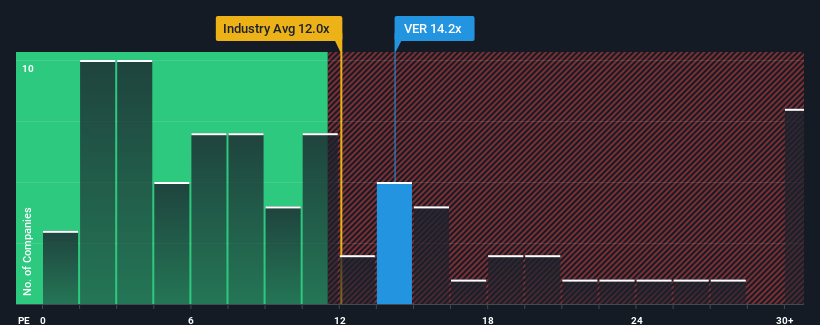

It's not a stretch to say that VERBUND AG's (VIE:VER) price-to-earnings (or "P/E") ratio of 14.2x right now seems quite "middle-of-the-road" compared to the market in Austria, where the median P/E ratio is around 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

VERBUND hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for VERBUND

Is There Some Growth For VERBUND?

There's an inherent assumption that a company should be matching the market for P/E ratios like VERBUND's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. Still, the latest three year period has seen an excellent 193% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings growth is heading into negative territory, declining 15% per annum over the next three years. That's not great when the rest of the market is expected to grow by 2.6% each year.

With this information, we find it concerning that VERBUND is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that VERBUND currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for VERBUND you should be aware of, and 1 of them is potentially serious.

You might be able to find a better investment than VERBUND. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:VER

VERBUND

Generates, trades, and sells electricity to energy exchange markets, traders, electric utilities and industrial companies, and households and commercial customers.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives