- Australia

- /

- Auto Components

- /

- ASX:ABV

Advanced Braking Technology Insiders Benefit From Selling Stock At AU$0.077

While Advanced Braking Technology Limited (ASX:ABV) shareholders have enjoyed a good week with stock up 11%, they need remain vigilant. Although prices were relatively low, insiders chose to sell AU$585k worth of stock in the past 12 months. This could be a sign of impending weakness.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Advanced Braking Technology Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the insider, Keith Knowles, for AU$585k worth of shares, at about AU$0.077 per share. That means that even when the share price was below the current price of AU$0.11, an insider wanted to cash in some shares. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. We note that the biggest single sale was only 12% of Keith Knowles's holding. Keith Knowles was the only individual insider to sell shares in the last twelve months.

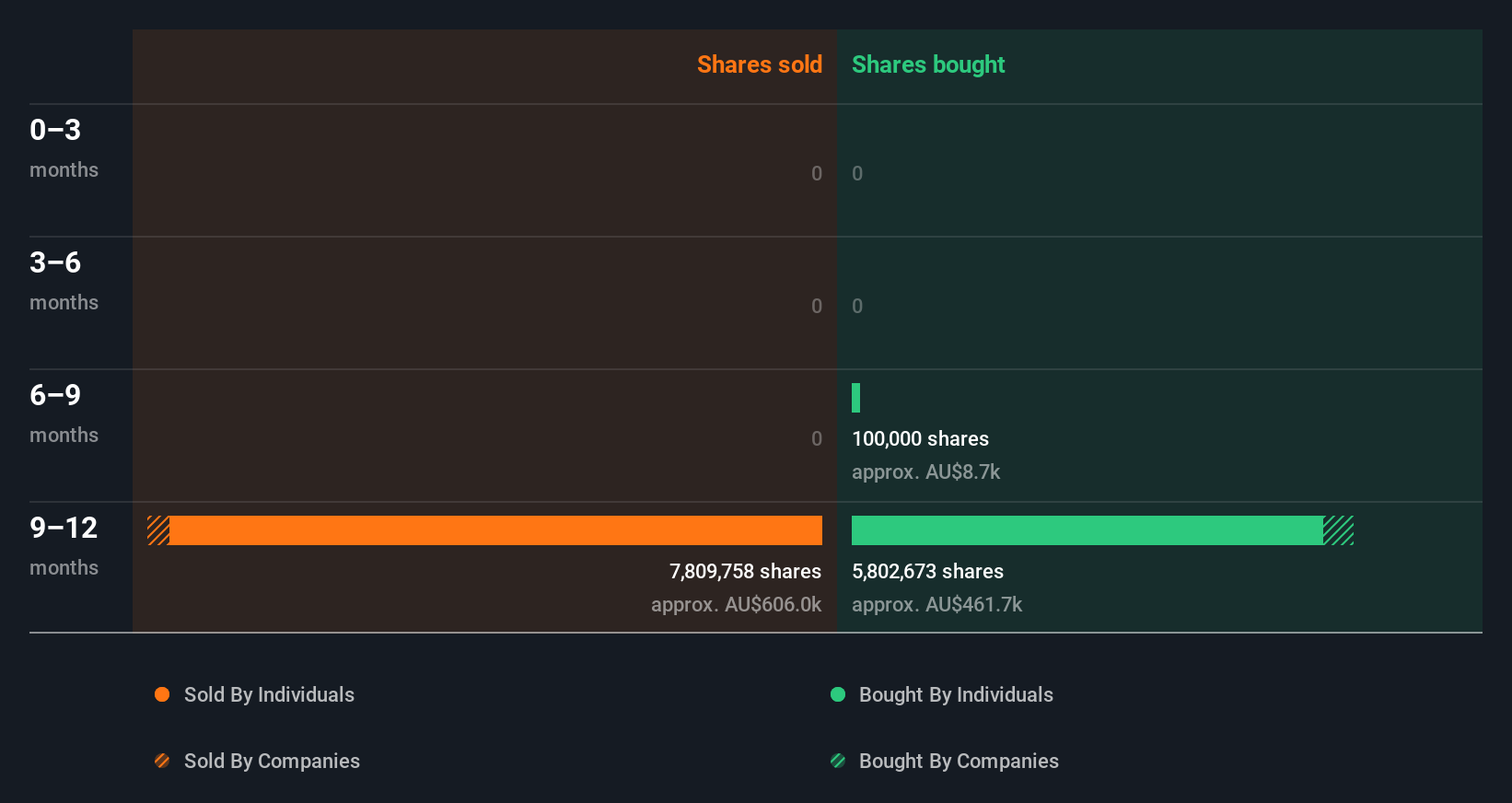

Over the last year, we can see that insiders have bought 5.56m shares worth AU$432k. But insiders sold 7.55m shares worth AU$585k. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

Check out our latest analysis for Advanced Braking Technology

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insider Ownership Of Advanced Braking Technology

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Advanced Braking Technology insiders own 41% of the company, currently worth about AU$18m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Advanced Braking Technology Insider Transactions Indicate?

The fact that there have been no Advanced Braking Technology insider transactions recently certainly doesn't bother us. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Advanced Braking Technology insider transactions don't fill us with confidence. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Our analysis shows 2 warning signs for Advanced Braking Technology (1 is significant!) and we strongly recommend you look at these before investing.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ABV

Advanced Braking Technology

Engages in the research, design, development, manufacture, distribution, and sale of braking solutions worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion