- Austria

- /

- Electrical

- /

- WBAG:ZAG

After Leaping 30% Zumtobel Group AG (VIE:ZAG) Shares Are Not Flying Under The Radar

Zumtobel Group AG (VIE:ZAG) shareholders have had their patience rewarded with a 30% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

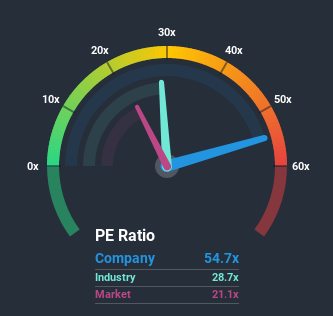

Following the firm bounce in price, given close to half the companies in Austria have price-to-earnings ratios (or "P/E's") below 21x, you may consider Zumtobel Group as a stock to avoid entirely with its 54.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Zumtobel Group has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Zumtobel Group

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Zumtobel Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 51%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 352% as estimated by the two analysts watching the company. With the market only predicted to deliver 30%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Zumtobel Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Zumtobel Group's P/E

Shares in Zumtobel Group have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Zumtobel Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Zumtobel Group you should be aware of.

If you're unsure about the strength of Zumtobel Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Zumtobel Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zumtobel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WBAG:ZAG

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives