- Australia

- /

- Hospitality

- /

- ASX:LNW

3 ASX Stocks Estimated To Be Trading Up To 40.9% Below Intrinsic Value

Reviewed by Simply Wall St

As the Australian market navigates through mixed signals with higher-than-expected CPI readings and fluctuating sector performances, investors are keenly observing the implications for future spending and economic stability. In this environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities, particularly when sectors like IT show resilience amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Symal Group (ASX:SYL) | A$2.58 | A$4.64 | 44.4% |

| Superloop (ASX:SLC) | A$2.72 | A$5.36 | 49.2% |

| Smart Parking (ASX:SPZ) | A$1.315 | A$2.26 | 41.9% |

| SenSen Networks (ASX:SNS) | A$0.099 | A$0.19 | 47.5% |

| Mader Group (ASX:MAD) | A$8.00 | A$13.96 | 42.7% |

| LGI (ASX:LGI) | A$4.13 | A$7.70 | 46.3% |

| Genesis Minerals (ASX:GMD) | A$6.76 | A$13.10 | 48.4% |

| Cromwell Property Group (ASX:CMW) | A$0.46 | A$0.85 | 45.9% |

| Aussie Broadband (ASX:ABB) | A$5.39 | A$10.58 | 49.1% |

| Airtasker (ASX:ART) | A$0.34 | A$0.68 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

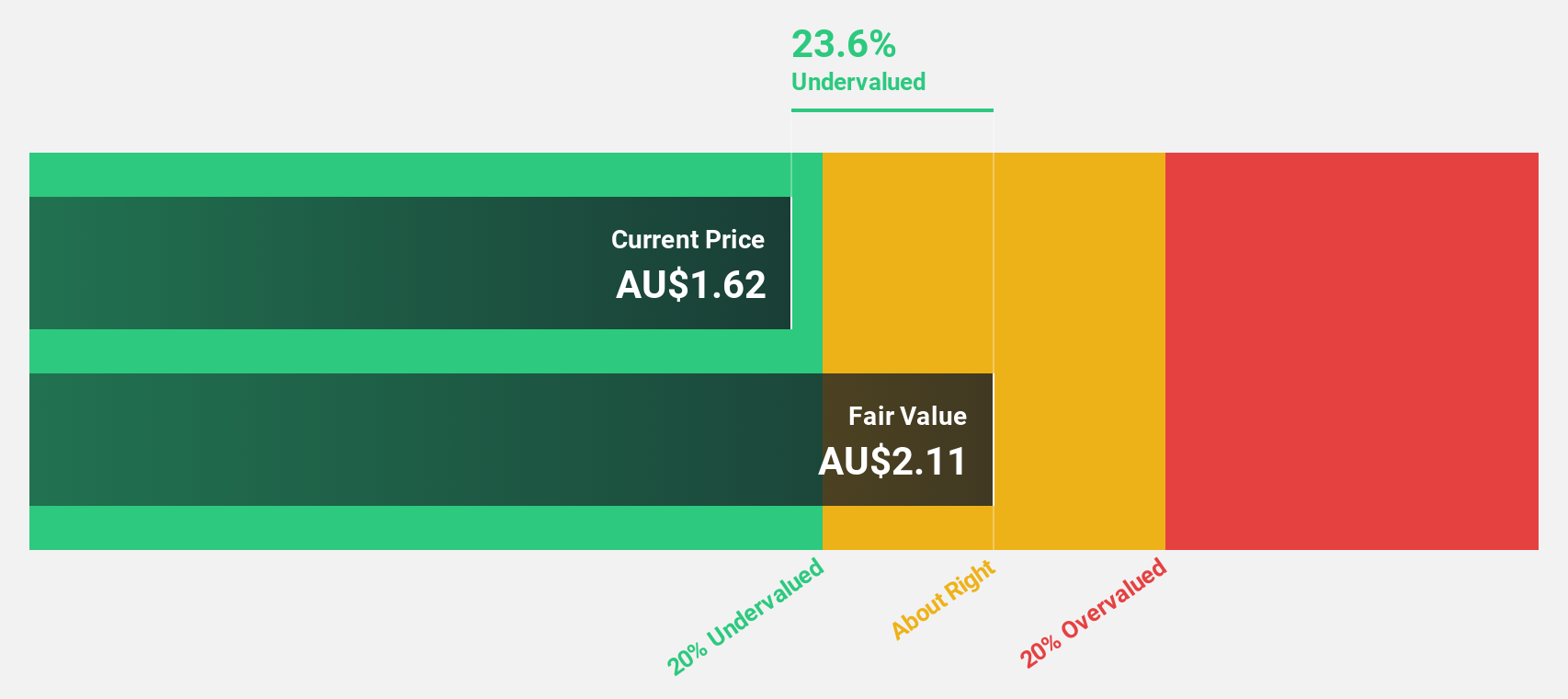

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited operates through its subsidiaries to provide a range of banking products and services tailored for small and medium businesses in Australia, with a market capitalization of A$1.78 billion.

Operations: The company generates revenue primarily from its Small and Medium Enterprises (SMEs) Lending segment, amounting to A$347.40 million.

Estimated Discount To Fair Value: 35.4%

Judo Capital Holdings, trading at A$1.59, is considered undervalued with a fair value estimate of A$2.45, suggesting significant upside potential. Analysts forecast earnings growth of 22.9% annually, outpacing the Australian market's 12%. However, challenges include a high bad loans ratio of 3.4% and a low allowance for these loans at 43%. Recent board changes include the retirement of Director Mette Schepers post-AGM in October 2025.

- The growth report we've compiled suggests that Judo Capital Holdings' future prospects could be on the up.

- Navigate through the intricacies of Judo Capital Holdings with our comprehensive financial health report here.

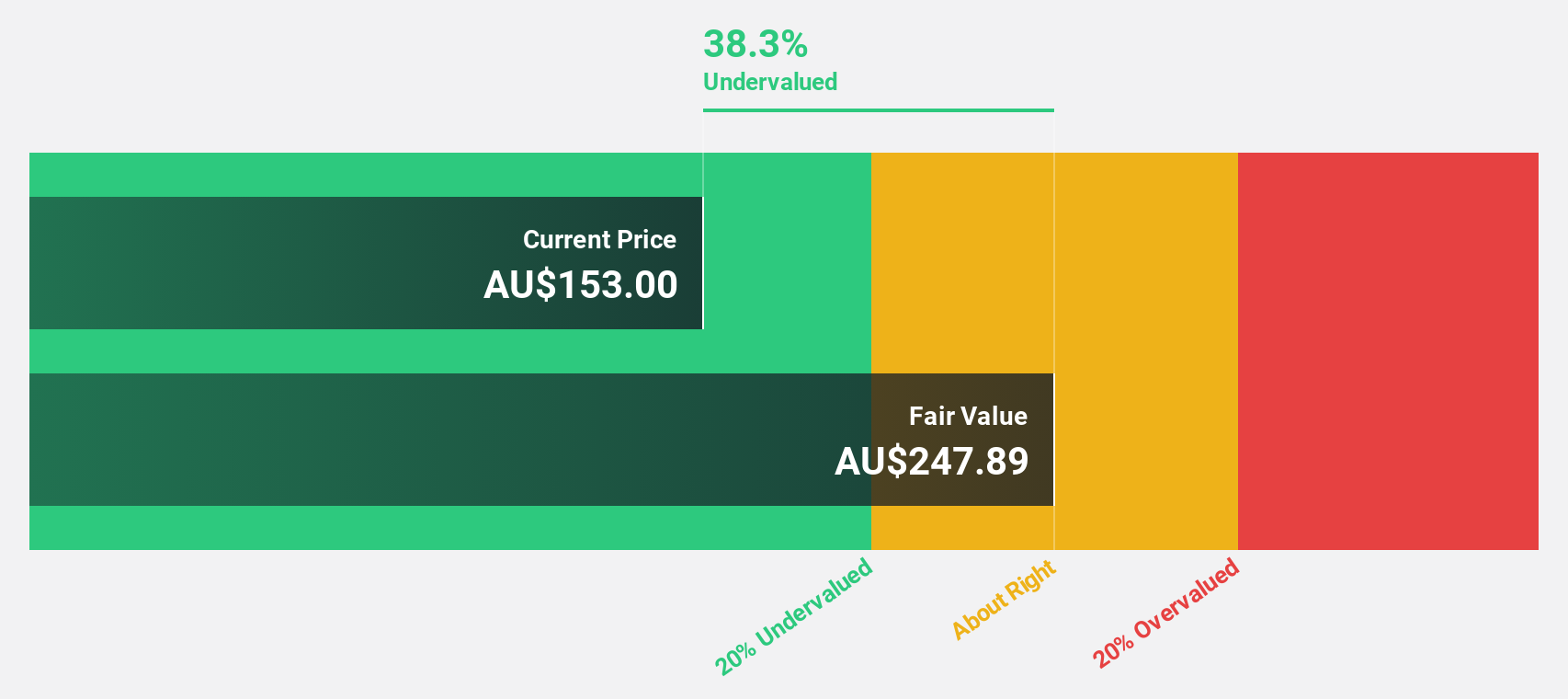

Light & Wonder (ASX:LNW)

Overview: Light & Wonder, Inc. is a cross-platform games company operating in the United States and internationally, with a market cap of A$12.20 billion.

Operations: The company's revenue is derived from three main segments: Gaming ($2.10 billion), SciPlay ($803 million), and iGaming ($321 million).

Estimated Discount To Fair Value: 38.7%

Light & Wonder, trading at A$152.06, is undervalued with a fair value estimate of A$248, offering potential upside. Earnings are forecast to grow 15% annually, surpassing the Australian market's 12%, though revenue growth is modest at 6.6%. Despite recent index removals and legal challenges, the company announced a significant share repurchase program and transitioned its primary listing to ASX to align with strategic goals. Interest payments remain poorly covered by earnings.

- Our comprehensive growth report raises the possibility that Light & Wonder is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Light & Wonder stock in this financial health report.

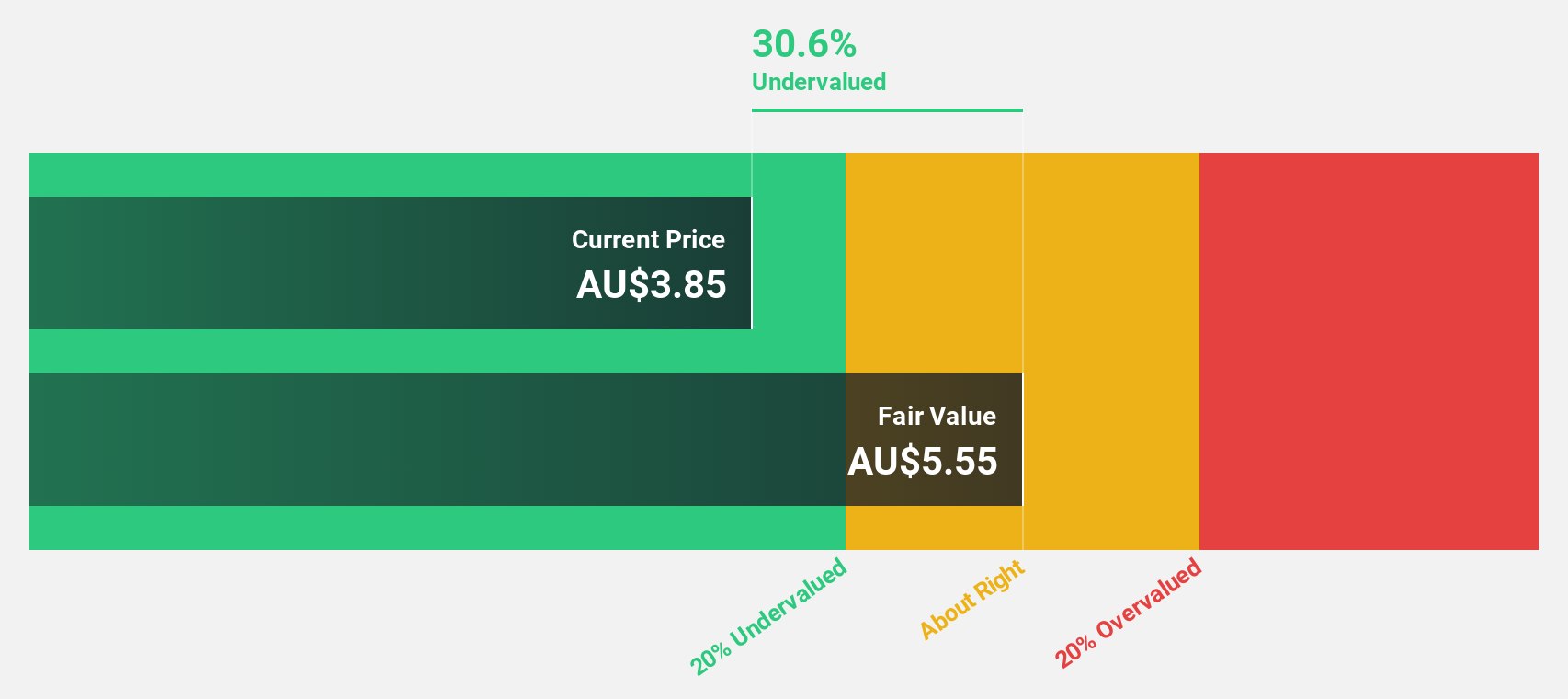

NRW Holdings (ASX:NWH)

Overview: NRW Holdings Limited, with a market cap of A$2.44 billion, offers diversified contract services to the resources and infrastructure sectors in Australia through its subsidiaries.

Operations: The company's revenue is derived from its key segments: Mining at A$1.54 billion, MET at A$932.02 million, and Civil at A$823.72 million.

Estimated Discount To Fair Value: 40.9%

NRW Holdings, trading at A$5.30, is significantly undervalued with a fair value estimate of A$8.96, presenting potential for investors focused on cash flow valuation. Earnings are forecast to grow substantially at 31% annually, outpacing the Australian market's 12%, although recent insider selling raises concerns. Revenue growth is expected to be moderate at 9.3%, above the market average but below high-growth benchmarks. Profit margins have decreased from last year’s levels, and dividends are not well covered by earnings.

- Our expertly prepared growth report on NRW Holdings implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of NRW Holdings.

Taking Advantage

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 35 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LNW

Light & Wonder

Operates as a cross-platform games company in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success