Westpac (ASX:WBC) Margin Decline Reinforces Concerns Over Premium Valuation

Reviewed by Simply Wall St

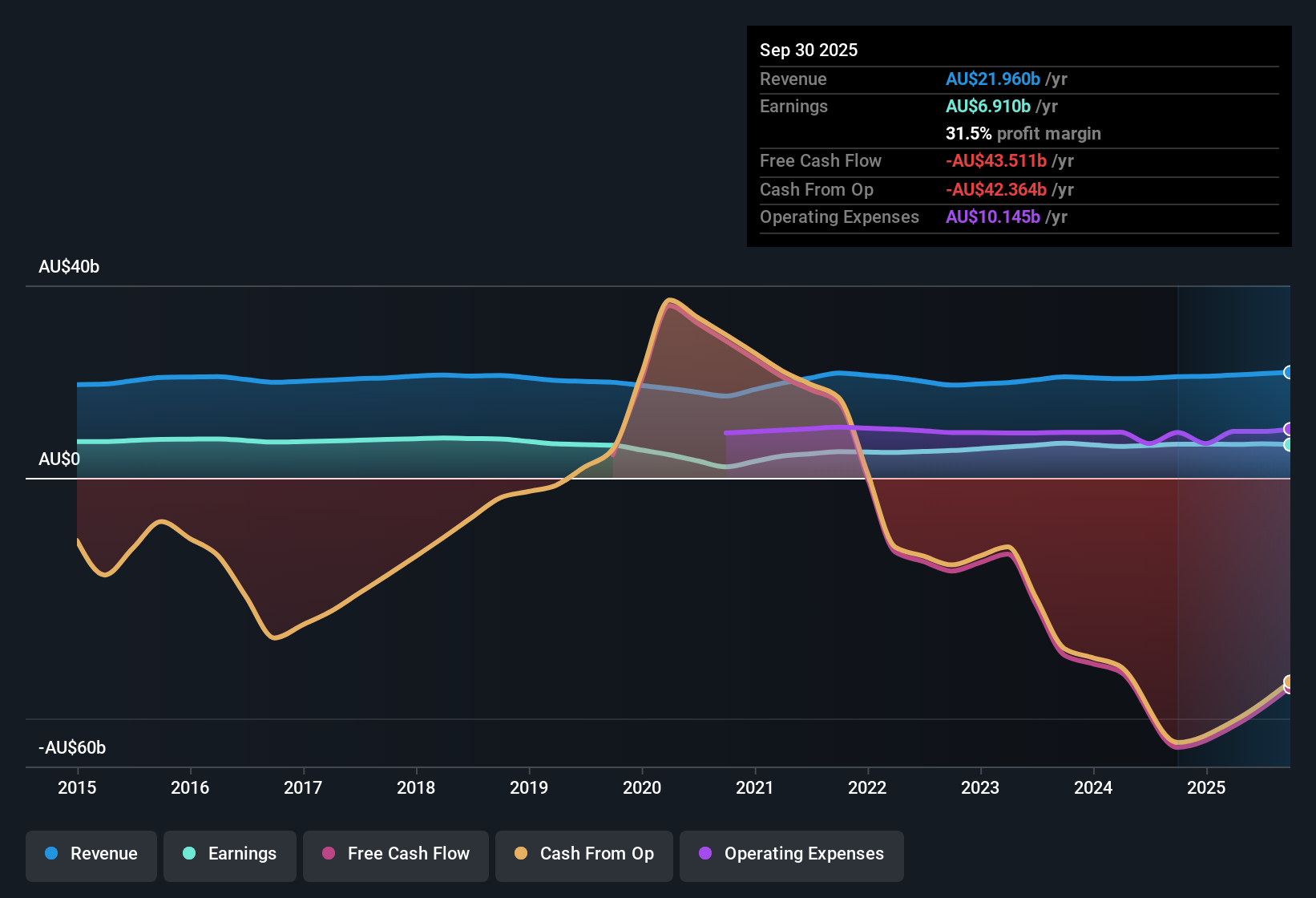

Westpac Banking (ASX:WBC) reported earnings growth of 3.93% per year, with revenue tracking slightly behind at 3.6% per year. The company’s current net profit margin is 31.5%, reflecting a modest decline from last year's 33.2%. Over the last five years, Westpac delivered a solid 12.4% annualized earnings growth, and its earnings quality remains high, although growth forecasts suggest the bank will lag the broader Australian market.

See our full analysis for Westpac Banking.Next up, we’ll see how these results measure against the most widely followed narratives for Westpac on Simply Wall St, where some storylines might hold up, and others could be put to the test.

See what the community is saying about Westpac Banking

Net Interest Margins Face Compression

- Profit margins are expected to shrink from 32.6% today to 27.7% in three years, highlighting downside risk for long-term profitability.

- Analysts' consensus view points to several headwinds that support this concern:

- Intense competition in consumer banking, especially mortgages, is already pressuring margins and is predicted to compress net margins further.

- Deposit mix shifting from call to term deposits due to higher interest rates may be less favorable for future margin recovery than bulls hope.

- What is striking in the consensus is that even with robust current financials, stubborn cost and margin pressures are expected to weigh on performance for years.

- Consensus narrative shows cautious optimism but warns on margin outlook given the competitive and funding environment. Bulls expecting quicker margin recovery may face disappointment because margin compression appears broadly structural.

Consensus estimates reinforce the need for investors to watch how quickly margin pressures play out, not just headline profit trends. Read the full Westpac Banking Consensus Narrative. 📊 Read the full Westpac Banking Consensus Narrative.

Rising Tech Investments Send Costs Up

- Operating expenses are climbing due to major technology spend, with large investments in projects like UNITE pushing near-term costs higher.

- According to the consensus narrative:

- Tech expenses and simplification projects are outpacing revenue gains, suggesting efficiency initiatives may take time to offset upfront cost growth.

- Strategic investments are intended to improve future efficiency and profitability, but the consensus expects these to remain a drag on net margins in the short term.

Valuation Premium Looms Over Growth

- Westpac trades at a Price-to-Earnings ratio of 19.7x, versus the global banks industry average of 10.1x and its peer average of 18.4x. The current share price of A$39.82 stands well above both the DCF fair value of A$32.10 and the analyst price target of A$33.70.

- Consensus narrative underscores that:

- Forecasted revenue and earnings growth are both set to trail the wider Australian market, making the premium valuation harder to justify on forward growth alone.

- This premium puts pressure on subsequent results to beat already high expectations, especially if margin compression and cost issues persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Westpac Banking on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or think the story unfolds another way? Share your perspective and craft your unique take in just minutes. Do it your way

A great starting point for your Westpac Banking research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Westpac’s premium valuation is difficult to justify given forecasts for slower growth, shrinking margins, and rising costs that are expected to outpace revenue expansion.

If you want more reliable future prospects, look for companies that offer better value for money and growth potential through these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westpac Banking might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WBC

Westpac Banking

Provides banking and other financial services in Australia, New Zealand, the Pacific Islands, Asia, the Americas, and Europe.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives