Palfinger (WBAG:PAL) Margins Worsen, Testing Bullish Valuation Narratives

Reviewed by Simply Wall St

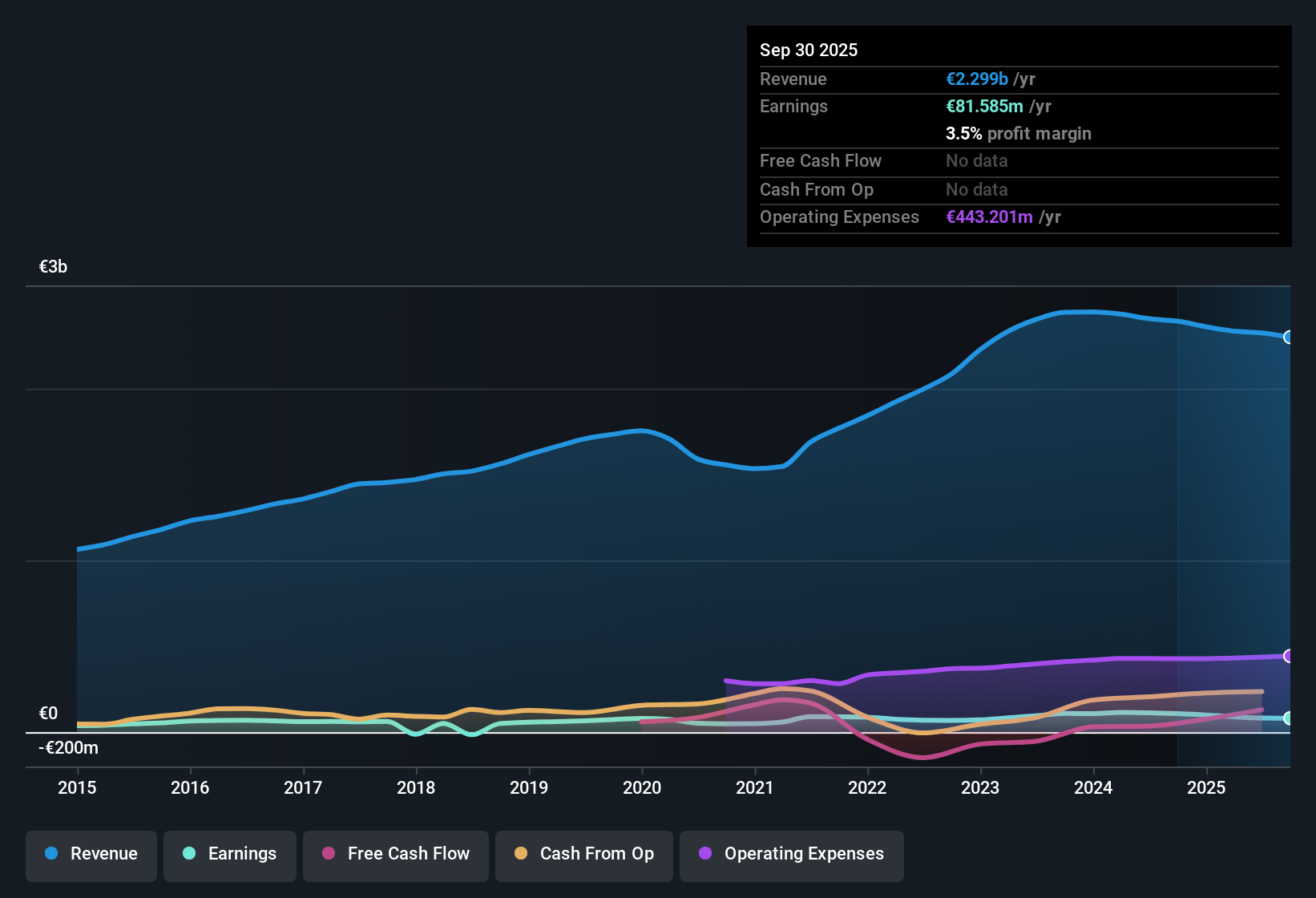

Palfinger (WBAG:PAL) is forecasting revenue growth of 6.7% per year, outpacing the Austrian market average of 3%. While earnings are expected to grow at 23.9% annually for the next three years, the company recorded negative earnings growth in the most recent year, even though it posted a 9.4% average annual earnings growth over the last five years. Margins have compressed, with the current net profit margin at 3.5%, down from 4.5% last year. This has kept investors focused on the stock’s relative value in the current market environment.

See our full analysis for Palfinger.Now we will look at how the reported results compare with broader market narratives and community views. This is where investor stories get tested by the latest numbers.

See what the community is saying about Palfinger

Order Intake Growth, Margin Recovery in Focus

- The company has maintained a strong order intake since Q4 2024, especially in the EMEA region, laying groundwork for revenue recovery and higher future net margins if operational efficiencies are achieved.

- According to analysts' consensus view, Palfinger’s focus on expanding its North American footprint and service business is expected to drive above-average revenue and margin growth.

- The goal to boost North America’s share to one-third of total revenue is a key lever, given it is Palfinger’s target region for the highest growth potential.

- Doubling of service revenue is anticipated to enhance margins, since service business typically delivers higher profitability compared to product sales.

- Consensus narrative anticipates strategic investments in North America, APAC, and sectors benefiting from ESG trends as material drivers behind improved revenue and net margins, beyond what pure demand recovery would deliver.

- See just how much these expansion efforts could move the needle on the bottom line. Analysts’ growth targets depend on successful execution.

📊 Read the full Palfinger Consensus Narrative.

Tariff Policy, Operational Inefficiencies Raise Questions

- Revenue and profit both declined in Q1 2025 despite a healthy order pipeline, as North American demand softened and the operations segment struggled with underutilization and reduced external revenue.

- Analysts’ consensus indicates several persistent risks that could dampen the pace of recovery:

- The Trump tariff policy is injecting uncertainty in North America, holding back customer orders and potentially capping growth in this strategically vital market.

- Operational inefficiencies, especially in third-party manufacturing and the non-core tail lift business undergoing restructuring, may continue to burden margins until more decisive actions are taken.

Discounted Valuation Relative to Peers

- Palfinger is trading at a price-to-earnings ratio of 14.9x, well below the European Machinery industry (20.4x) and the peer average (30.5x), and its share price of €32.25 sits at a 25% discount to the consensus analyst price target of €43.98.

- Consensus narrative points out Palfinger’s combination of attractive valuation and above-market forecasted earnings growth could provide a margin of safety for investors.

- The current share price is also substantially below the DCF fair value of €86.56, strengthening the relative value argument.

- To meet the consensus target, the company would need to trade at a lower forward PE (12.2x) by 2028, which is currently well below industry averages, aligning with analysts’ growth and margin forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Palfinger on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something new in the figures? It only takes a few minutes to build your own perspective and share your narrative, Do it your way.

A great starting point for your Palfinger research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Palfinger faces uncertainty from operational inefficiencies and volatile North American demand, which raises concerns about the consistency of its earnings recovery and long-term growth.

If you want companies with proven, consistent financial performance regardless of market cycles, check out stable growth stocks screener (2126 results) for stocks delivering reliable growth and steadier returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:PAL

Palfinger

Produces and sells crane and lifting solutions in Austria and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives