- Australia

- /

- Auto Components

- /

- ASX:DDT

Did You Manage To Avoid DataDot Technology's Devastating 78% Share Price Drop?

DataDot Technology Limited (ASX:DDT) shareholders will doubtless be very grateful to see the share price up 133% in the last quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 78% lower after that period. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The fundamental business performance will ultimately determine if the turnaround can be sustained.

See our latest analysis for DataDot Technology

DataDot Technology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade DataDot Technology reduced its trailing twelve month revenue by 10% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 26% per year in the same time period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

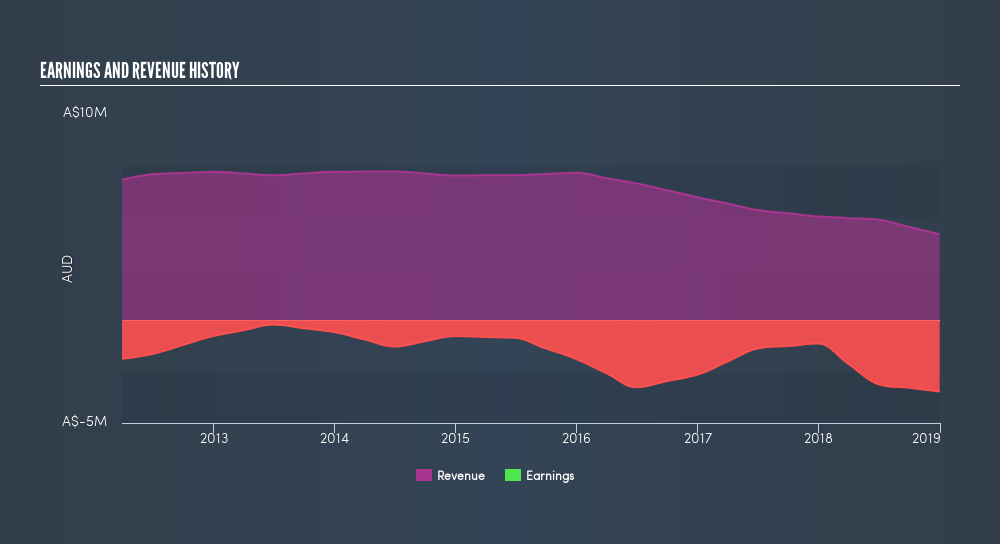

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of DataDot Technology's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that DataDot Technology shareholders have received a total shareholder return of 17% over one year. There's no doubt those recent returns are much better than the TSR loss of 26% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of DataDot Technology by clicking this link.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:DDT

DataDot Technology

Manufactures and distributes asset identification, management, protection, and authentication solutions in Australia, Europe, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives