A Look at ANZ (ASX:ANZ) Valuation After FY Results, Dividend Decision, and Strategic Updates

Reviewed by Simply Wall St

ANZ Group Holdings (ASX:ANZ) has just announced its full-year results, showing a dip in profit following settlement and restructuring charges. Despite this, the Board confirmed a final dividend and highlighted higher net interest income.

See our latest analysis for ANZ Group Holdings.

Despite the headline dip in annual profit, ANZ Group Holdings has kept the market’s attention with its ongoing strategic updates, board-backed dividend plans, and transparent governance releases. Interestingly, while recent news weighed on share price in the past day, ANZ still boasts a robust year-to-date share price return of 29.2% and a one-year total shareholder return of nearly 23%. That momentum has been building over the past three and five years, with returns of 81.4% and 120.5% respectively, marking a period of consistent outperformance and resilience.

If you’re curious to see which other resilient names have been gaining traction, now’s a perfect moment to broaden your investing landscape and discover fast growing stocks with high insider ownership

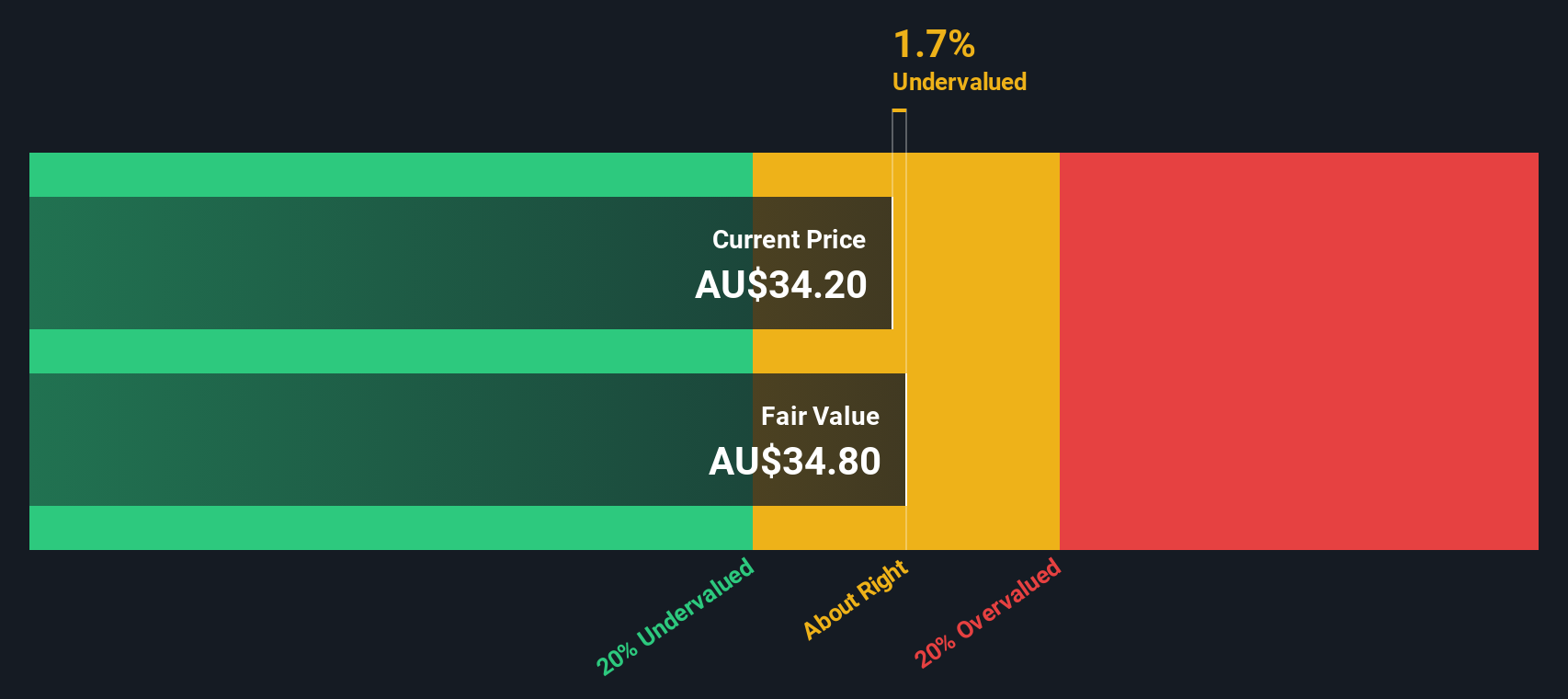

Yet with the stock rallying over the past year and analyst targets lagging the current share price, investors must consider whether ANZ is now undervalued or if the market has already factored in its future growth prospects.

Most Popular Narrative: 7.9% Overvalued

At A$36.94, ANZ Group Holdings trades above the most popular narrative's fair value estimate of A$34.24 per share, signaling some optimism has been priced in. Let’s explore what is driving this view.

The completion of the Suncorp Bank acquisition is expected to yield larger and earlier synergies than initially planned. This is projected to enhance scale and growth in Queensland, which should positively impact revenue and net margins. A significant shift towards a lower-cost, dual platform system with ANZ Plus and Transactive also aims to improve efficiency, reduce costs, and allow faster roll-out of new products. These changes are expected to increase market share and positively impact net margins.

Wondering why this valuation stands above market consensus? The secret lies in upbeat forecasts for future revenues and margins, with ambitious transformation targets that could reshape ANZ's profit profile. Dig into the narrative to uncover the pivotal assumptions, surprising projections, and the metrics that fuel this higher price estimate.

Result: Fair Value of $34.24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny and execution risks related to digital transformation could challenge ANZ's ability to sustain its current growth and margin outlook.

Find out about the key risks to this ANZ Group Holdings narrative.

Another View: SWS DCF Model Signals Upside

While most analysts see ANZ as priced for optimism, our DCF model paints a different picture. It suggests the shares are actually undervalued, trading around 6% below their calculated fair value. This challenges assumptions behind consensus targets. Could this signal hidden potential or simply reflect different underlying risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ANZ Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ANZ Group Holdings Narrative

If you see things differently or want to dive into the numbers for yourself, you can quickly shape your own narrative in just a few minutes. Do it your way.

A great starting point for your ANZ Group Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let high-potential opportunities pass you by. Use the power of the Simply Wall Street Screener to uncover fresh stocks that can energize your portfolio.

- Supercharge your search for stable income and maximize your returns by reviewing these 14 dividend stocks with yields > 3% with yields over 3%.

- Get ahead of the curve and capitalize on groundbreaking tech trends by zeroing in on these 25 AI penny stocks already making waves in artificial intelligence.

- Uncover tomorrow’s possible success stories before they’re widely known by analyzing these 3575 penny stocks with strong financials showing strong fundamentals and momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ANZ

ANZ Group Holdings

Engages in the provision of banking and financial products and services to retail and business customers in Australia and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives