- Australia

- /

- Aerospace & Defense

- /

- ASX:ASB

Here's Why I Think Austal (ASX:ASB) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Austal (ASX:ASB), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Austal

How Fast Is Austal Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Austal has grown EPS by 49% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Austal's EBIT margins have actually improved by 2.4 percentage points in the last year, to reach 7.2%, but, on the flip side, revenue was down 7.4%. That's not ideal.

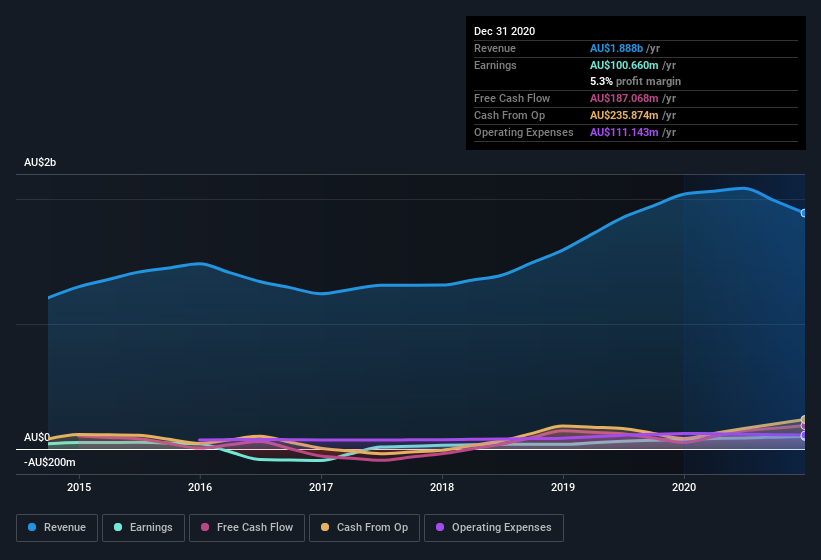

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Austal EPS 100% free.

Are Austal Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Austal insiders refrain from selling stock during the year, but they also spent AU$228k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Director Michael McCormack for AU$208k worth of shares, at about AU$2.08 per share.

Along with the insider buying, another encouraging sign for Austal is that insiders, as a group, have a considerable shareholding. To be specific, they have AU$19m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 2.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Austal Deserve A Spot On Your Watchlist?

Austal's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Austal deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Austal (at least 1 which makes us a bit uncomfortable) , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Austal, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Austal, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ASB

Austal

Engages in the design, manufacture, and support of vessels for commercial and defense customers in the United States, Australia, Europe, Asia, and South America.

Flawless balance sheet and good value.

Market Insights

Community Narratives