- Australia

- /

- Capital Markets

- /

- ASX:MFF

3 Promising ASX Penny Stocks With Market Caps Under A$3B

Reviewed by Simply Wall St

The Australian market recently faced downward pressure, with the ASX200 closing down 0.7% amid a sell-off in energy stocks and banks, influenced by global trade tensions. Despite these challenges, investors continue to seek opportunities beyond the traditional sectors. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area due to their affordability and potential for growth when supported by strong financials. In this article, we explore three such penny stocks that stand out for their financial strength and growth potential amidst current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.58 | A$68.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$146.79M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$319.94M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$234.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$325.58M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.54 | A$117.72M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.695 | A$813.53M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.445 | A$87.21M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$66.44M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.71 | A$461.75M | ★★★★☆☆ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Austin Engineering (ASX:ANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Austin Engineering Limited, with a market cap of A$325.58 million, operates in the industrial and resources sectors by manufacturing, repairing, overhauling, and supplying mining attachment products and related services.

Operations: The company's revenue is derived from three geographical segments: Asia-Pacific (A$166.14 million), North America (A$95.53 million), and South America (A$51.58 million).

Market Cap: A$325.58M

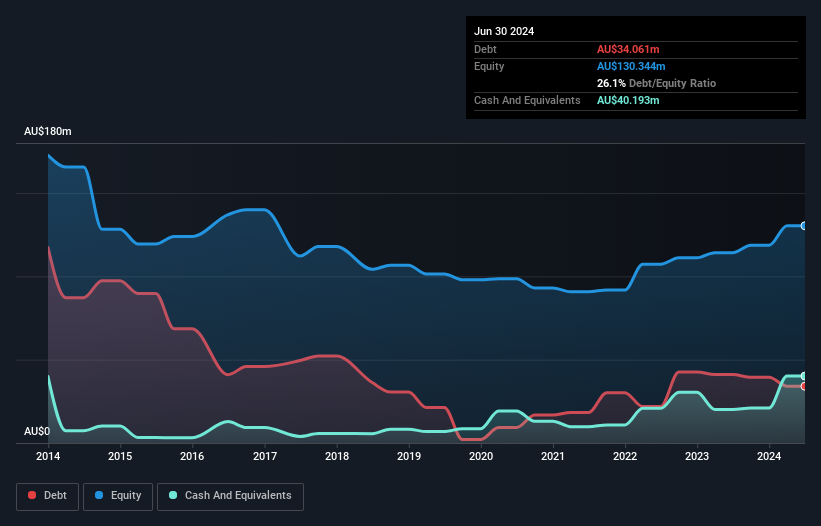

Austin Engineering has demonstrated significant earnings growth, with a 317.3% increase over the past year, outpacing both its historical average and industry peers. The company maintains a strong financial position, with short-term assets exceeding liabilities and sufficient cash flow to cover debt obligations. Despite an unstable dividend history and recent shareholder dilution, Austin's profitability has improved markedly, reflected in higher net profit margins and robust return on equity of 22.8%. Recent developments include constitutional changes approved at the AGM and a modest dividend announcement for H2 2024.

- Click to explore a detailed breakdown of our findings in Austin Engineering's financial health report.

- Examine Austin Engineering's earnings growth report to understand how analysts expect it to perform.

MFF Capital Investments (ASX:MFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.45 billion.

Operations: The company generates revenue primarily from its equity investment segment, amounting to A$659.96 million.

Market Cap: A$2.45B

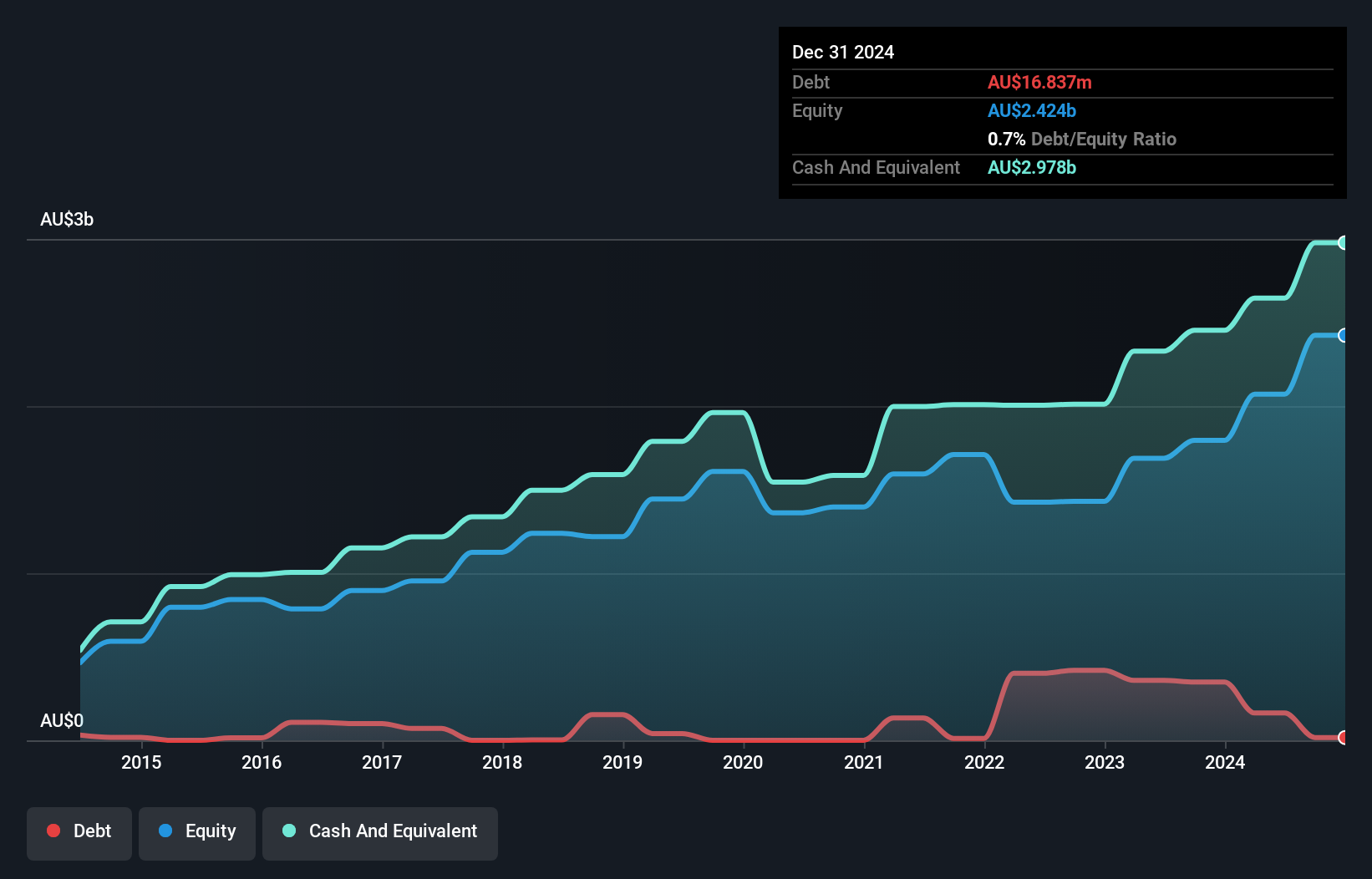

MFF Capital Investments exhibits robust financial health, with significant earnings growth of 38.3% over the past year, surpassing its five-year average and industry benchmarks. The company maintains a high return on equity at 21.6%, indicating efficient use of shareholder funds. Its strong balance sheet shows short-term assets exceeding both short- and long-term liabilities, alongside well-covered interest payments and debt by operating cash flow. While the debt to equity ratio has increased over five years, MFF's dividend yield remains reliable at 3.3%. Recent AGM discussions have not indicated major strategic shifts or concerns.

- Take a closer look at MFF Capital Investments' potential here in our financial health report.

- Gain insights into MFF Capital Investments' historical outcomes by reviewing our past performance report.

SciDev (ASX:SDV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SciDev Limited offers environmental solutions for water-intensive industries across Australia, the United States, Asia, and other international markets with a market cap of A$94.93 million.

Operations: The company's revenue is primarily derived from its Chemical Services segment, which generated A$86.64 million, and its Water Technology segment, contributing A$22.54 million.

Market Cap: A$94.93M

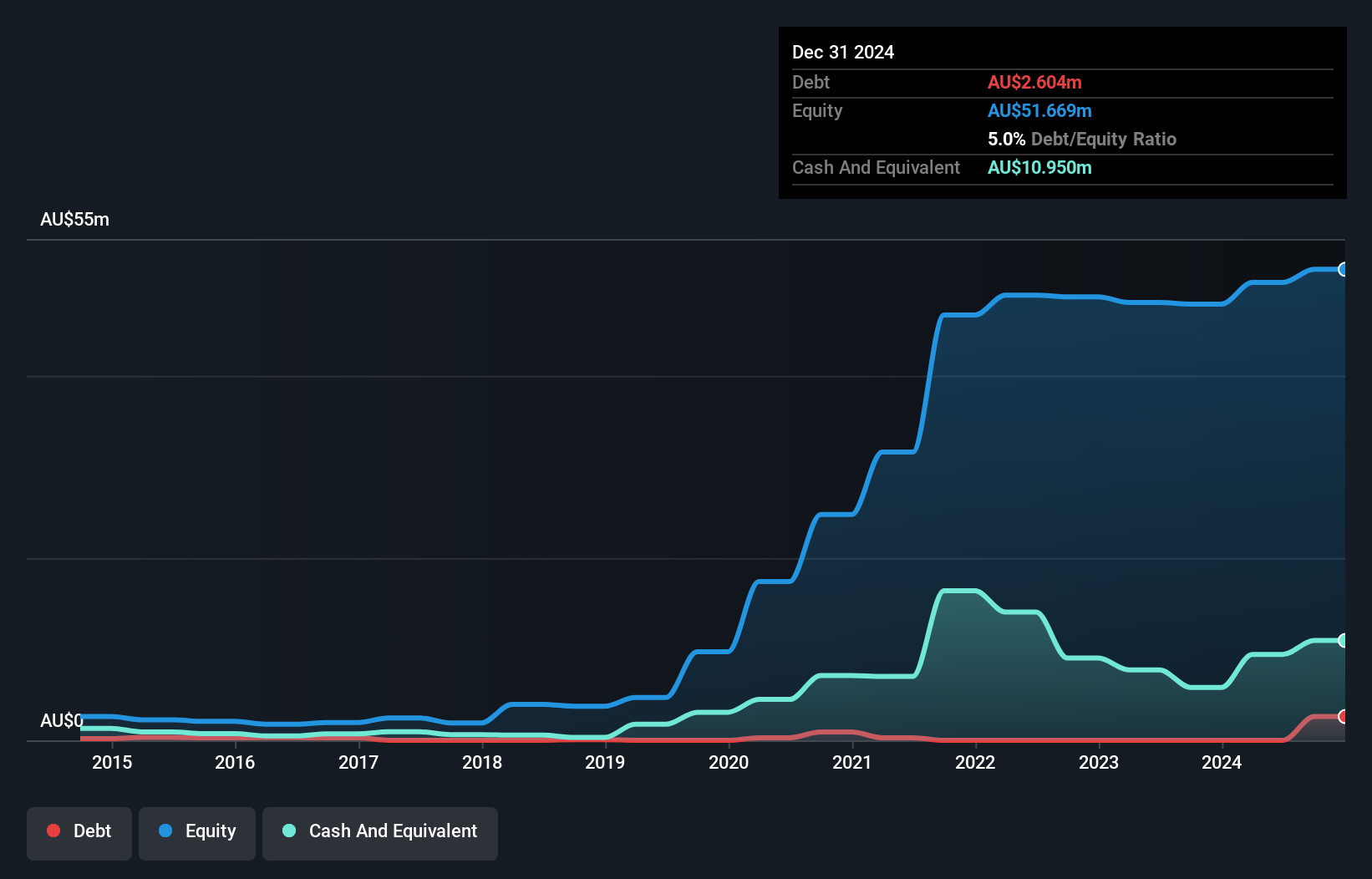

SciDev Limited has demonstrated significant growth, becoming profitable over the past year with reported sales of A$109.24 million. The company operates debt-free, ensuring financial stability and eliminating concerns about interest coverage. Its short-term assets (A$30 million) comfortably cover both short- and long-term liabilities, enhancing its liquidity position. SciDev's earnings are considered high quality, and it trades at a substantial discount to estimated fair value. Despite low return on equity at 4.3%, the company's profitability trajectory is promising with forecasted earnings growth of 36.88% annually. Recent board changes include the resignation of Director Simone Watt after six years of service.

- Get an in-depth perspective on SciDev's performance by reading our balance sheet health report here.

- Evaluate SciDev's prospects by accessing our earnings growth report.

Make It Happen

- Navigate through the entire inventory of 1,046 ASX Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Outstanding track record with excellent balance sheet and pays a dividend.