- Austria

- /

- Hospitality

- /

- WBAG:WXF

Subdued Growth No Barrier To Warimpex Finanz- und Beteiligungs AG (VIE:WXF) With Shares Advancing 31%

Warimpex Finanz- und Beteiligungs AG (VIE:WXF) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 28%.

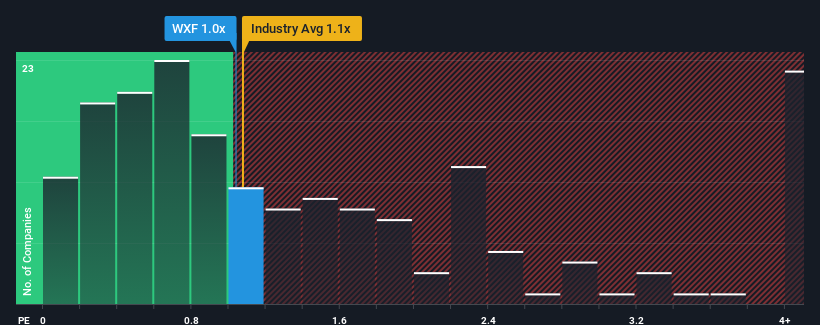

Although its price has surged higher, it's still not a stretch to say that Warimpex Finanz- und Beteiligungs' price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Austria, where the median P/S ratio is around 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Warimpex Finanz- und Beteiligungs

What Does Warimpex Finanz- und Beteiligungs' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Warimpex Finanz- und Beteiligungs has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Warimpex Finanz- und Beteiligungs' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Warimpex Finanz- und Beteiligungs would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 51% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 22% over the next year. With the industry predicted to deliver 78% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that Warimpex Finanz- und Beteiligungs' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Warimpex Finanz- und Beteiligungs' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Warimpex Finanz- und Beteiligungs' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 5 warning signs for Warimpex Finanz- und Beteiligungs (3 are a bit unpleasant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Warimpex Finanz- und Beteiligungs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:WXF

Warimpex Finanz- und Beteiligungs

Operates as a real estate development and investment company in Austria, and Central and Eastern Europe.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives