In a week marked by fluctuating consumer confidence and mixed economic signals, global markets experienced moderate gains, with U.S. stocks finishing the holiday-shortened period on a high note before giving back some of their advances. Amid these market dynamics, investors may find value in dividend stocks, which can offer steady income streams and potential resilience against economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bénéteau (ENXTPA:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bénéteau S.A. designs, manufactures, and sells boats and leisure homes in France and internationally, with a market cap of €708.81 million.

Operations: Bénéteau S.A.'s revenue is primarily driven by its boat segment, which generated €1.21 billion.

Dividend Yield: 8.3%

Bénéteau's dividend yield of 8.3% ranks in the top 25% of French market payers, but its sustainability is questionable due to lack of free cash flow coverage and volatile past payments. Despite a reasonable payout ratio of 65.8%, earnings are insufficient to cover dividends, and future earnings are forecasted to decline by 0.6% annually over three years. The stock trades at a significant discount, valued at €1 billion below estimated fair value. Recent events include closing a buyback plan on December 14, 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Bénéteau.

- Our comprehensive valuation report raises the possibility that Bénéteau is priced lower than what may be justified by its financials.

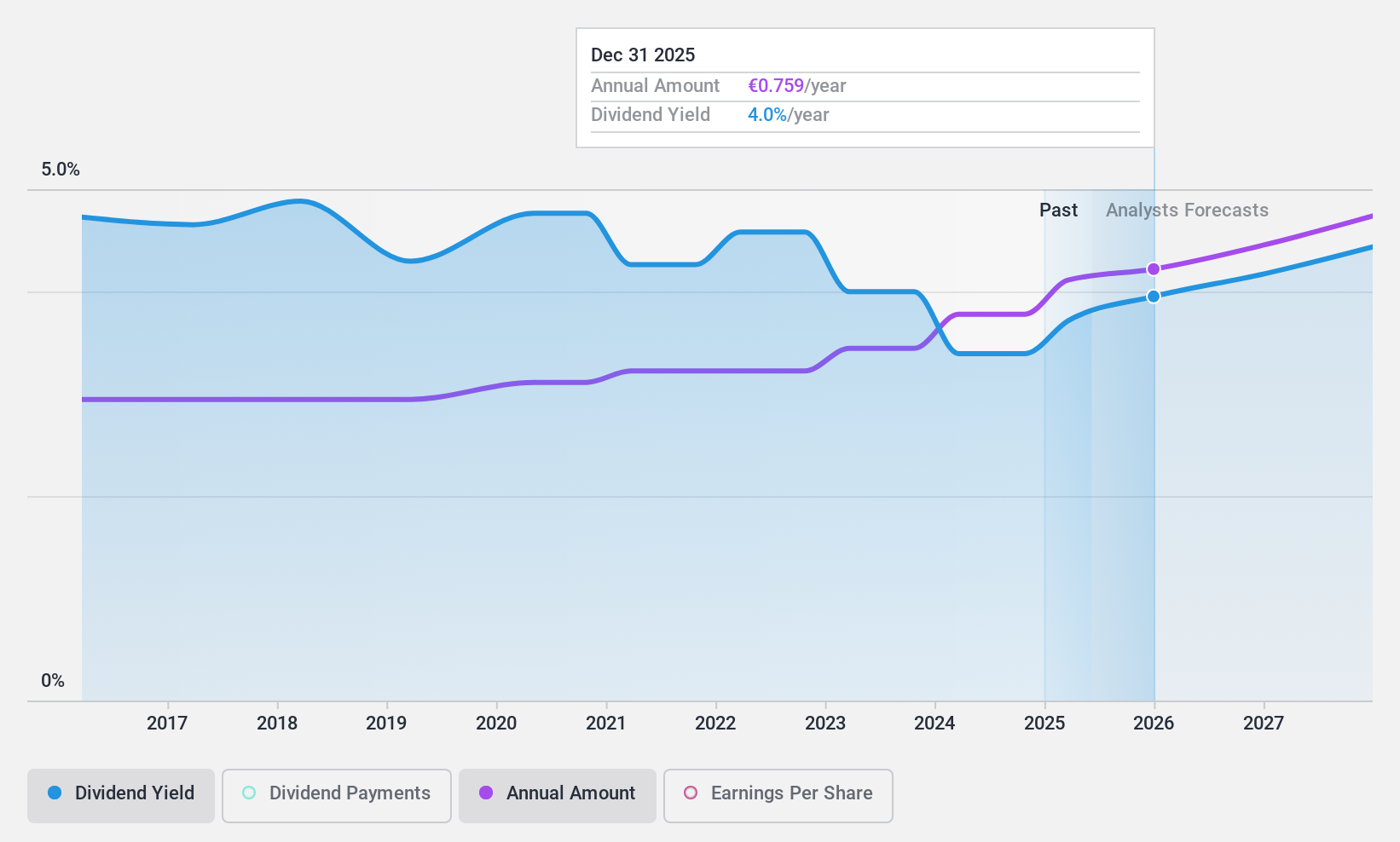

Kemira Oyj (HLSE:KEMIRA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kemira Oyj is a chemicals company operating across Finland, Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of €3.07 billion.

Operations: Kemira Oyj generates revenue through its Pulp & Paper segment, contributing €1.65 billion, and its Industry & Water segment, which accounts for €1.38 billion.

