- Austria

- /

- Oil and Gas

- /

- WBAG:OMV

A Look at OMV’s (WBAG:OMV) Valuation Following Major Hydrogen Electrolyzer Investment for Clean Energy Transition

Reviewed by Simply Wall St

OMV (WBAG:OMV) is moving forward with plans to build a 140 MW hydrogen electrolyzer in Austria’s Bruck an der Leitha region, marking a major step in its sustainable energy efforts. This facility will also be connected to a 13-mile pipeline linking to OMV’s Schwechat refinery, demonstrating the company’s broader commitment to clean hydrogen and decarbonization.

See our latest analysis for OMV.

OMV’s bold move into green hydrogen comes as the stock builds momentum, with a year-to-date share price return of 20.0% and an impressive 31.5% total shareholder return over the last year. These gains reflect renewed confidence in OMV’s transition-focused strategy, especially as major projects like the new electrolyzer point to long-term growth potential.

If the clean energy shift has you watching OMV, now is a great moment to expand your search and discover fast growing stocks with high insider ownership

With OMV’s share price already near analyst targets and long-term gains on the board, the key question is whether the stock remains undervalued or if the market is already pricing in its future growth potential.

Most Popular Narrative: 6.8% Undervalued

OMV’s current share price of €46.14 is trading below the narrative's fair value estimate of €49.48, hinting at possible upside according to the most popular market view. The difference suggests the stock could be poised for revaluation if the assumptions behind the fair value play out.

OMV's diversified expansion in gas, petrochemicals, and specialty products strengthens revenue stability and cushions earnings from energy market volatility. Investments in renewables, recycling, and international partnerships support long-term profitability and reduce exposure to regulatory and market risks.

What’s the foundation of this bullish view? The calculation banks on future earnings growth, expanding profit margins, and a sharp shift in how OMV’s profit is valued. Curious which of these assumptions most tips the valuation scale? The answer may surprise you. Dig into the narrative to unlock the details.

Result: Fair Value of €49.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as declining hydrocarbon output or prolonged cost pressures could undermine OMV’s long-term earnings stability and challenge its growth narrative.

Find out about the key risks to this OMV narrative.

Another View: Market Multiples Paint a Different Picture

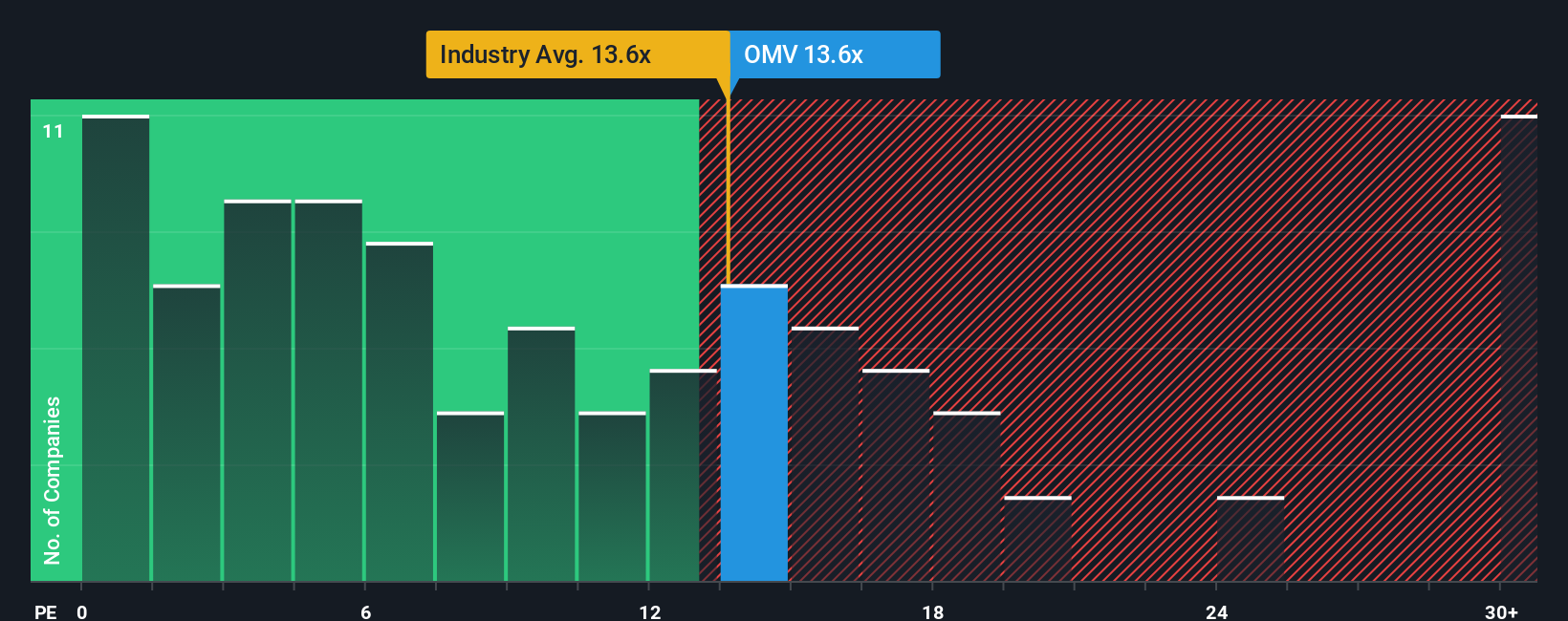

Taking a look at the company's price-to-earnings ratio shows a less optimistic angle. OMV is trading at 18.7 times earnings, which is higher than the European Oil and Gas industry average of 14.5 and its peer average of 15.3. It is also above the fair ratio of 16 that our analysis suggests the market could revert to. This signals that, by this method, OMV may actually be priced on the high side compared to the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OMV Narrative

If you have a different take or want to put the numbers to the test yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your OMV research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Leave no opportunity behind by tapping into handpicked stock ideas tailored for your goals. Broaden your portfolio with these thematic lists investors are watching right now:

- Accelerate your search for stable income by checking out these 21 dividend stocks with yields > 3% offering yields above 3%, an essential addition for any income-focused portfolio.

- Capitalize on tomorrow’s technology trends by selecting these 26 AI penny stocks, where innovation and AI breakthroughs are fueling exciting new growth stories.

- Uncover hidden value by reviewing these 866 undervalued stocks based on cash flows to spot shares trading below their cash flow potential before the wider market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:OMV

OMV

Operates as an oil, gas, and chemicals company in Austria, Belgium, Germany, New Zealand, Norway, Romania, the United Arab Emirates, the rest of Central and Eastern Europe, the rest of Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives