- Austria

- /

- Electronic Equipment and Components

- /

- WBAG:KTCG

How Does Kapsch TrafficCom's (VIE:KTCG) CEO Pay Compare With Company Performance?

This article will reflect on the compensation paid to Georg Kapsch who has served as CEO of Kapsch TrafficCom AG (VIE:KTCG) since 2002. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Kapsch TrafficCom.

View our latest analysis for Kapsch TrafficCom

How Does Total Compensation For Georg Kapsch Compare With Other Companies In The Industry?

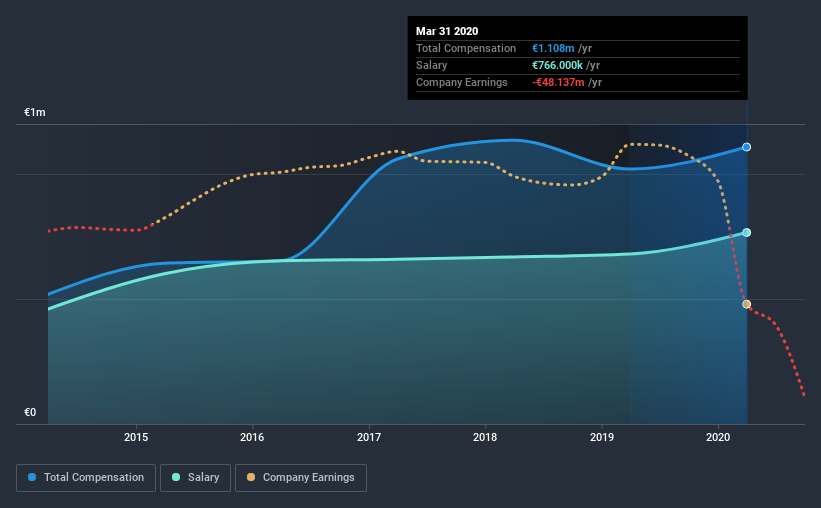

According to our data, Kapsch TrafficCom AG has a market capitalization of €170m, and paid its CEO total annual compensation worth €1.1m over the year to March 2020. That's a notable increase of 8.6% on last year. We note that the salary portion, which stands at €766.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between €82m and €327m, we discovered that the median CEO total compensation of that group was €412k. Accordingly, our analysis reveals that Kapsch TrafficCom AG pays Georg Kapsch north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €766k | €680k | 69% |

| Other | €342k | €340k | 31% |

| Total Compensation | €1.1m | €1.0m | 100% |

Speaking on an industry level, nearly 63% of total compensation represents salary, while the remainder of 37% is other remuneration. According to our research, Kapsch TrafficCom has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Kapsch TrafficCom AG's Growth

Over the last three years, Kapsch TrafficCom AG has shrunk its earnings per share by 86% per year. In the last year, its revenue is down 17%.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Kapsch TrafficCom AG Been A Good Investment?

Since shareholders would have lost about 71% over three years, some Kapsch TrafficCom AG investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we touched on above, Kapsch TrafficCom AG is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. Arguably worse, we've been waiting for positive EPS growth for the last three years. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Kapsch TrafficCom that you should be aware of before investing.

Switching gears from Kapsch TrafficCom, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Kapsch TrafficCom or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kapsch TrafficCom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WBAG:KTCG

Kapsch TrafficCom

Provides intelligent transportation systems technologies, solutions, and services in Austria, Europe, the Middle East, Africa, the Asia-Pacific, and the Americas.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026