- Germany

- /

- Auto Components

- /

- XTRA:ED4

3 Dividend Stocks To Consider With Yields From 3% To 8%

Reviewed by Simply Wall St

As global markets experience volatility with U.S. stock indexes nearing record highs and inflation concerns prompting cautious monetary policies, investors are increasingly seeking stability through dividend stocks. In such an environment, a good dividend stock is often characterized by a reliable yield and the potential for steady income, making it an attractive option for those looking to navigate uncertain economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Nichia Steel Works (TSE:5658)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nichia Steel Works, Ltd. is a Japanese company that manufactures and sells iron and steel products, with a market capitalization of approximately ¥15.42 billion.

Operations: Nichia Steel Works, Ltd.'s revenue is primarily derived from its Specialty Steel Wires segment at ¥16.82 billion, Ordinary Wire Products at ¥9.48 billion, and Silver Spiral Wire Products at ¥7.32 billion, with additional income from Real Estate Leasing amounting to ¥164.12 million.

Dividend Yield: 3.1%

Nichia Steel Works has a mixed dividend profile. Despite trading at 64.1% below its estimated fair value and having a low cash payout ratio of 18%, indicating strong coverage by cash flows, the dividend yield is relatively low at 3.07% compared to market leaders in Japan. Earnings growth of 10.6% supports sustainability, but dividends have been volatile and unreliable over the past decade, with significant annual drops exceeding 20%. Recent share buybacks totaling ¥140.63 million may impact future dividend decisions.

- Take a closer look at Nichia Steel Works' potential here in our dividend report.

- Our valuation report unveils the possibility Nichia Steel Works' shares may be trading at a discount.

Schoeller-Bleckmann Oilfield Equipment (WBAG:SBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Schoeller-Bleckmann Oilfield Equipment Aktiengesellschaft manufactures and sells steel products globally, with a market cap of €538.97 million.

Operations: Schoeller-Bleckmann Oilfield Equipment's revenue is primarily derived from its Oilfield Equipment segment, contributing €305.97 million, and its Advanced Manufacturing & Services segment, which accounts for €418.15 million.

Dividend Yield: 5.7%

Schoeller-Bleckmann Oilfield Equipment's dividend profile shows coverage by earnings and cash flows, with payout ratios of 62.8% and 57.9%, respectively. However, the dividend yield of 5.68% is slightly below top-tier Austrian payers, and payments have been volatile over the past decade despite growth. Recent financials indicate a decline in net income to €34.39 million for nine months ending September 2024 from €55.75 million a year ago, raising concerns about sustainability amidst unstable dividends historically.

- Click here and access our complete dividend analysis report to understand the dynamics of Schoeller-Bleckmann Oilfield Equipment.

- The valuation report we've compiled suggests that Schoeller-Bleckmann Oilfield Equipment's current price could be quite moderate.

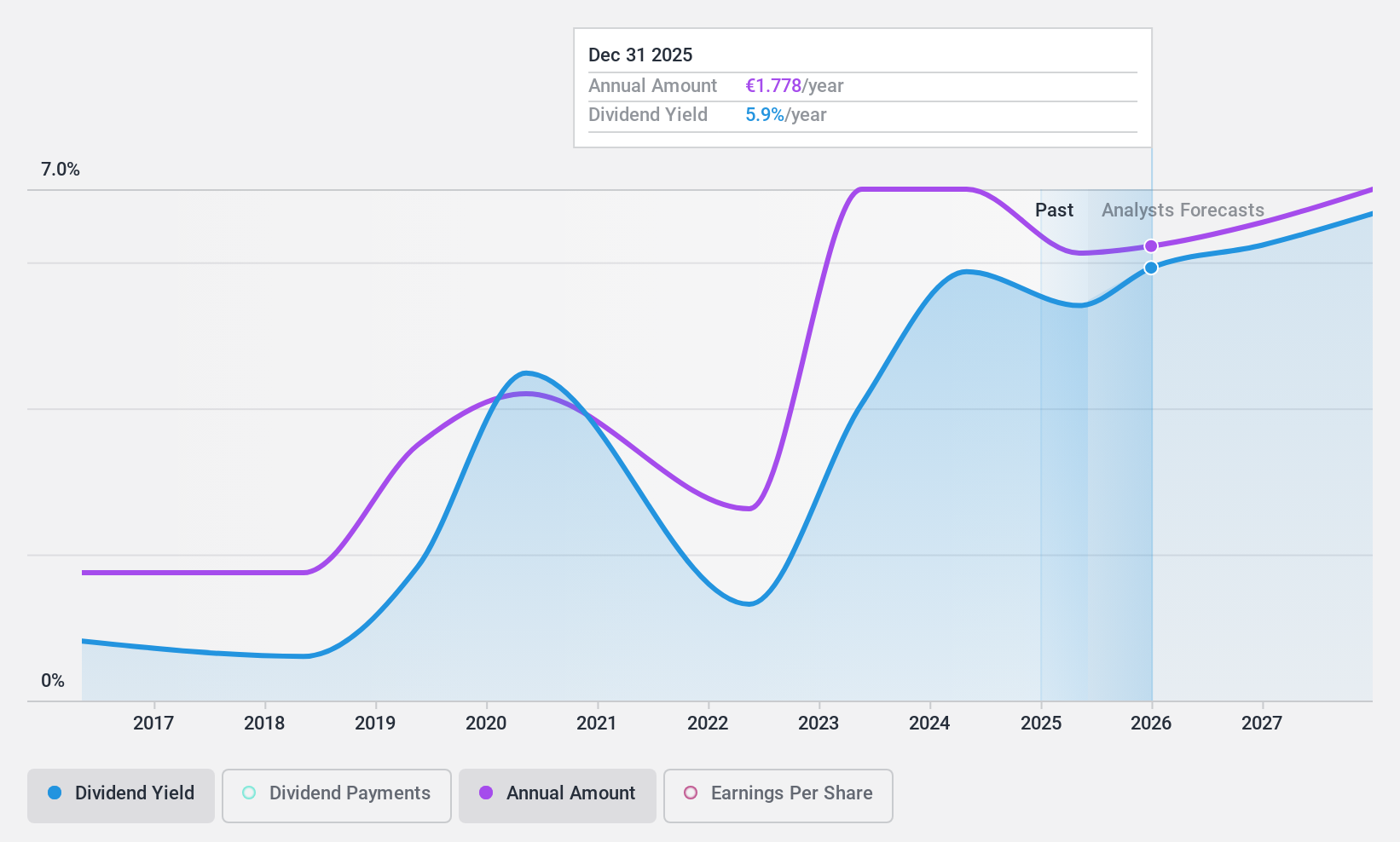

EDAG Engineering Group (XTRA:ED4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG specializes in the development of vehicles, derivatives, modules, and production facilities for the global automotive and commercial vehicle industries, with a market cap of €161 million.

Operations: EDAG Engineering Group AG generates revenue through its Vehicle Engineering segment (€488.72 million), Production Solutions (€280.93 million), and Electrics/Electronics (€102.73 million).

Dividend Yield: 8.1%

EDAG Engineering Group's dividend is supported by a 65.1% payout ratio and an 18% cash payout ratio, indicating strong coverage by earnings and cash flows. Despite a high dividend yield of 8.09%, the company's dividends have been volatile over its nine-year history, with payments decreasing and lacking reliability. The stock trades at a low P/E ratio of 8.1x compared to the German market average, suggesting potential value despite its unstable dividend track record.

- Click to explore a detailed breakdown of our findings in EDAG Engineering Group's dividend report.

- Our valuation report here indicates EDAG Engineering Group may be undervalued.

Make It Happen

- Reveal the 1970 hidden gems among our Top Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EDAG Engineering Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ED4

EDAG Engineering Group

Engages in the development of vehicles, derivatives, modules, and production facilities for the automotive and commercial vehicle industries worldwide.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives