- Australia

- /

- Trade Distributors

- /

- ASX:CYG

Take Care Before Diving Into The Deep End On Coventry Group Ltd (ASX:CYG)

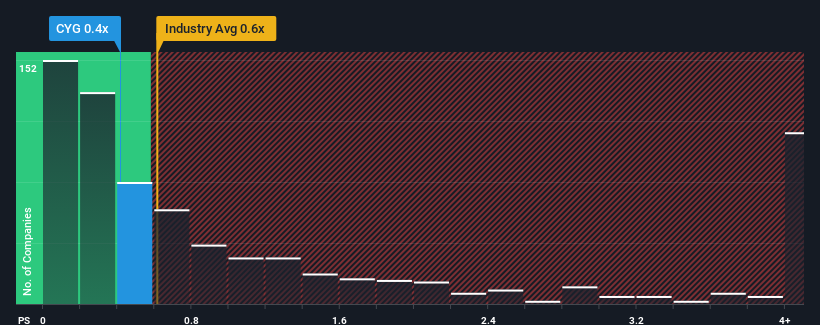

Coventry Group Ltd's (ASX:CYG) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Trade Distributors industry in Australia have P/S ratios greater than 1.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Coventry Group

What Does Coventry Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Coventry Group has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Coventry Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Coventry Group?

The only time you'd be truly comfortable seeing a P/S as low as Coventry Group's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.0%. The latest three year period has also seen an excellent 40% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 6.3% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 4.7% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Coventry Group's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Coventry Group remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Coventry Group.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CYG

Coventry Group

Distributes industrial products and services in Australia and New Zealand.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.