Dividend Yield: 3.4%

Kemira Oyj's dividend stability over the past decade is complemented by reliable and growing payments, supported by a sustainable payout ratio of 61.1% and a cash payout ratio of 36.9%. Despite recent declines in sales and net income, the company maintains strong earnings coverage for dividends. The dividend yield of 3.42% is modest compared to top Finnish payers but remains attractive due to consistent growth. Analysts suggest potential stock price appreciation, trading below fair value estimates.

- Get an in-depth perspective on Kemira Oyj's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Kemira Oyj shares in the market.

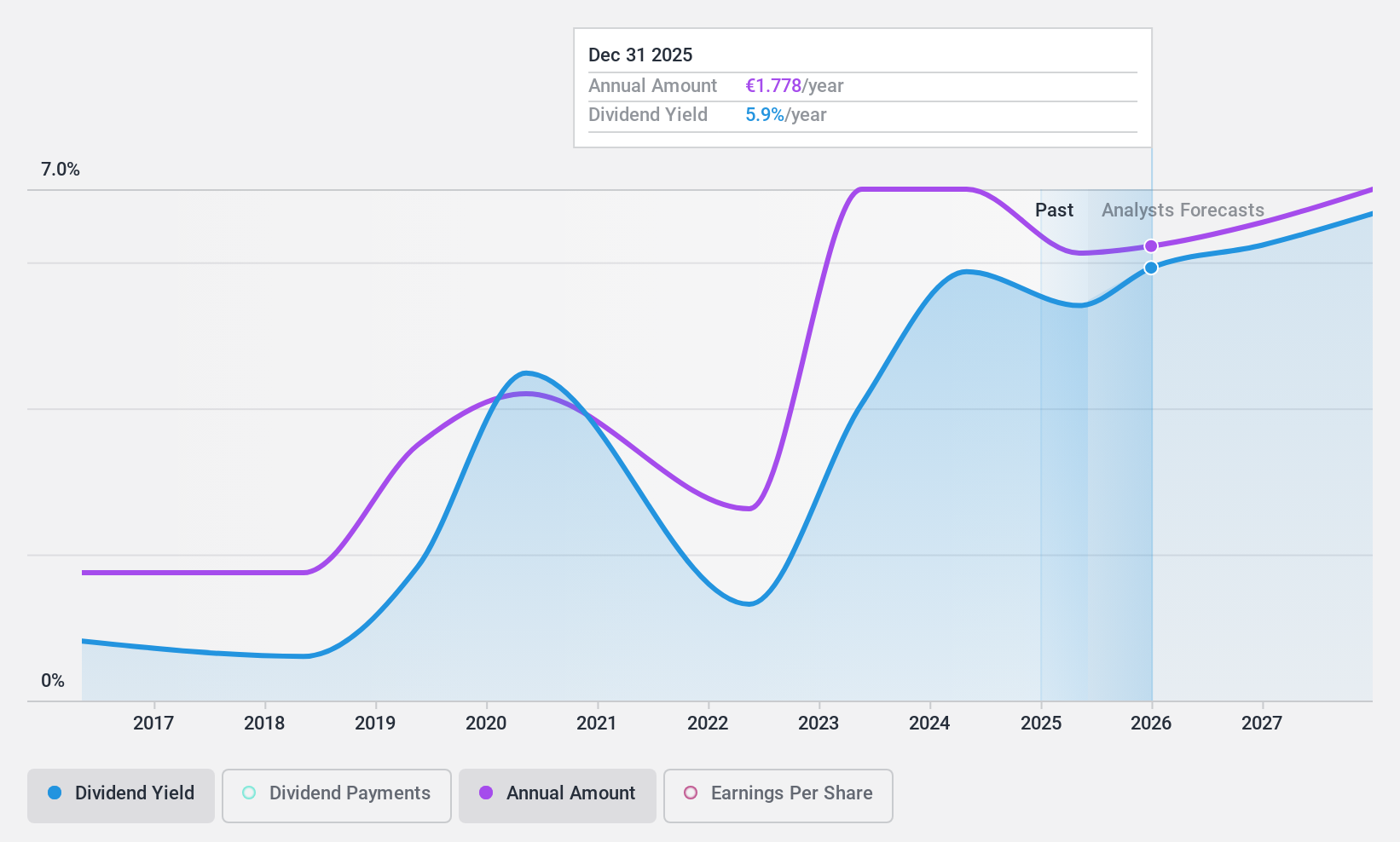

Schoeller-Bleckmann Oilfield Equipment (WBAG:SBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Schoeller-Bleckmann Oilfield Equipment Aktiengesellschaft is a global manufacturer and seller of steel products for the oilfield industry, with a market cap of €495.64 million.

Operations: Schoeller-Bleckmann Oilfield Equipment's revenue is primarily derived from its Oilfield Equipment segment, generating €305.97 million, and its Advanced Manufacturing & Services segment, contributing €418.15 million.

Dividend Yield: 6.4%

Schoeller-Bleckmann Oilfield Equipment's dividend yield is among the top 25% in Austria, with payments covered by a sustainable payout ratio of 62.8% and cash flow coverage at 57.9%. Despite recent declines in sales and net income, the company maintains sufficient earnings to support dividends. However, its dividend history has been volatile over the past decade, reflecting instability. The stock trades significantly below fair value estimates, suggesting potential for price appreciation according to analysts.

- Click to explore a detailed breakdown of our findings in Schoeller-Bleckmann Oilfield Equipment's dividend report.

- The valuation report we've compiled suggests that Schoeller-Bleckmann Oilfield Equipment's current price could be quite moderate.

Make It Happen

- Embark on your investment journey to our 1963 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kemira Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KEMIRA

Kemira Oyj

Operates as a chemicals company in Finland, rest of Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives