscores its evolving market presence.

- Unlock comprehensive insights into our analysis of Navigator Global Investments stock in this health report.

Understand Navigator Global Investments' track record by examining our Past report.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Value Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various continents including Australia, Asia, the Americas, Africa, and Europe with a market capitalization of A$644.55 million.

Operations: RPMGlobal Holdings generates revenue primarily from its Software segment, which accounts for A$72.67 million, followed by its Advisory segment at A$31.41 million.

RPMGlobal Holdings has been making waves with its impressive 134.6% earnings growth over the past year, far outpacing the software industry's average of 6.8%. With no debt on its books for five years, RPMGlobal stands out as a financially robust entity in its sector. The company reported a revenue increase to A$104.19 million from A$91.56 million, while net income jumped to A$8.66 million from A$3.69 million compared to the previous year, reflecting strong operational performance and high-quality earnings that are free cash flow positive and forecasted to grow annually by 22.62%.

- Get an in-depth perspective on RPMGlobal Holdings' performance by reading our health report here.

Evaluate RPMGlobal Holdings' historical performance by accessing our past performance report.

Where To Now?

- Gain an insight into the universe of 54 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Global Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NGI

Navigator Global Investments

HFA Holdings Limited operates as a fund management company in Australia.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives