- Austria

- /

- Energy Services

- /

- WBAG:SBO

With EPS Growth And More, Schoeller-Bleckmann Oilfield Equipment (VIE:SBO) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Schoeller-Bleckmann Oilfield Equipment (VIE:SBO). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Schoeller-Bleckmann Oilfield Equipment

How Fast Is Schoeller-Bleckmann Oilfield Equipment Growing Its Earnings Per Share?

In the last three years Schoeller-Bleckmann Oilfield Equipment's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Schoeller-Bleckmann Oilfield Equipment's EPS has risen over the last 12 months, growing from €4.29 to €4.81. There's little doubt shareholders would be happy with that 12% gain.

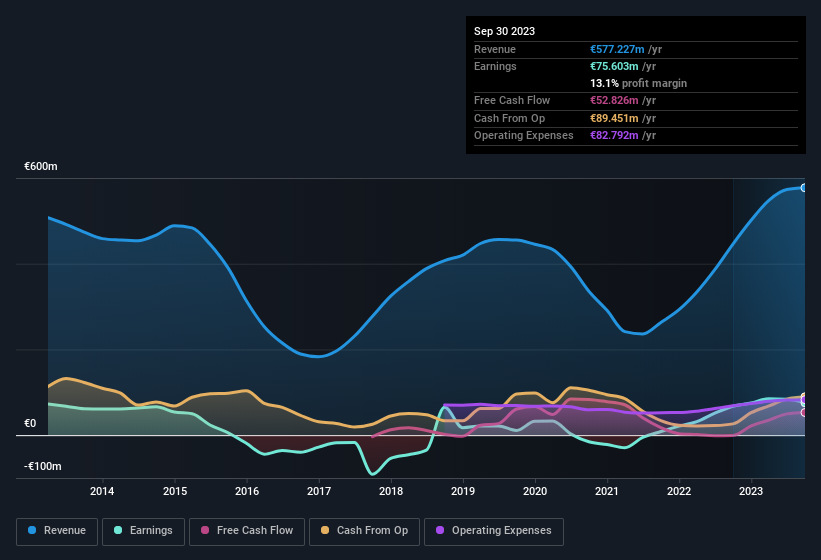

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Schoeller-Bleckmann Oilfield Equipment achieved similar EBIT margins to last year, revenue grew by a solid 29% to €577m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Schoeller-Bleckmann Oilfield Equipment's future EPS 100% free.

Are Schoeller-Bleckmann Oilfield Equipment Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to Schoeller-Bleckmann Oilfield Equipment, with market caps between €369m and €1.5b, is around €1.3m.

Schoeller-Bleckmann Oilfield Equipment offered total compensation worth €948k to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Schoeller-Bleckmann Oilfield Equipment To Your Watchlist?

As previously touched on, Schoeller-Bleckmann Oilfield Equipment is a growing business, which is encouraging. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. All things considered, Schoeller-Bleckmann Oilfield Equipment is definitely worth taking a deeper dive into. It is worth noting though that we have found 1 warning sign for Schoeller-Bleckmann Oilfield Equipment that you need to take into consideration.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in AT with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:SBO

Schoeller-Bleckmann Oilfield Equipment

Manufactures and sells steel products worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives