Did Slower Profit Growth and Rising Costs Just Shift National Australia Bank's (ASX:NAB) Investment Narrative?

Reviewed by Sasha Jovanovic

- National Australia Bank recently announced its full-year results, reporting a cash profit of A$7.1 billion for the period ended 30 September 2025, slightly below analyst expectations, and declared a fully franked final dividend of 85 cents per share, payable in December 2025.

- While revenue increased 1.2%, profit margins were pressured by higher credit impairment charges and a 4.6% rise in operating expenses, raising renewed scrutiny of the bank’s competitive position as it faces stronger rivals in business lending.

- We'll examine how the lower-than-expected full-year profit and higher expenses may influence National Australia Bank’s investment narrative going forward.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

National Australia Bank Investment Narrative Recap

To be a shareholder in National Australia Bank, you need confidence in its ability to defend its leadership in business banking and adapt to sector shifts like digital banking, even as competitive challenges intensify. The softer-than-expected profit and higher expenses revealed in the latest results may curb near-term optimism, putting extra attention on the bank’s cost control and market share momentum; however, these headwinds are in line with persistent sector risks and the bank’s long-term investment case remains unchanged for now regarding its primary growth drivers. Among recent developments, the fully franked final dividend of A$0.85 per share, payable in December, stands out, reaffirming National Australia Bank’s commitment to steady shareholder returns despite increased competition and a slight dip in profit. This dividend affirmation is particularly meaningful as it demonstrates stability for income-focused investors amid ongoing margin and cost pressures impacting the sector’s short-term outlook. But, in contrast to reassuring dividend consistency, investors should also be aware that rising operating expenses remain a material risk as ...

Read the full narrative on National Australia Bank (it's free!)

National Australia Bank's narrative projects A$22.7 billion revenue and A$7.3 billion earnings by 2028. This requires 4.2% yearly revenue growth and an A$0.3 billion earnings increase from A$7.0 billion today.

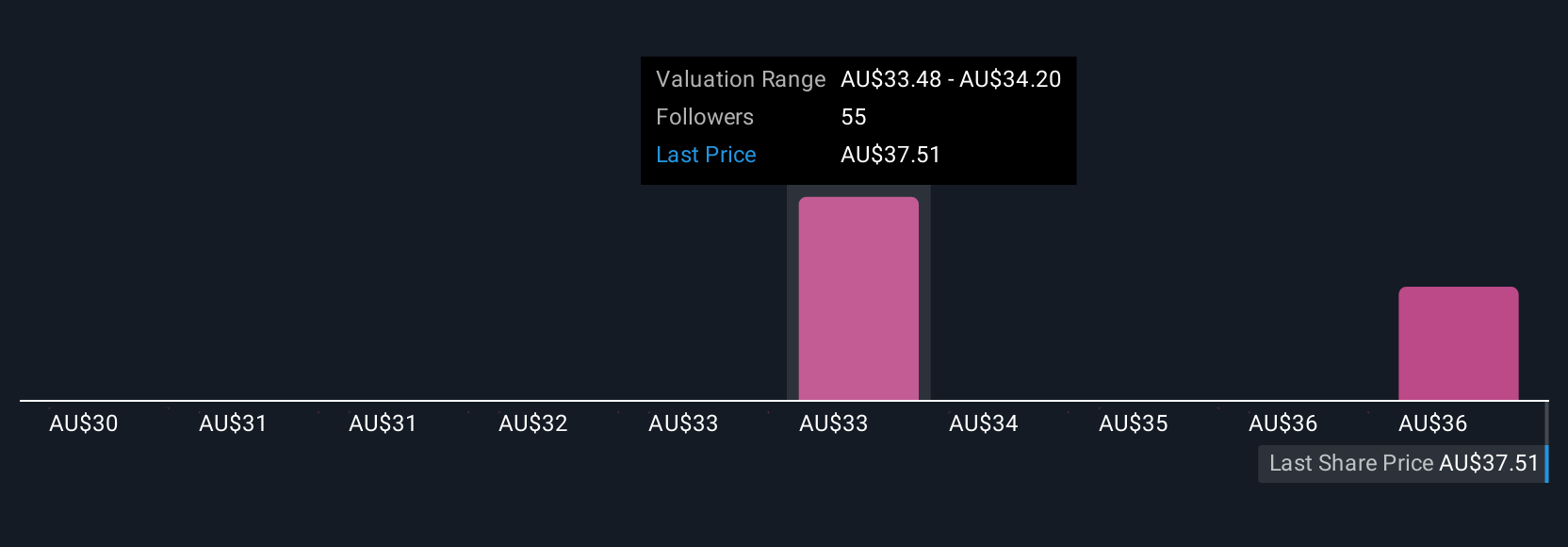

Uncover how National Australia Bank's forecasts yield a A$37.01 fair value, a 14% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted 6 fair value estimates for NAB ranging from A$29.00 to A$39.35, reflecting wide variation in expectations. Opinions are split on the bank’s near-term outlook, particularly as heightened operating costs could restrict margin growth and weigh on performance, explore the full spectrum of views for a broader perspective.

Explore 6 other fair value estimates on National Australia Bank - why the stock might be worth as much as A$39.35!

Build Your Own National Australia Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Australia Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Australia Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Australia Bank's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Australia Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NAB

National Australia Bank

Provides financial services to individuals and businesses in Australia, New Zealand, Europe, Asia, the United States, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives