- Australia

- /

- Aerospace & Defense

- /

- ASX:ASB

The Austal (ASX:ASB) Share Price Is Up 177% And Shareholders Are Boasting About It

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Austal Limited (ASX:ASB) share price has flown 177% in the last three years. That sort of return is as solid as granite. On top of that, the share price is up 26% in about a quarter.

See our latest analysis for Austal

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

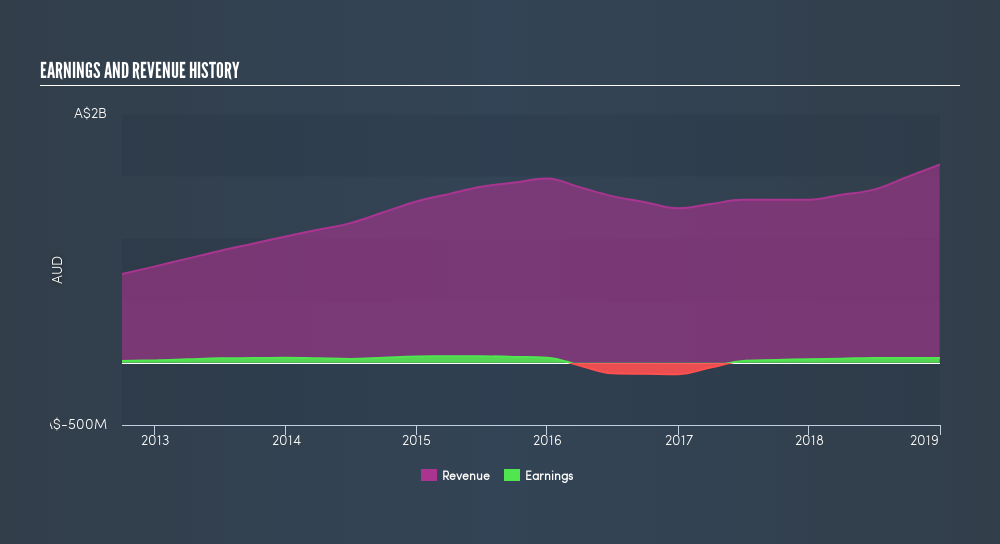

During the three years of share price growth, Austal actually saw its earnings per share (EPS) drop 1.6% per year. Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. So other metrics may hold the key to understanding what is influencing investors.

The modest 1.6% dividend yield is unlikely to be propping up the share price. Do you think that shareholders are buying for the 2.6% per annum revenue growth trend? We don't. So truth be told we can't see an easy explanation for the share price action, but perhaps you can...

We know that Austal has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Austal will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Austal, it has a TSR of 199% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Austal shareholders have received a total shareholder return of 114% over one year. Of course, that includes the dividend. That's better than the annualised return of 25% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Austal in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:ASB

Austal

Engages in the design, manufacture, and support of vessels for commercial and defense customers worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives