- Italy

- /

- Oil and Gas

- /

- BIT:DIS

3 European Dividend Stocks Yielding Up To 9.4%

Reviewed by Simply Wall St

As European markets navigate a landscape marked by cooling enthusiasm for artificial intelligence and economic challenges in key regions, the pan-European STOXX Europe 600 Index managed to rise by 1.77%, buoyed by relief over the reopening of the U.S. federal government. Despite these headwinds, dividend stocks remain an attractive option for investors seeking steady income and potential resilience amidst market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.28% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.45% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.21% | ★★★★★★ |

| Evolution (OM:EVO) | 4.98% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.43% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.32% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.77% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.75% | ★★★★★★ |

| Afry (OM:AFRY) | 4.00% | ★★★★★☆ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

d'Amico International Shipping (BIT:DIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: d'Amico International Shipping S.A., with a market cap of €639.45 million, operates globally as a marine transportation company through its subsidiaries.

Operations: d'Amico International Shipping S.A. generates revenue primarily from its product tankers segment, amounting to $367.40 million.

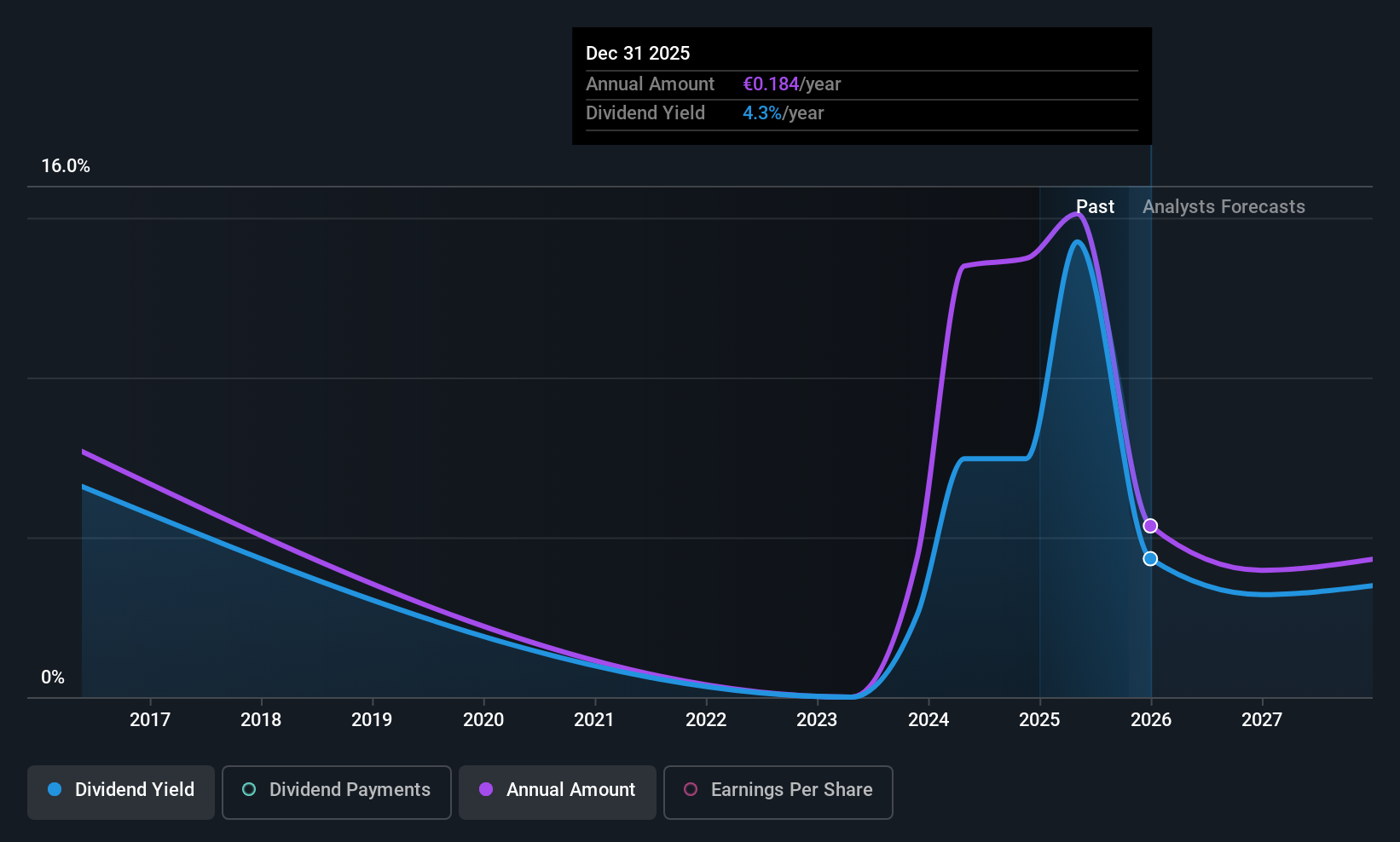

Dividend Yield: 9.4%

d'Amico International Shipping offers a high dividend yield of 9.45%, placing it in the top 25% of Italian market payers, but its dividends are not well covered by cash flows, with a cash payout ratio at 126.4%. Despite stable and reliable dividend growth over the past decade, recent earnings have declined significantly. The company trades at a significant discount to estimated fair value, suggesting potential for capital appreciation despite challenges in sustaining current dividend levels from free cash flows.

- Navigate through the intricacies of d'Amico International Shipping with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that d'Amico International Shipping is trading behind its estimated value.

Voyageurs du Monde (ENXTPA:ALVDM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Voyageurs du Monde SA operates as a travel agency in France and internationally, with a market cap of €714.12 million.

Operations: Voyageurs du Monde SA generates revenue through its segments: Bike (€115.83 million), Adventure Tours (€214.57 million), and Tailor-Made Trips (€432.27 million).

Dividend Yield: 3.1%

Voyageurs du Monde SA's dividends are well-covered by earnings and cash flows, with payout ratios of 33% and 44.9%, respectively. However, its dividend history is unstable and has seen volatility over the past decade. Despite this, dividends have grown over ten years. Recent earnings reports show a modest increase in net income to €5.73 million for H1 2025 from €5.49 million a year prior, with sales rising to €317.34 million from €288.98 million.

- Get an in-depth perspective on Voyageurs du Monde's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Voyageurs du Monde shares in the market.

UNIQA Insurance Group (WBAG:UQA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UNIQA Insurance Group AG is an insurance company operating in Austria and Central and Eastern Europe, with a market cap of approximately €4.03 billion.

Operations: UNIQA Insurance Group AG's revenue is primarily derived from its segments including €252.28 million from UNIQA Austria Life, €1.27 billion from UNIQA Austria Health, €729.33 million from UNIQA International Life, €139.30 million from UNIQA International Health, and significant contributions of €1.36 billion and €2.47 billion respectively from Property and Casualty Insurance in Reinsurance and UNIQA Austria, along with other notable inputs like €2.30 billion from Property and Casualty Insurance - UNIQA International.

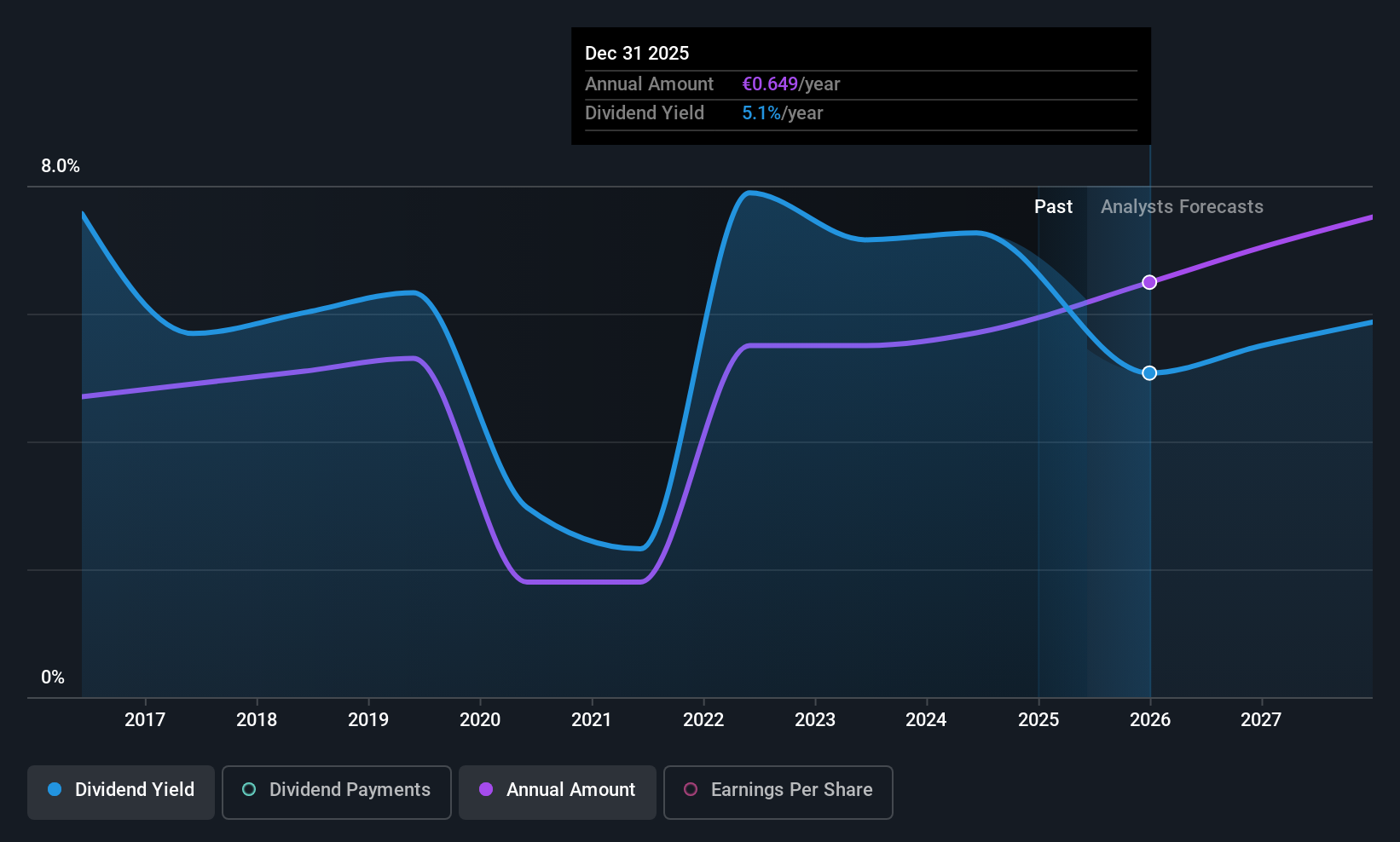

Dividend Yield: 4.6%

UNIQA Insurance Group's dividends are well-supported by earnings and cash flows, with payout ratios of 50.9% and 47.5%, respectively. While the dividend yield is in the top quartile for Austria at 4.57%, its history shows volatility over the past decade despite overall growth. Recent earnings for H1 2025 reported net income of €232.5 million, slightly down from €277.5 million a year ago, yet basic EPS increased to €0.76 from €0.72, indicating some resilience in profitability amidst challenges.

- Dive into the specifics of UNIQA Insurance Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that UNIQA Insurance Group is priced lower than what may be justified by its financials.

Taking Advantage

- Access the full spectrum of 228 Top European Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DIS

d'Amico International Shipping

Through its subsidiaries, operates as a marine transportation company worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives