European Growth Stocks With Strong Insider Ownership In June 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of trade negotiations and inflationary pressures, investor attention is increasingly drawn to growth companies with substantial insider ownership. In such an environment, stocks that boast strong insider confidence can offer a compelling proposition for investors seeking alignment of interests and potential resilience amidst economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.2% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| Lokotech Group (OB:LOKO) | 14.8% | 58.1% |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| Elliptic Laboratories (OB:ELABS) | 22.9% | 79% |

Let's review some notable picks from our screened stocks.

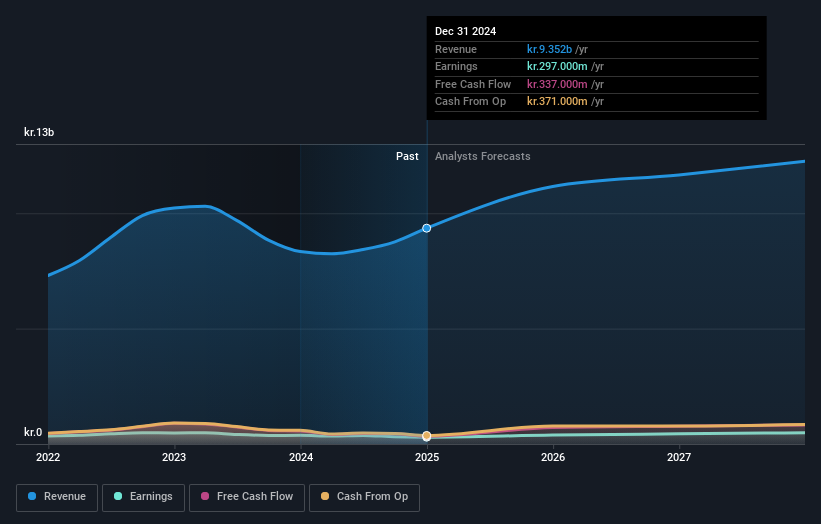

NTG Nordic Transport Group (CPSE:NTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NTG Nordic Transport Group A/S, with a market cap of DKK4.45 billion, offers asset-light freight forwarding services across road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

Operations: The company's revenue is primarily derived from two segments: Air & Ocean, which contributes DKK2.89 billion, and Road & Logistics, which accounts for DKK7.04 billion.

Insider Ownership: 24.6%

Earnings Growth Forecast: 20.8% p.a.

NTG Nordic Transport Group shows potential as a growth company with high insider ownership. Despite recent declines in net income and profit margins, NTG's earnings are forecast to grow significantly at 20.8% annually, outpacing the Danish market. The company is trading well below its estimated fair value, suggesting room for price appreciation. However, it faces challenges with high debt levels and slower revenue growth at 8.5% annually compared to its ambitious M&A strategy aimed at scaling operations further across Europe and globally.

- Click to explore a detailed breakdown of our findings in NTG Nordic Transport Group's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of NTG Nordic Transport Group shares in the market.

Edda Wind (OB:EWIND)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Edda Wind ASA develops, builds, owns, operates, and charters purpose-built service operation vessels (SOVs) and commissioning service operation vessels (CSOVs) for offshore wind farms and maritime operations globally, with a market cap of NOK2.94 billion.

Operations: The company's revenue segment is primarily derived from the Offshore Wind Segment, generating €79.42 million.

Insider Ownership: 29.6%

Earnings Growth Forecast: 94.6% p.a.

Edda Wind is experiencing rapid growth, with earnings forecasted to increase significantly at 94.6% annually, well above the Norwegian market average. Revenue is also expected to grow robustly at 33.1% per year. However, recent results show a decline in net income and profit margins compared to last year. The company has a volatile share price and faces challenges with debt coverage by operating cash flow. A proposed acquisition could lead to delisting from the Oslo Stock Exchange.

- Click here and access our complete growth analysis report to understand the dynamics of Edda Wind.

- Our valuation report unveils the possibility Edda Wind's shares may be trading at a premium.

Semperit Holding (WBAG:SEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Semperit Aktiengesellschaft Holding is a company that develops, produces, and sells rubber products for the medical and industrial sectors globally, with a market cap of €290.09 million.

Operations: The company's revenue is generated from its Semperit Engineered Applications segment, which accounts for €361.97 million, and its Semperit Industrial Applications segment, contributing €290.48 million.

Insider Ownership: 10.1%

Earnings Growth Forecast: 85.3% p.a.

Semperit Holding, with substantial insider ownership, is forecasted to experience significant earnings growth of 85.31% annually, outpacing the Austrian market. However, its revenue growth of 7.2% per year is slower than desired for high-growth companies and recent financial results show a net loss of €7.2 million for Q1 2025 compared to a profit last year. The company's share price has been highly volatile recently and its dividend yield isn't well covered by earnings.

- Unlock comprehensive insights into our analysis of Semperit Holding stock in this growth report.

- According our valuation report, there's an indication that Semperit Holding's share price might be on the cheaper side.

Make It Happen

- Click this link to deep-dive into the 211 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Ready For A Different Approach? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:SEM

Semperit Holding

Develops, produces, and sells rubber products for the medical and industrial sectors worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives