While shareholders of AML3D (ASX:AL3) are in the black over 3 years, those who bought a week ago aren't so fortunate

AML3D Limited (ASX:AL3) shareholders might be concerned after seeing the share price drop 11% in the last week. In contrast, the return over three years has been impressive. The share price marched upwards over that time, and is now 158% higher than it was. After a run like that some may not be surprised to see prices moderate. Only time will tell if there is still too much optimism currently reflected in the share price.

Although AML3D has shed AU$16m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

AML3D isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years AML3D saw its revenue grow at 69% per year. That's much better than most loss-making companies. Along the way, the share price gained 37% per year, a solid pop by our standards. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say AML3D is still worth investigating - successful businesses can often keep growing for long periods.

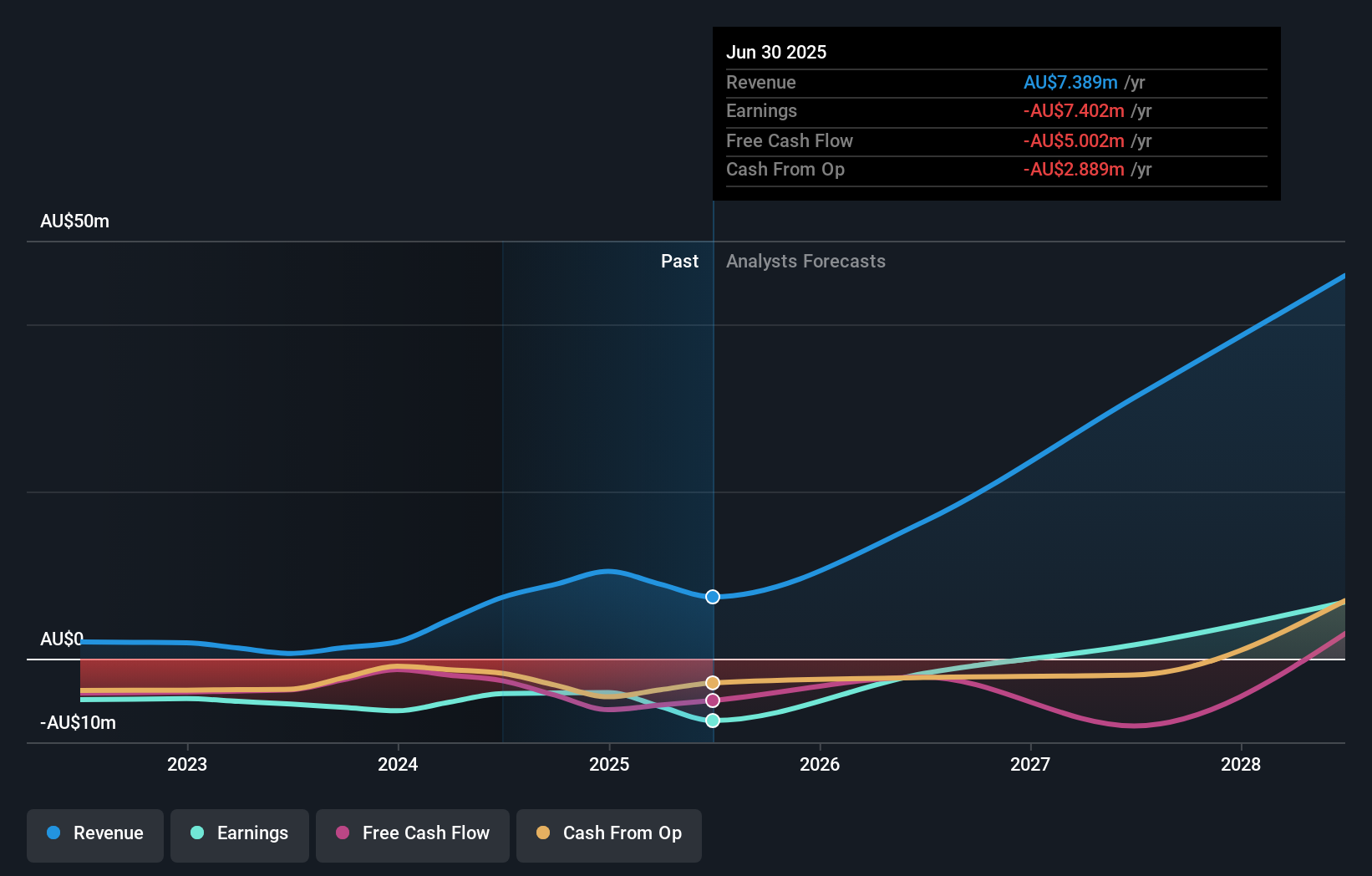

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on AML3D's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered AML3D's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. AML3D hasn't been paying dividends, but its TSR of 162% exceeds its share price return of 158%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that AML3D shareholders have received a total shareholder return of 65% over the last year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand AML3D better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with AML3D (including 1 which shouldn't be ignored) .

But note: AML3D may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AL3

AML3D

Engages in the provision of 3D printing systems and contract manufacturing services to the aerospace, marine, defence, oil and gas, mining, and general manufacturing sectors in Australia, Singapore, and the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.