- Austria

- /

- Oil and Gas

- /

- WBAG:OMV

Is OMV’s 29% 2025 Rally Backed by Positive Oil Price News?

Reviewed by Bailey Pemberton

- Wondering if OMV stock is a genuine bargain or just getting caught up in market hype? You are definitely not alone in asking that question.

- OMV’s share price has impressed lately, jumping 13.6% over the past month and rising an eye-opening 28.7% year-to-date. This may suggest fresh enthusiasm or perhaps a shift in how investors see its future risks and rewards.

- One of the big catalysts behind these moves has been a string of positive updates regarding oil and gas prices as well as strategic partnerships in renewable energy. Investors have been watching closely as energy sector dynamics shift and OMV adapts through both operational changes and new sustainability initiatives.

- Our valuation checks give OMV a score of 2 out of 6, which means there is still plenty left to discuss when it comes to estimating its true worth using different methods. An even better approach will be covered by the end of this article.

OMV scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: OMV Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future free cash flows and discounting them back to their value as of today. This approach aims to assess the true worth of a business, focusing on the money it is expected to generate for shareholders over time.

OMV’s latest reported free cash flow stands at €1.26 Billion. Analyst forecasts provide growth estimates for the next five years, with free cash flow projected to rise to €2.23 Billion by the end of 2029. For subsequent years, additional projections are extrapolated, allowing for a full ten-year outlook based on current trends and industry assumptions.

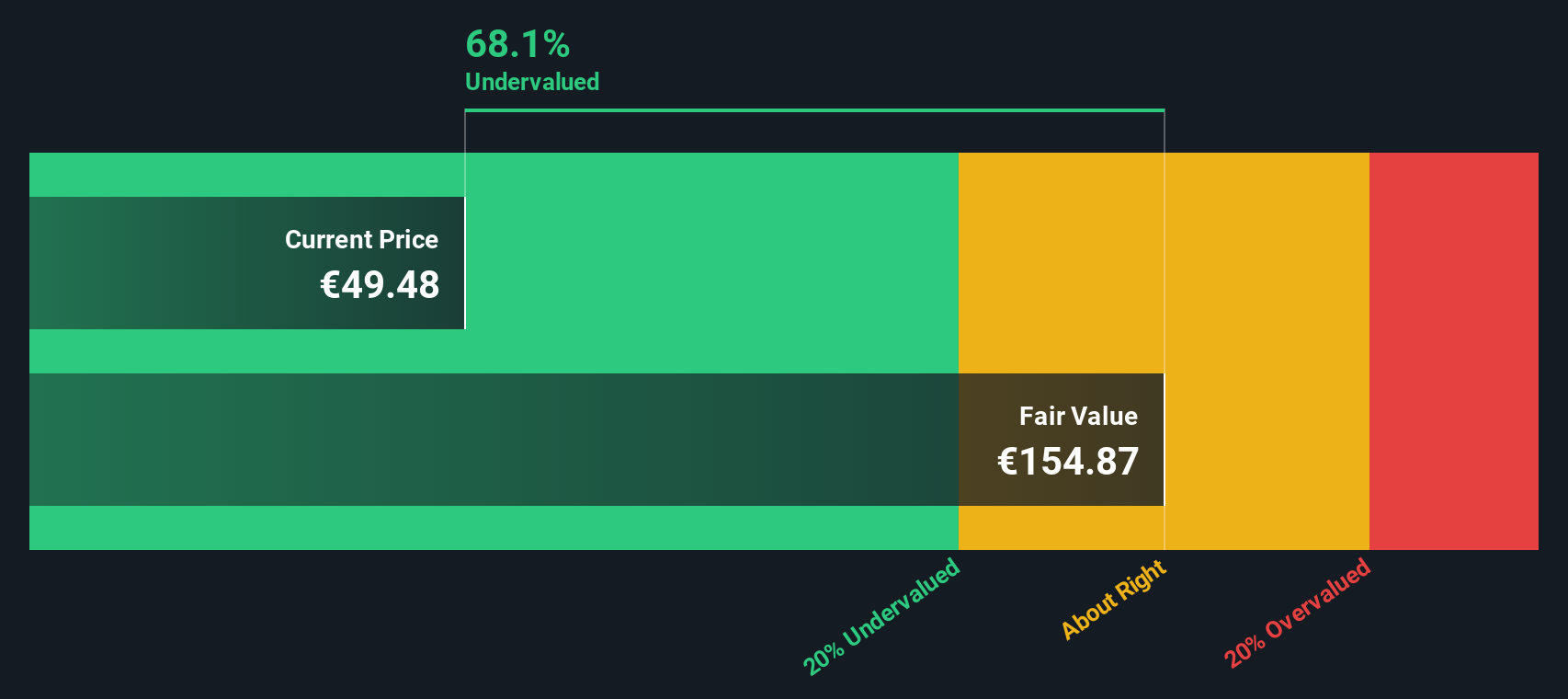

According to this two-stage free cash flow to equity model, OMV’s estimated fair value is €154.87 per share. This implies the stock is trading at a substantial 68.1% discount to its intrinsic value. This suggests a significant undervaluation at present prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests OMV is undervalued by 68.1%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: OMV Price vs Earnings

For companies like OMV that are consistently profitable, the Price-to-Earnings (PE) ratio is a widely trusted indicator of valuation. This multiple helps investors understand how much they are paying for each euro of the company's earnings. It is especially useful for comparing across profitable businesses in the same industry.

The "right" PE ratio for a company depends on factors such as its future earnings growth, perceived risks, and how those compare to competitors. Faster-growing businesses or those with lower risks will often command higher multiples, while a mature or riskier company might trade at a lower PE.

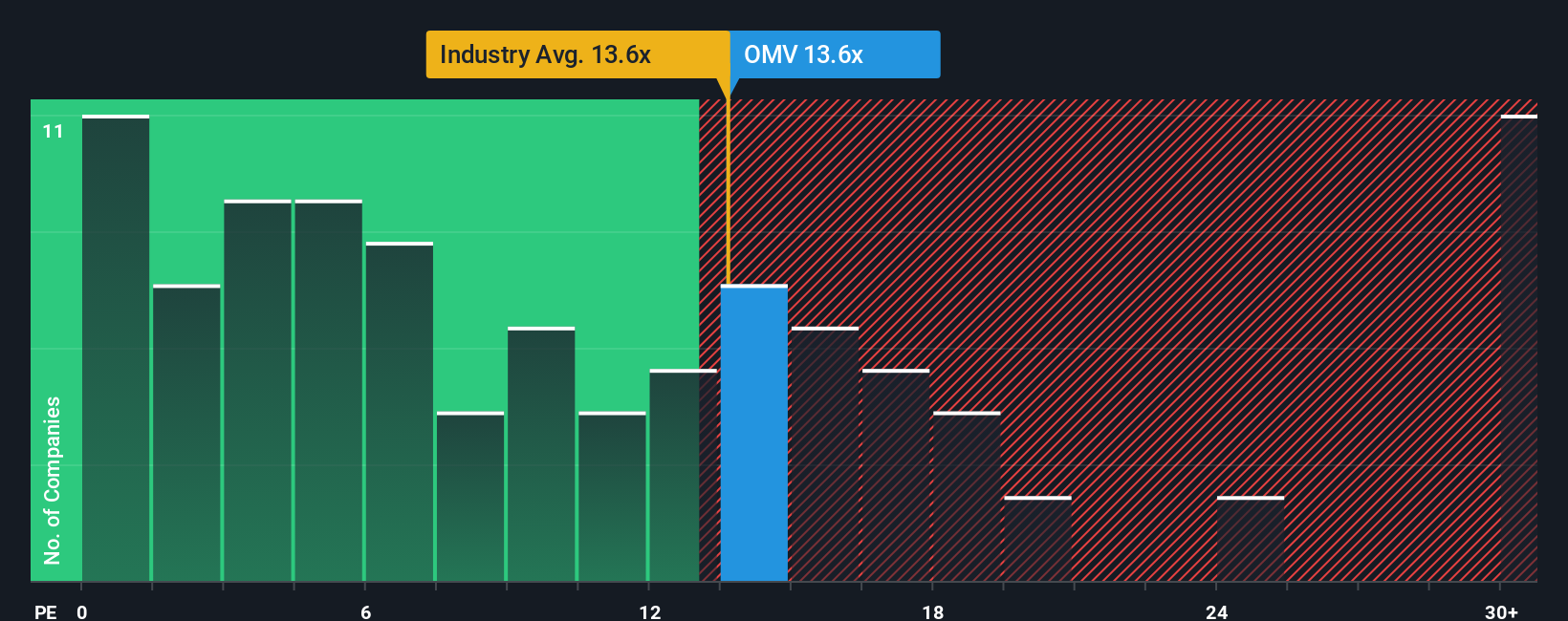

OMV currently trades at a PE multiple of 14.26x. For context, the average PE ratio across similar oil and gas peers is 13.31x, and the broader industry average sits at 13.53x. On the surface, OMV appears to be priced slightly above these benchmarks. This could reflect factors like its current growth profile or market position.

Simply Wall St's proprietary "Fair Ratio" for OMV is 13.89x. Unlike basic peer or industry averages, the Fair Ratio weighs factors such as OMV's earnings growth, profit margins, risk profile, industry outlook, and market size. This makes it a more precise yardstick for judging whether the stock is being valued appropriately relative to its unique profile.

Comparing OMV's current PE of 14.26x to its Fair Ratio of 13.89x, the valuation is very close to what is considered fair. This suggests the stock is trading about where it should, given its fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your OMV Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are an investor's way to connect their perspective or "story" about a company with their own financial forecasts and calculations of fair value, making the numbers personal and meaningful. More than just crunching numbers, a Narrative links what you believe about OMV's future—including its business direction, risks, opportunities, and changes—to concrete forecasts for revenue, earnings, and margins. This process ultimately leads to your own fair value assessment.

On Simply Wall St's platform, Narratives are shared by millions of investors within the Community page. They make it easy and accessible to craft, track, and update your thinking as new information arrives, whether it is breaking news, earnings results, or strategic announcements. Narratives help you cut through market noise and decide whether to buy or sell by comparing your fair value to the current price. You can always update your Narrative when something changes.

For example, one investor may believe OMV's bold push into renewables and advanced materials could unlock massive growth and assign a fair value as high as €62 per share, while another might see regulatory risks and industry headwinds as limiting upside and suggest a fair value as low as €40. This demonstrates how Narratives reflect diverse yet data-driven viewpoints.

Do you think there's more to the story for OMV? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:OMV

OMV

Operates as an oil, gas, and chemicals company in Austria, Belgium, Germany, New Zealand, Norway, Romania, the United Arab Emirates, the rest of Central and Eastern Europe, the rest of Europe, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives