- Austria

- /

- Electrical

- /

- WBAG:ZAG

Zumtobel Group (WBAG:ZAG) Q2 Net Profit Rebound Tests “Depressed Value” Narrative

Reviewed by Simply Wall St

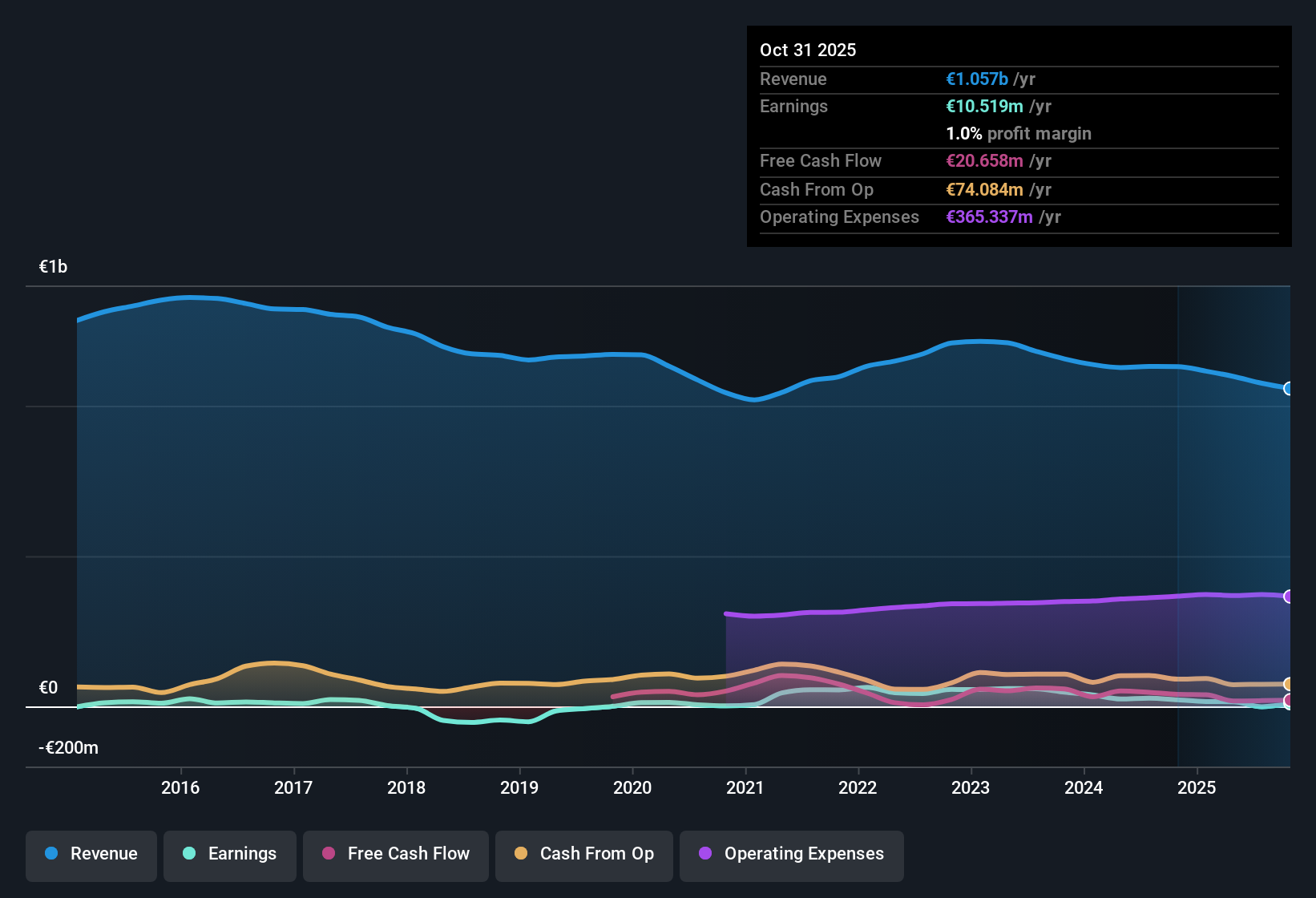

Zumtobel Group (WBAG:ZAG) has just posted Q2 2026 numbers with revenue of about €271 million and EPS of €0.41, setting a clearer earnings picture after a volatile run of recent quarters. The company has seen quarterly revenue move from roughly €289 million in Q1 2025 to €271 million in Q2 2026, while EPS has swung between €0.30 and negative territory over that stretch, underscoring how much the earnings story now hinges on where margins settle from here.

See our full analysis for Zumtobel Group.With the headline figures on the table, the next step is to see how these results stack up against the dominant narratives around Zumtobel Group’s growth prospects, risks, and profitability profile.

See what the community is saying about Zumtobel Group

Net Profit Swings Back to €17.4 Million

- After a loss of €3.9 million in Q1 2026, Zumtobel Group reported net income of €17.4 million in Q2 2026, while trailing 12 month net income sits at €10.5 million, highlighting how volatile profitability has been over the past year.

- Analysts' consensus view is that long term contracts and key accounts can smooth earnings, which contrasts with this volatility, as:

- Trailing 12 month net profit margin is just 1 percent, down from 1.9 percent last year, and does not yet reflect the margin uplift that a more stable contract mix is expected to provide.

- Earnings have declined around 14.3 percent per year over the last five years, so the current rebound to €17.4 million in a single quarter contrasts with a weaker multi year track record that consensus expects to improve only gradually.

Revenue Growth Stalls Around €1.1 Billion Run Rate

- On a trailing 12 month basis, revenue is about €1,057 million, down from €1,130 million a year ago. Recent quarters have hovered between roughly €250 million and €289 million, indicating only modest top line movement even as forecasts point to about 2.3 percent annual growth ahead.

- Consensus narrative highlights renovation and maintenance demand as a future growth engine, yet the recent numbers show:

- Group revenues over the last year have eased from €1,130 million to €1,057 million, and the Lighting segment recently saw a 1.7 percent revenue decline. The expected recovery in non residential construction is therefore not visible in reported sales yet.

- Analysts still project revenue to reach roughly €1.1 billion by about 2028 with earnings per share of €0.67. This assumes the current flat to slightly lower revenue trend can reverse, even though the latest trailing figures are below last year.

Low 1 Percent Margin Meets “Cheap but Depressed” Valuation

- Zumtobel Group is trading at about €3.62 per share on a 14.5 times price to earnings multiple, which is below the 23.3 times European Electrical industry average. DCF fair value is estimated at roughly €12.84 and trailing 12 month net margin sits at only 1 percent, down from 1.9 percent last year.

- Bulls argue that strong projected earnings growth of 53.7 percent per year and the gap to DCF fair value support the stock’s appeal, but the data also show:

- The share price of €3.62 is roughly 71.8 percent below the €12.84 DCF fair value and about 29 percent below the €5.10 analyst price target, yet earnings were negative over the most recent trailing year and only recently moved back to €0.41 EPS in Q2 2026.

- Past earnings have fallen about 14.3 percent per year over five years and the dividend record is unstable, so while the valuation looks inexpensive against the industry and the DCF model, the combination of thin 1 percent margins and a weakening multi year profit history makes this a classic value versus quality trade off for investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Zumtobel Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a moment to test your own view against the data and build a fresh narrative in minutes, Do it your way.

A great starting point for your Zumtobel Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Zumtobel Group is struggling with thin 1 percent margins, inconsistent earnings, and flat to declining revenue, leaving its rebound story heavily dependent on forecasts.

If you want businesses already proving they can grow steadily through cycles, use our stable growth stocks screener (2087 results) today to quickly uncover companies with more reliable revenue and earnings momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zumtobel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:ZAG

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026