- Taiwan

- /

- Hospitality

- /

- TWSE:2762

3 Stocks That May Be Priced Below Their Estimated Worth In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape of interest rate adjustments and economic uncertainties, the Nasdaq Composite has reached new heights while other major indexes face declines. Amidst these fluctuations, investors are increasingly on the lookout for stocks that may be trading below their intrinsic value. Identifying such opportunities often involves assessing a company's fundamentals and market position, particularly in an environment where growth stocks have outperformed value counterparts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.70 | CN¥11.35 | 49.8% |

| Hanwha Systems (KOSE:A272210) | ₩20850.00 | ₩41692.30 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.92 | CA$11.83 | 50% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP579.00 | 49.9% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| Compagnia dei Caraibi (BIT:TIME) | €0.542 | €1.08 | 50% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.28 | 49.9% |

| Fnac Darty (ENXTPA:FNAC) | €29.45 | €58.67 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.00 | CN¥125.29 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

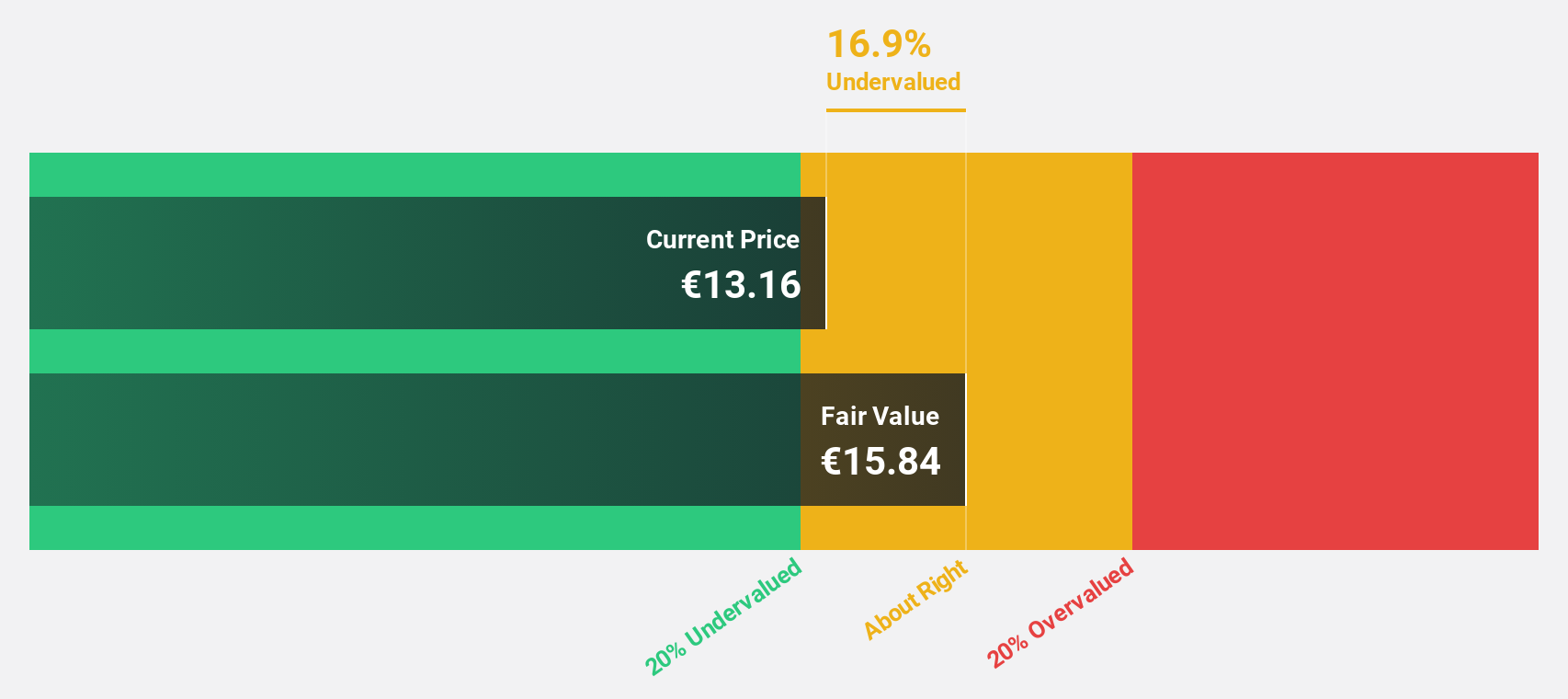

Ponsse Oyj (HLSE:PON1V)

Overview: Ponsse Oyj is a manufacturer of cut-to-length forest machines with operations in Northern Europe, Central and Southern Europe, North and South America, and internationally, with a market cap of €562.49 million.

Operations: The company's revenue primarily comes from its Forest Machines and Maintenance Services segment, generating €769.72 million.

Estimated Discount To Fair Value: 38.4%

Ponsse Oyj is trading at €20.1, significantly below its estimated fair value of €32.61, indicating it may be undervalued based on cash flows. Despite a challenging nine-month period with sales declining to €526.93 million and net income dropping to €0.322 million, the company reported a strong third quarter turnaround with net income of €12.04 million and basic earnings per share rising to €0.43 from a loss last year, highlighting potential for recovery amidst forecasted high earnings growth of 55% annually over the next three years.

- Insights from our recent growth report point to a promising forecast for Ponsse Oyj's business outlook.

- Navigate through the intricacies of Ponsse Oyj with our comprehensive financial health report here.

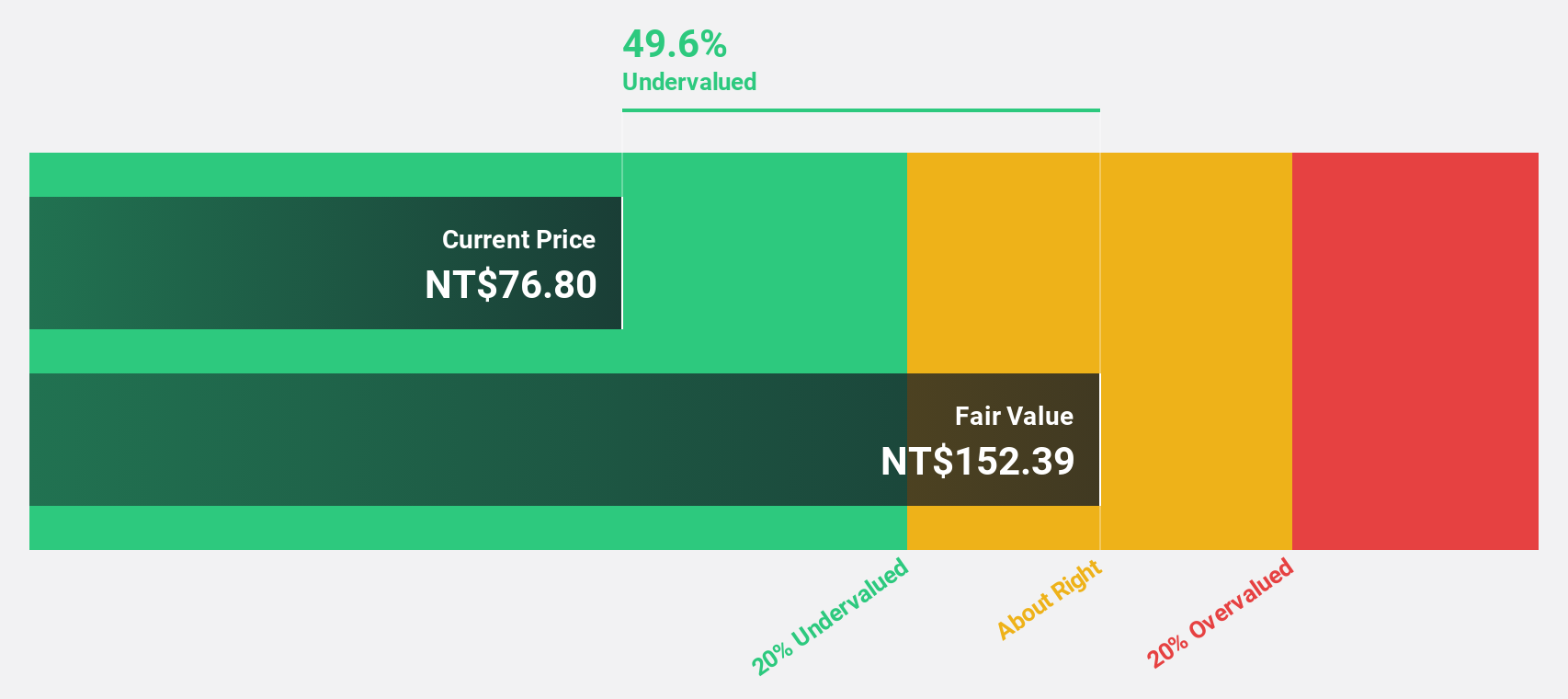

World Fitness Services (TWSE:2762)

Overview: World Fitness Services Ltd. operates in the physical fitness, sports, and sauna industry in Taiwan with a market cap of NT$10.58 billion.

Operations: The company generates revenue primarily from its recreational activities segment, totaling NT$9.68 billion.

Estimated Discount To Fair Value: 47.5%

World Fitness Services is trading at NT$96.2, significantly below its estimated fair value of NT$183.24, suggesting it might be undervalued based on cash flows. Despite a dip in Q3 net income to TWD 63.07 million from TWD 83.32 million last year, nine-month earnings improved to TWD 291.28 million from TWD 244.39 million previously. Revenue and earnings are forecasted to grow faster than the market at 11% and 37.8% annually, respectively, although dividend coverage remains weak.

- Our growth report here indicates World Fitness Services may be poised for an improving outlook.

- Click here to discover the nuances of World Fitness Services with our detailed financial health report.

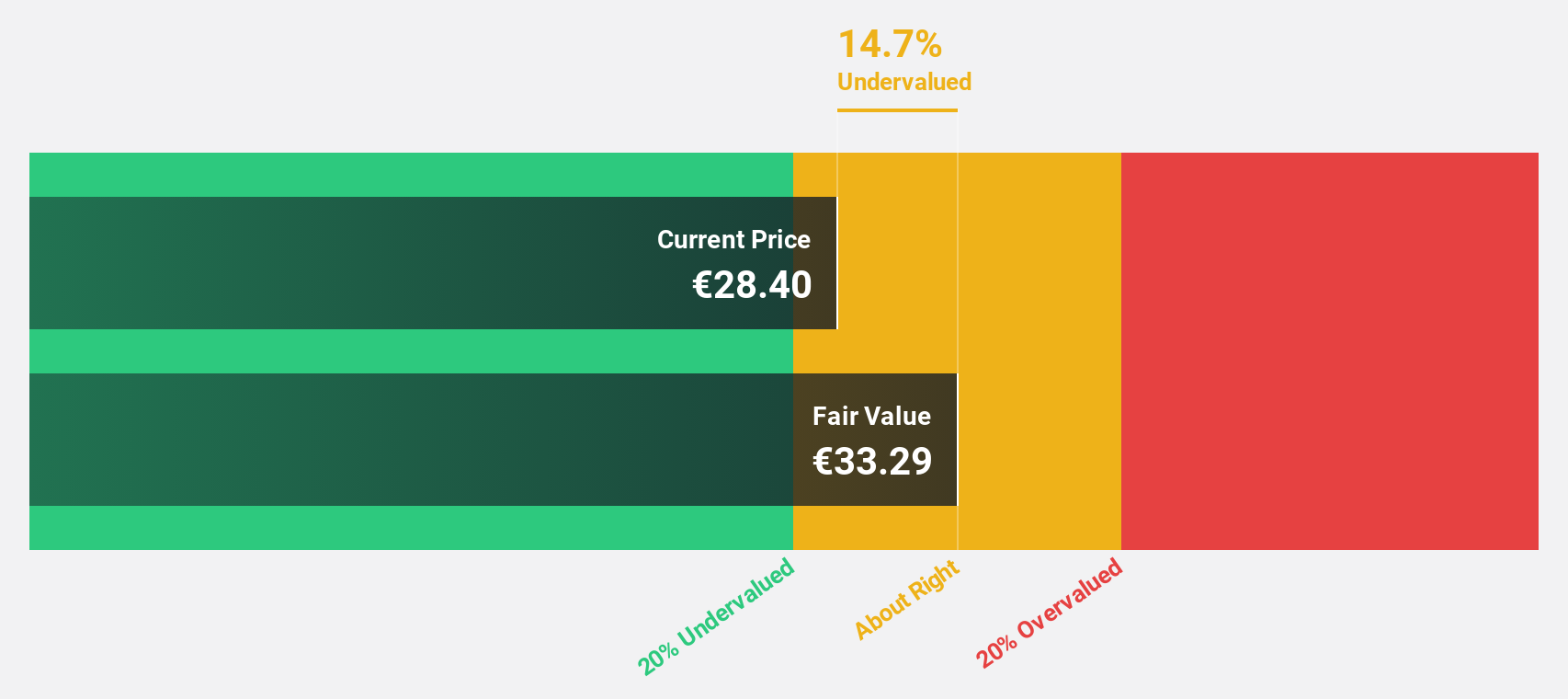

Semperit Holding (WBAG:SEM)

Overview: Semperit Holding is a company that develops, produces, and sells rubber products for the medical and industrial sectors worldwide, with a market cap of €247.29 million.

Operations: The company's revenue segments include €34.32 million from Surgical Operations and €380.82 million from Semperit Engineered Applications, along with €288.16 million from Semperit Industrial Applications.

Estimated Discount To Fair Value: 43.1%

Semperit Holding is trading at €12.02, significantly below its estimated fair value of €21.12, highlighting potential undervaluation based on cash flows. Despite a Q3 net loss of €2.5 million, the nine-month period saw a turnaround to a net income of €7.14 million from a previous loss of €26.5 million. Revenue and earnings are anticipated to grow faster than the Austrian market at 6.3% and 47% annually, respectively, though profit margins have declined recently.

- The analysis detailed in our Semperit Holding growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Semperit Holding stock in this financial health report.

Summing It All Up

- Access the full spectrum of 885 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if World Gym might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2762

World Gym

Engages in the physical fitness, sports, and sauna business in Taiwan and the United States.

Reasonable growth potential and fair value.

Market Insights

Community Narratives