Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that PORR AG (VIE:POS) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for PORR

How Much Debt Does PORR Carry?

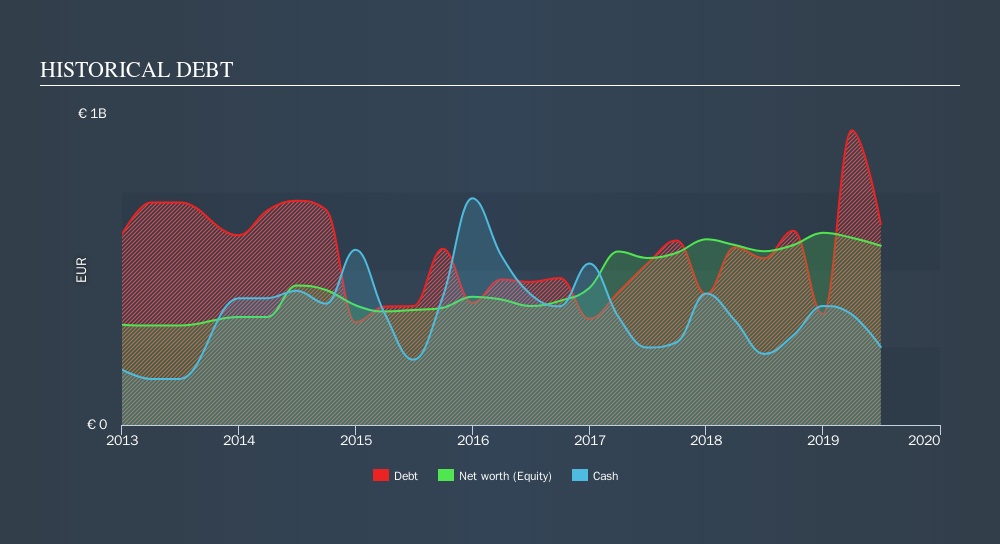

You can click the graphic below for the historical numbers, but it shows that as of June 2019 PORR had €617.2m of debt, an increase on €535.9m, over one year. However, because it has a cash reserve of €250.9m, its net debt is less, at about €366.3m.

How Strong Is PORR's Balance Sheet?

According to the last reported balance sheet, PORR had liabilities of €2.00b due within 12 months, and liabilities of €991.2m due beyond 12 months. Offsetting this, it had €250.9m in cash and €1.86b in receivables that were due within 12 months. So its liabilities total €876.8m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of €618.0m, we think shareholders really should watch PORR's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if PORR can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year PORR wasn't profitable at an EBIT level, but managed to grow its revenue by3.7%, to €4.9b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months PORR produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at €27m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of €105m over the last twelve months. So suffice it to say we consider the stock to be risky. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how PORR's profit, revenue, and operating cashflow have changed over the last few years.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WBAG:POS

PORR

Operates as a construction company in Austria, Germany, Poland, the Czech Republic, Italy, Romania, Switzerland, Serbia, Great Britain, Slovakia, Norway, Belgium, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives