European Companies That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As European markets experience a lift from easing trade tensions and optimism surrounding potential U.S. interest rate cuts, investors are increasingly attentive to opportunities that may be trading below their estimated value. In this environment, identifying stocks with strong fundamentals and growth potential can be crucial for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK359.64 | 49% |

| InPost (ENXTAM:INPST) | €13.36 | €26.57 | 49.7% |

| IDI (ENXTPA:IDIP) | €79.40 | €157.98 | 49.7% |

| Echo Investment (WSE:ECH) | PLN5.38 | PLN10.71 | 49.7% |

| DO & CO (WBAG:DOC) | €235.00 | €461.46 | 49.1% |

| ATON Green Storage (BIT:ATON) | €2.09 | €4.09 | 48.9% |

| Atea (OB:ATEA) | NOK142.40 | NOK283.91 | 49.8% |

| Aquila Part Prod Com (BVB:AQ) | RON1.46 | RON2.86 | 49% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.855 | €3.66 | 49.3% |

| Absolent Air Care Group (OM:ABSO) | SEK254.00 | SEK506.58 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

AutoStore Holdings (OB:AUTO)

Overview: AutoStore Holdings Ltd. offers robotic and software technology solutions across Norway, Germany, Europe, the United States, Asia, and other international markets with a market cap of NOK30.57 billion.

Operations: The company's revenue segment includes Industrial Automation & Controls, generating $529 million.

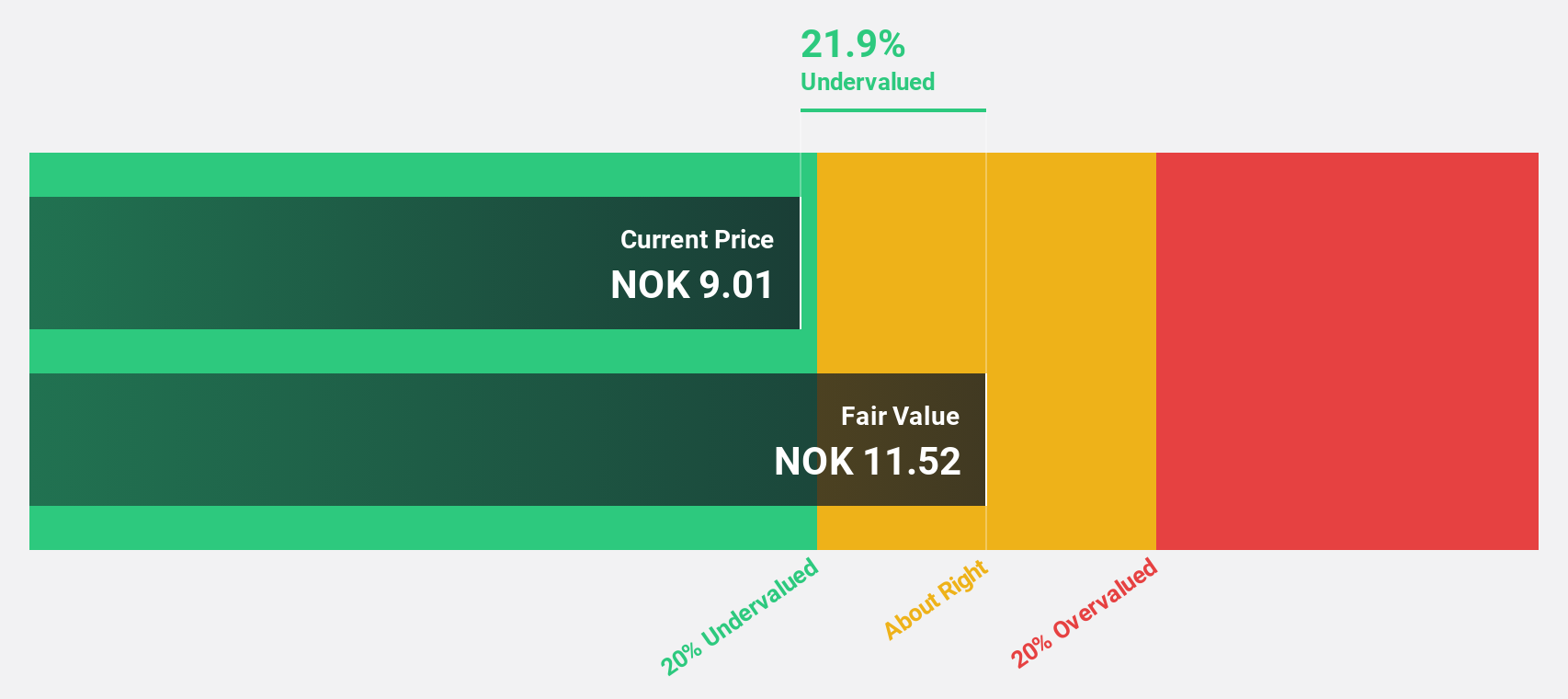

Estimated Discount To Fair Value: 23.4%

AutoStore Holdings is trading at NOK9.1, significantly below its estimated fair value of NOK11.88, suggesting potential undervaluation based on cash flows. Despite a volatile share price and declining net profit margins from 26.3% to 15.1%, earnings are forecast to grow substantially by 27.5% annually, outpacing the Norwegian market's growth rate of 11%. Recent earnings reports show reduced revenue and net income compared to last year, highlighting challenges amidst growth prospects.

- Our earnings growth report unveils the potential for significant increases in AutoStore Holdings' future results.

- Click here to discover the nuances of AutoStore Holdings with our detailed financial health report.

Europris (OB:EPR)

Overview: Europris ASA operates as a discount variety retailer in Norway with a market cap of NOK15.82 billion.

Operations: Europris generates revenue of NOK14.36 billion from its retail variety stores in Norway.

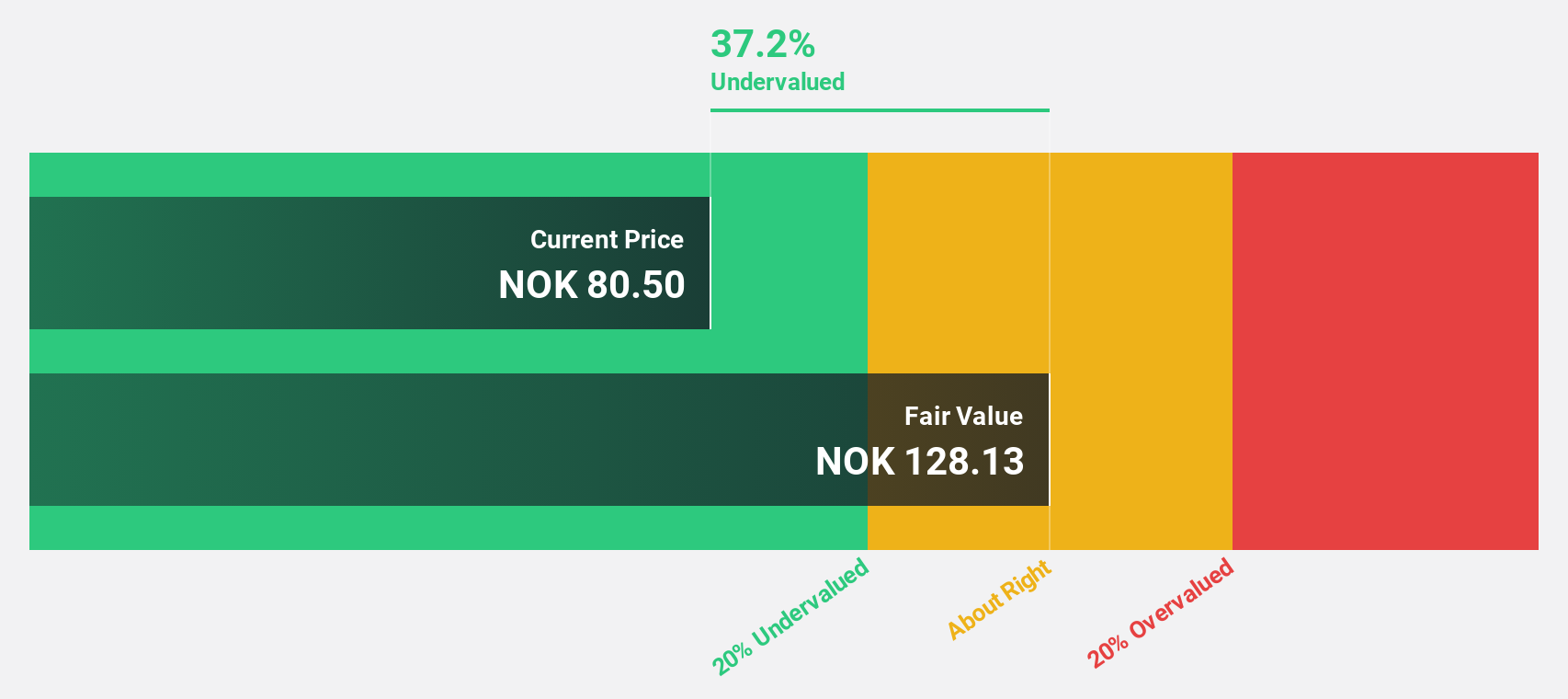

Estimated Discount To Fair Value: 32.5%

Europris is trading at NOK96.7, over 20% below its estimated fair value of NOK143.24, highlighting potential undervaluation based on cash flows. Despite a dip in net profit margin from 8.6% to 5%, earnings are expected to grow significantly at 23.3% annually, surpassing the Norwegian market's growth rate of 11%. Recent expansions with new stores and full ownership of Swedish retailer ÖoB bolster Europris' growth strategy amidst high debt levels and robust revenue forecasts.

- Our comprehensive growth report raises the possibility that Europris is poised for substantial financial growth.

- Take a closer look at Europris' balance sheet health here in our report.

DO & CO (WBAG:DOC)

Overview: DO & CO Aktiengesellschaft is a company that provides catering services across Austria, Turkey, Great Britain, the United States, Spain, Germany, and other international markets with a market cap of €2.58 billion.

Operations: The company's revenue segments are Airline Catering (€1.82 billion), International Event Catering (€305.31 million), and Restaurants, Lounges & Hotels (€172.53 million).

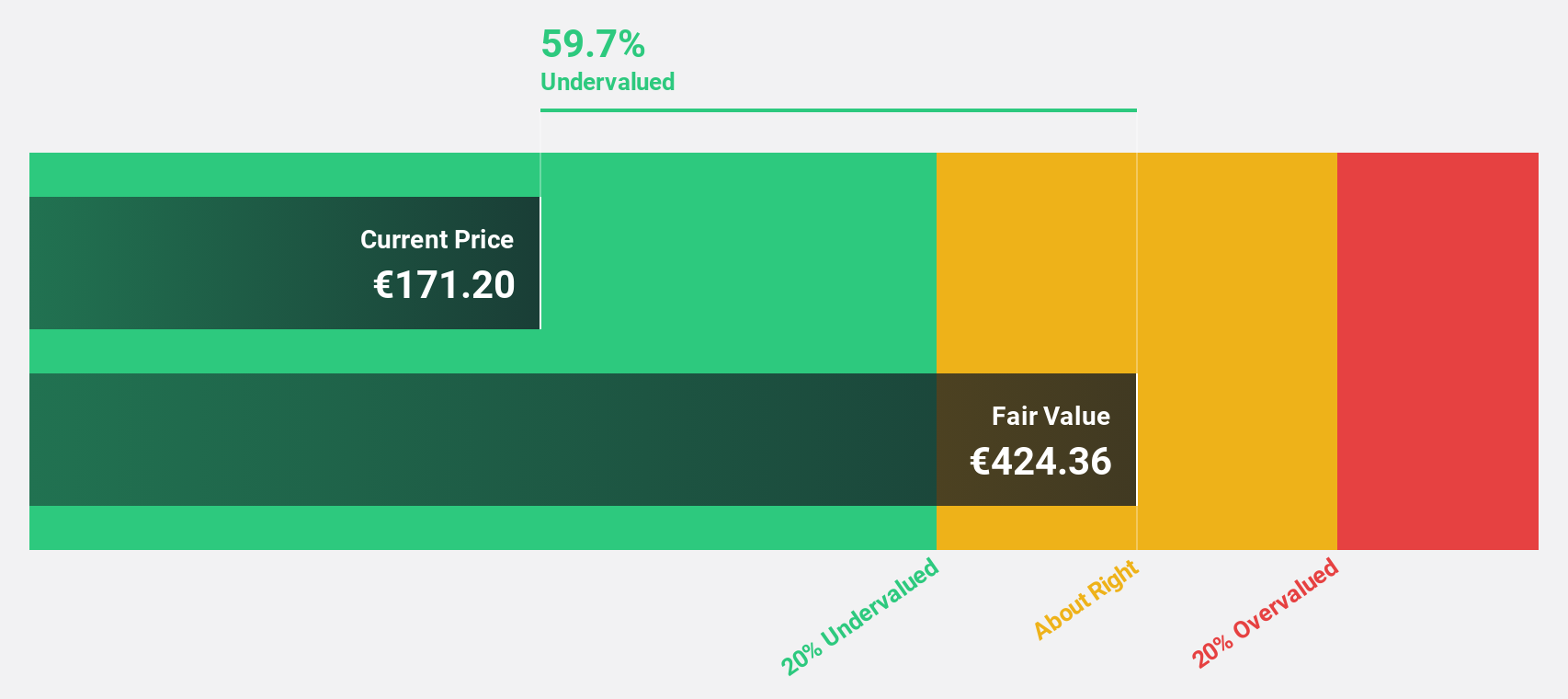

Estimated Discount To Fair Value: 49.1%

DO & CO Aktiengesellschaft, trading at €235, is significantly undervalued with an estimated fair value of €461.46, according to discounted cash flow analysis. Recent earnings results show robust growth with net income rising from €18.6 million to €26.79 million year-over-year for Q1 2025. Forecasted annual profit growth of 15.6% exceeds the Austrian market's average, though revenue growth lags behind broader targets at 6.8%. Despite volatile share prices recently, its strong return on equity forecast supports long-term potential.

- Our expertly prepared growth report on DO & CO implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of DO & CO.

Turning Ideas Into Actions

- Unlock our comprehensive list of 216 Undervalued European Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AUTO

AutoStore Holdings

Provides robotic and software technology in Norway, Germany, Europe, the United States, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives