Is Now the Right Moment for Westpac Shares After Recent Price Surge in 2025?

Reviewed by Bailey Pemberton

If you have been thinking about what to do with Westpac Banking shares, you are not alone. There is plenty of chatter around whether now is the right time to jump in, trim your position, or simply watch from afar. Westpac has been on a run lately, with its stock closing at $39.37 and a strong 1.1% gain over the past week. Zoom out a little, and the numbers get even more eye-catching: 3.1% over the last month, 21.5% since the start of the year, and a powerful 34.2% over the past twelve months. If you are interested in the longer perspective, the stock has surged 117.3% in three years and 176.8% across five years. These are clear signs that something is energizing investor sentiment.

Much of this recent momentum ties back to shifts in the broader market, especially updates in banking sector regulations and shifting expectations about interest rates globally. As investors reassess the risks and opportunities in large banks, Westpac has benefited from renewed confidence and a perception that the sector’s headwinds may be easing, at least for now.

But does all this upward movement mean Westpac is actually undervalued? When you look at standard valuation checks, Westpac currently scores a zero out of six. This means that across six different methods commonly used to spot undervalued stocks, it fails to tick a single box. Up next, we will break down how these valuation methods work and show why they matter, but stick with us as we save the most practical way to make a call on Westpac’s value for last.

Westpac Banking scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Westpac Banking Excess Returns Analysis

The Excess Returns valuation approach examines whether a company is able to generate profits above the required cost of equity for its shareholders. It looks at return on equity to assess how efficiently Westpac uses its invested capital, and projects whether such returns are likely to exceed what investors could expect from similar, less risky opportunities.

For Westpac Banking, the current Book Value stands at A$21.07 per share, while analysts expect future earnings to stabilize at around A$2.14 per share. These projections are based on a weighted average of future Return on Equity estimates from 12 analysts. The bank's Cost of Equity is estimated at A$1.71 per share, which means its actual Excess Return, or earnings generated above the cost of equity, is just A$0.43 per share. Westpac’s average Return on Equity is 9.76%, and the Stable Book Value is projected to be A$21.95 per share, according to nine different analyst sources.

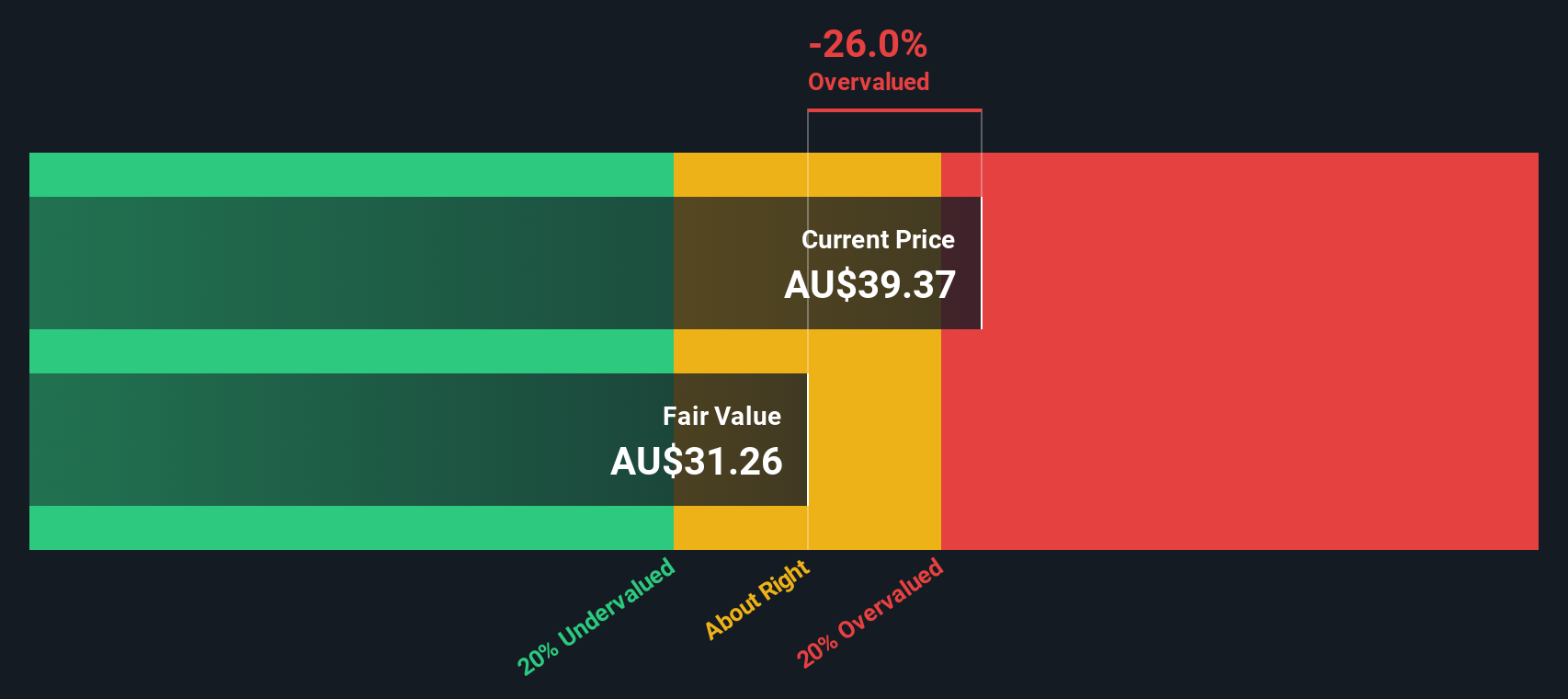

Based on the Excess Returns model, the intrinsic value of Westpac comes in at A$31.25 per share. Compared with the current closing price of A$39.37, this approach indicates that Westpac is trading at a premium and is roughly 26.0% overvalued.

Result: OVERVALUED

Our Excess Returns analysis suggests Westpac Banking may be overvalued by 26.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Westpac Banking Price vs Earnings

For profitable companies like Westpac Banking, the Price-to-Earnings (PE) ratio is a widely used and meaningful valuation metric. The PE ratio essentially tells us how much investors are willing to pay for each dollar of the company's earnings. This makes it especially useful when those earnings are consistent and reliable.

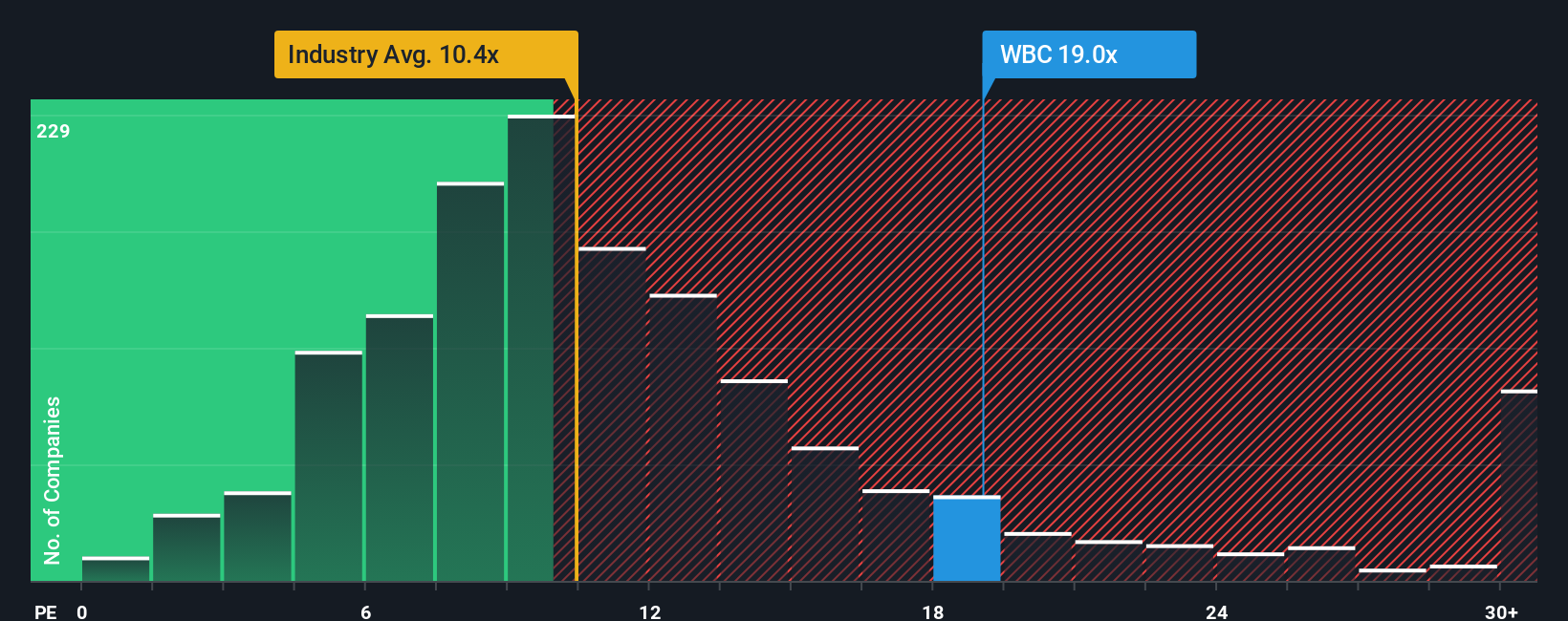

What is considered a “normal” or “fair” PE ratio depends on growth prospects and risk levels. A higher ratio might be justified for businesses expected to grow faster or seen as less risky, while mature or riskier firms usually trade at lower multiples. In Westpac's case, the current PE ratio sits at 19.0x. For context, this compares to an industry average of 10.3x for banks and an average of 17.9x among its direct peers.

Simply Wall St's proprietary "Fair Ratio" offers a more tailored benchmark than simply comparing with peers or industry averages. This Fair Ratio, calculated as 18.2x for Westpac, not only accounts for the company’s growth outlook and profit margins but also adjusts for its risk profile, market capitalization, and the industry in which it operates.

When comparing Westpac’s actual PE ratio of 19.0x with the Fair Ratio of 18.2x, the stock appears slightly more expensive than justified but not by a significant margin. This suggests the current market price is close to fair given all relevant factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Westpac Banking Narrative

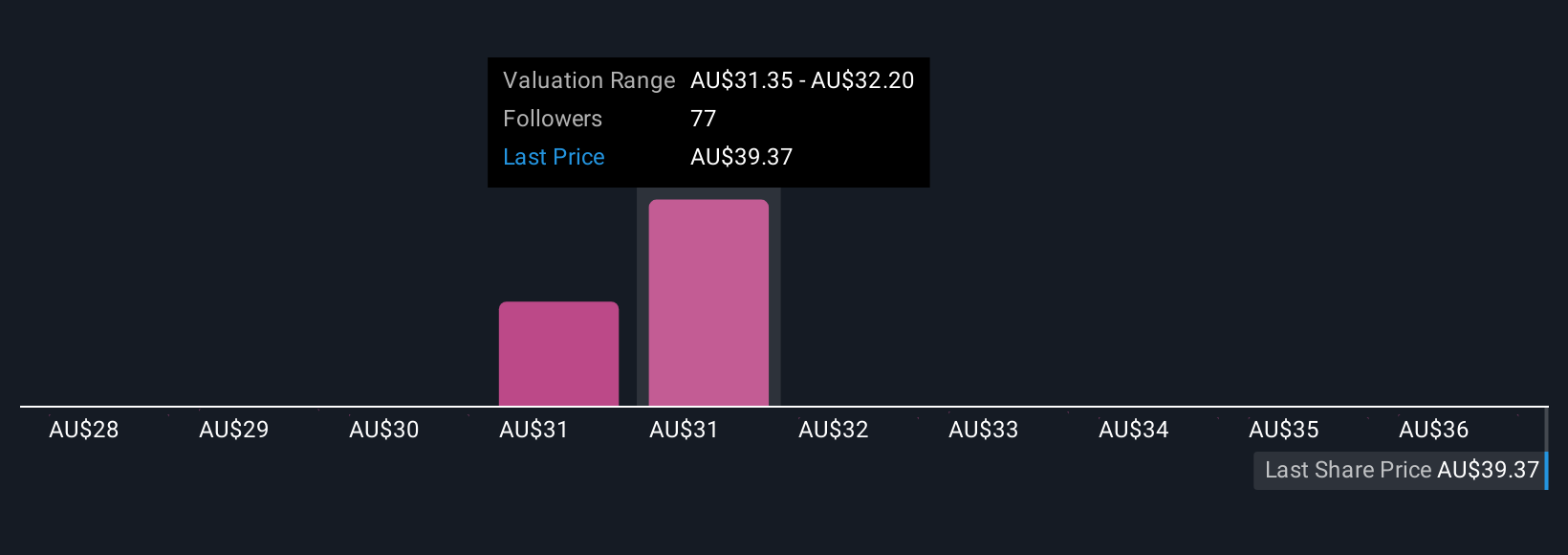

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company's future, connecting your personal outlook with real financial forecasts and producing a tailored fair value.

Rather than focus solely on historic numbers or traditional ratios, Narratives let you describe why you think Westpac Banking’s revenue, earnings, or margins will change. These views are then transformed into concrete projections and valuations. On Simply Wall St’s platform, Narratives are easy to build and share within the Community page. Millions of investors are already using this feature to track, compare, and learn from diverse viewpoints.

What makes Narratives powerful is their flexibility. You can instantly see if your fair value suggests Westpac is a buy, hold, or sell based on your own reasoning, and every Narrative is kept up to date automatically as news and earnings reports arrive. For example, some investors believe Westpac is worth as much as A$38.0 per share if tech investments succeed and margins improve, while others see a fair value as low as A$27.5 amid concerns about rising costs and competitive pressure.

Do you think there's more to the story for Westpac Banking? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westpac Banking might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WBC

Westpac Banking

Provides banking and other financial services in Australia, New Zealand, the Pacific Islands, Asia, the Americas, and Europe.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success