Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Strabag SE (VIE:STR) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Strabag

What Is Strabag's Debt?

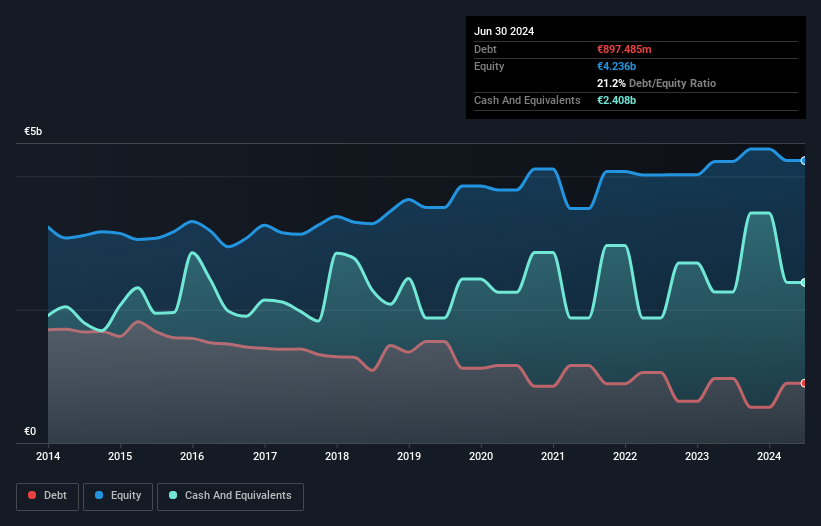

You can click the graphic below for the historical numbers, but it shows that Strabag had €897.5m of debt in June 2024, down from €966.6m, one year before. However, it does have €2.41b in cash offsetting this, leading to net cash of €1.51b.

How Healthy Is Strabag's Balance Sheet?

According to the last reported balance sheet, Strabag had liabilities of €7.11b due within 12 months, and liabilities of €2.22b due beyond 12 months. Offsetting this, it had €2.41b in cash and €3.64b in receivables that were due within 12 months. So its liabilities total €3.28b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of €4.73b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. Despite its noteworthy liabilities, Strabag boasts net cash, so it's fair to say it does not have a heavy debt load!

Another good sign is that Strabag has been able to increase its EBIT by 28% in twelve months, making it easier to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Strabag's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Strabag has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Strabag actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

Although Strabag's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €1.51b. And it impressed us with free cash flow of €666m, being 109% of its EBIT. So is Strabag's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Strabag (1 is a bit unpleasant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:STR

Strabag

Engages in the construction projects in the fields of transportation infrastructures, building construction, and civil engineering.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026