- Austria

- /

- Real Estate

- /

- WBAG:UBS

Some UBM Development AG (VIE:UBS) Analysts Just Made A Major Cut To Next Year's Estimates

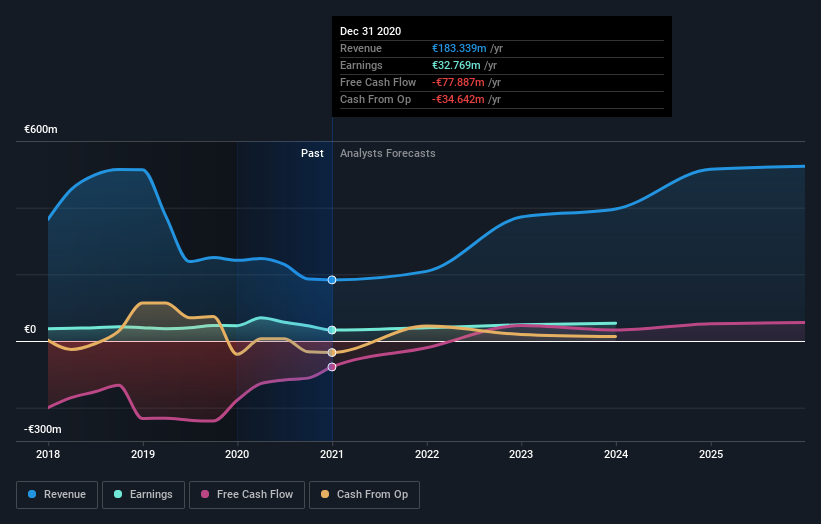

One thing we could say about the analysts on UBM Development AG (VIE:UBS) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Following the downgrade, the current consensus from UBM Development's six analysts is for revenues of €209m in 2021 which - if met - would reflect a meaningful 14% increase on its sales over the past 12 months. Statutory earnings per share are supposed to dip 4.7% to €4.18 in the same period. Prior to this update, the analysts had been forecasting revenues of €275m and earnings per share (EPS) of €5.32 in 2021. It looks like analyst sentiment has declined substantially, with a pretty serious reduction to revenue estimates and a pretty serious decline to earnings per share numbers as well.

Check out our latest analysis for UBM Development

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing stands out from these estimates, which is that UBM Development is forecast to grow faster in the future than it has in the past, with revenues expected to display 14% annualised growth until the end of 2021. If achieved, this would be a much better result than the 12% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to decline 2.3% per year. So it's pretty clear that UBM Development is expected to grow faster than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for UBM Development. Sadly they also cut their revenue estimates, although at least the company is expected to perform a bit better than the wider market. After a cut like that, investors could be forgiven for thinking analysts are a lot more bearish on UBM Development, and a few readers might choose to steer clear of the stock.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple UBM Development analysts - going out to 2025, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WBAG:UBS

UBM Development

Engages in the development, management, and sale of real estate properties in Germany, Austria, Poland, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.