- Poland

- /

- Professional Services

- /

- WSE:GPP

3 European Stocks Estimated To Be Up To 46.8% Below Their Intrinsic Value

Reviewed by Simply Wall St

As the European market grapples with uncertainty surrounding U.S. trade policy and recent economic adjustments by the European Central Bank, investor sentiment remains cautious despite potential boosts from increased defense and infrastructure spending. In this environment, identifying undervalued stocks—those trading below their intrinsic value—can offer opportunities for investors seeking to navigate these complex conditions effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sword Group (ENXTPA:SWP) | €33.00 | €64.77 | 49.1% |

| Airbus (ENXTPA:AIR) | €163.12 | €320.31 | 49.1% |

| Comet Holding (SWX:COTN) | CHF233.00 | CHF461.06 | 49.5% |

| TF Bank (OM:TFBANK) | SEK364.00 | SEK719.55 | 49.4% |

| Wienerberger (WBAG:WIE) | €34.86 | €68.58 | 49.2% |

| adidas (XTRA:ADS) | €226.80 | €451.85 | 49.8% |

| Xplora Technologies (OB:XPLRA) | NOK27.60 | NOK54.21 | 49.1% |

| Star7 (BIT:STAR7) | €6.15 | €12.26 | 49.8% |

| Waystream Holding (OM:WAYS) | SEK18.28 | SEK35.95 | 49.2% |

| Galderma Group (SWX:GALD) | CHF96.52 | CHF189.57 | 49.1% |

Let's uncover some gems from our specialized screener.

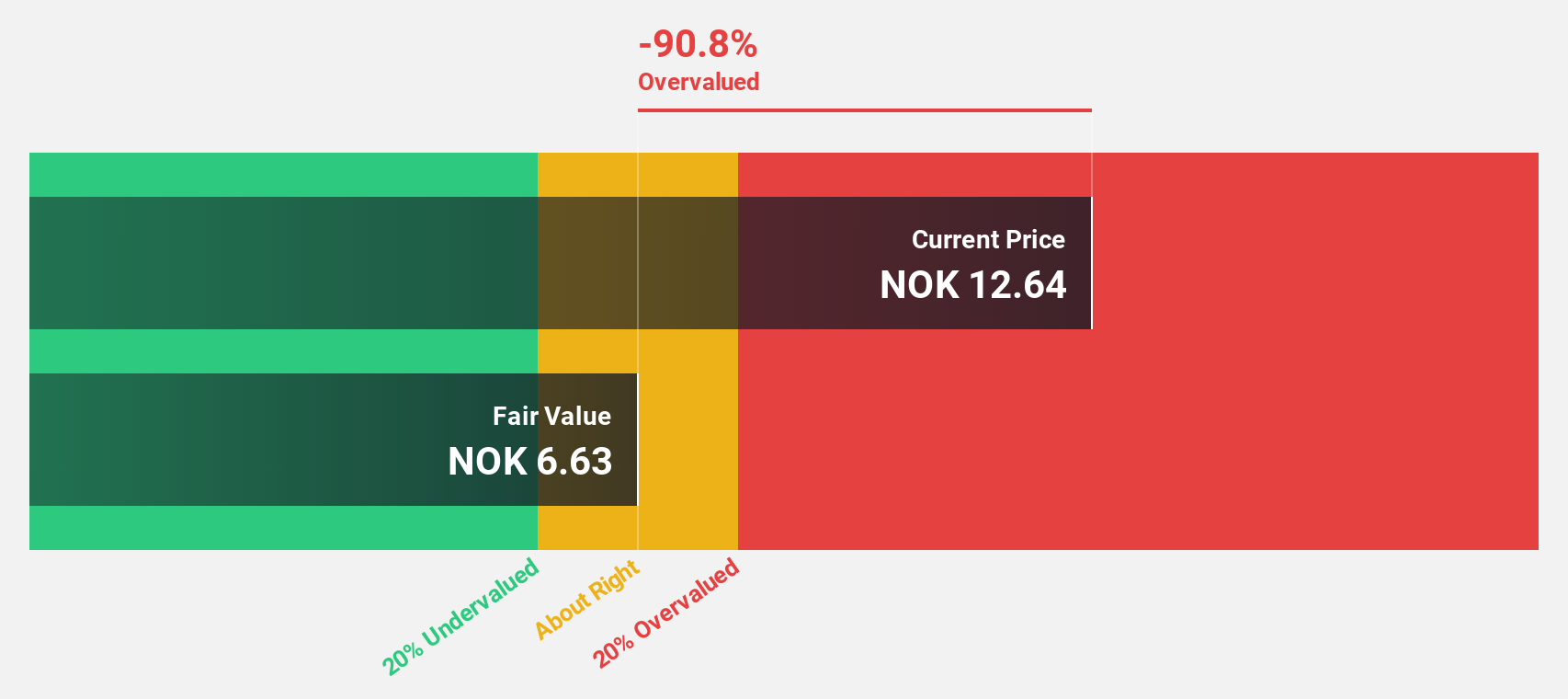

B2 Impact (OB:B2I)

Overview: B2 Impact ASA, with a market cap of NOK3.68 billion, operates through its subsidiaries to offer a range of debt solutions.

Operations: The company generates revenue through its segments, with Servicing contributing NOK1.22 billion and Investments adding NOK3.01 billion.

Estimated Discount To Fair Value: 10.5%

B2 Impact ASA is trading at a 10.5% discount to its estimated fair value of NOK 11.16, suggesting it may be undervalued based on cash flows. Despite recent declines in revenue and net income, earnings are projected to grow significantly at 26.4% annually, outpacing the Norwegian market's growth rate. However, the company's high debt level and unsustainable dividend coverage are potential concerns for investors evaluating its financial health and long-term prospects.

- In light of our recent growth report, it seems possible that B2 Impact's financial performance will exceed current levels.

- Get an in-depth perspective on B2 Impact's balance sheet by reading our health report here.

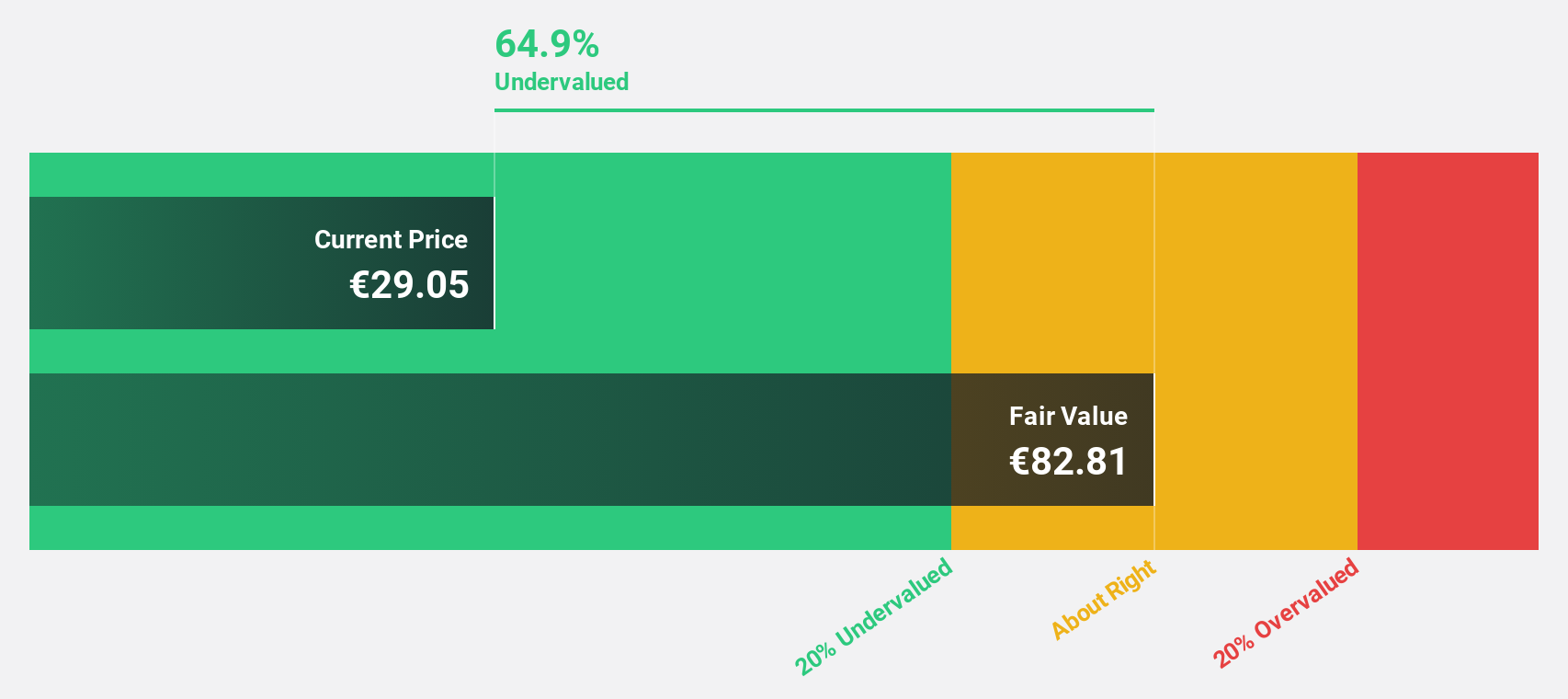

Schoeller-Bleckmann Oilfield Equipment (WBAG:SBO)

Overview: Schoeller-Bleckmann Oilfield Equipment Aktiengesellschaft manufactures and sells steel products globally, with a market cap of €537.40 million.

Operations: The company's revenue segments include €305.97 million from Oilfield Equipment and €418.15 million from Advanced Manufacturing & Services.

Estimated Discount To Fair Value: 46.8%

Schoeller-Bleckmann Oilfield Equipment is trading at €34.1, significantly below its estimated fair value of €64.1, highlighting undervaluation based on cash flows. Revenue is expected to grow 3.6% annually, outpacing the Austrian market's 1.4%. Earnings are anticipated to increase substantially by 20.8% per year, surpassing market growth rates despite a decline in profit margins from last year and an unstable dividend history. Analysts agree on a potential price rise of 46.3%.

- Our expertly prepared growth report on Schoeller-Bleckmann Oilfield Equipment implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Schoeller-Bleckmann Oilfield Equipment with our comprehensive financial health report here.

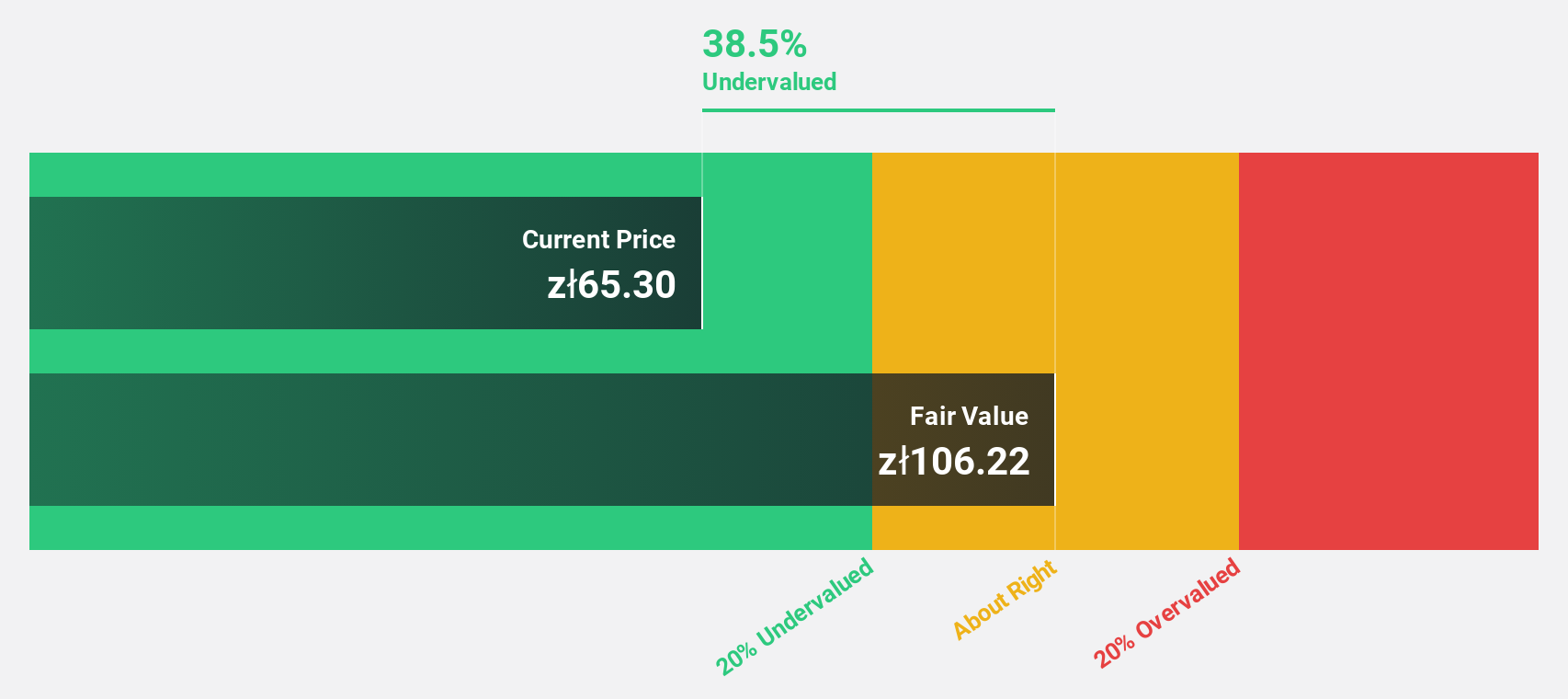

Grupa Pracuj (WSE:GPP)

Overview: Grupa Pracuj S.A. operates in the digital recruitment market across Poland, Ukraine, and Germany with a market cap of PLN3.77 billion.

Operations: The company's revenue segment includes Staffing & Outsourcing Services, generating PLN756.07 million.

Estimated Discount To Fair Value: 41.2%

Grupa Pracuj, trading at PLN55.2, is significantly undervalued with an estimated fair value of PLN93.95, reflecting a 41.2% discount based on cash flow analysis. Revenue is projected to grow at 8.5% annually, outpacing the Polish market's 5.1%. Earnings are expected to rise by 15.3% per year, surpassing market growth rates despite an unstable dividend track record and moderate past profit growth of 9.6%. Return on Equity is forecasted to be very high at 48.3%.

- The analysis detailed in our Grupa Pracuj growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Grupa Pracuj.

Turning Ideas Into Actions

- Explore the 201 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:GPP

Grupa Pracuj

Operates HR technology platform in Poland, Ukraine, and Germany.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives