Erste Group Bank (WBAG:EBS) Sees Margin Compression Challenge Despite Sector-Leading Growth Forecasts

Reviewed by Simply Wall St

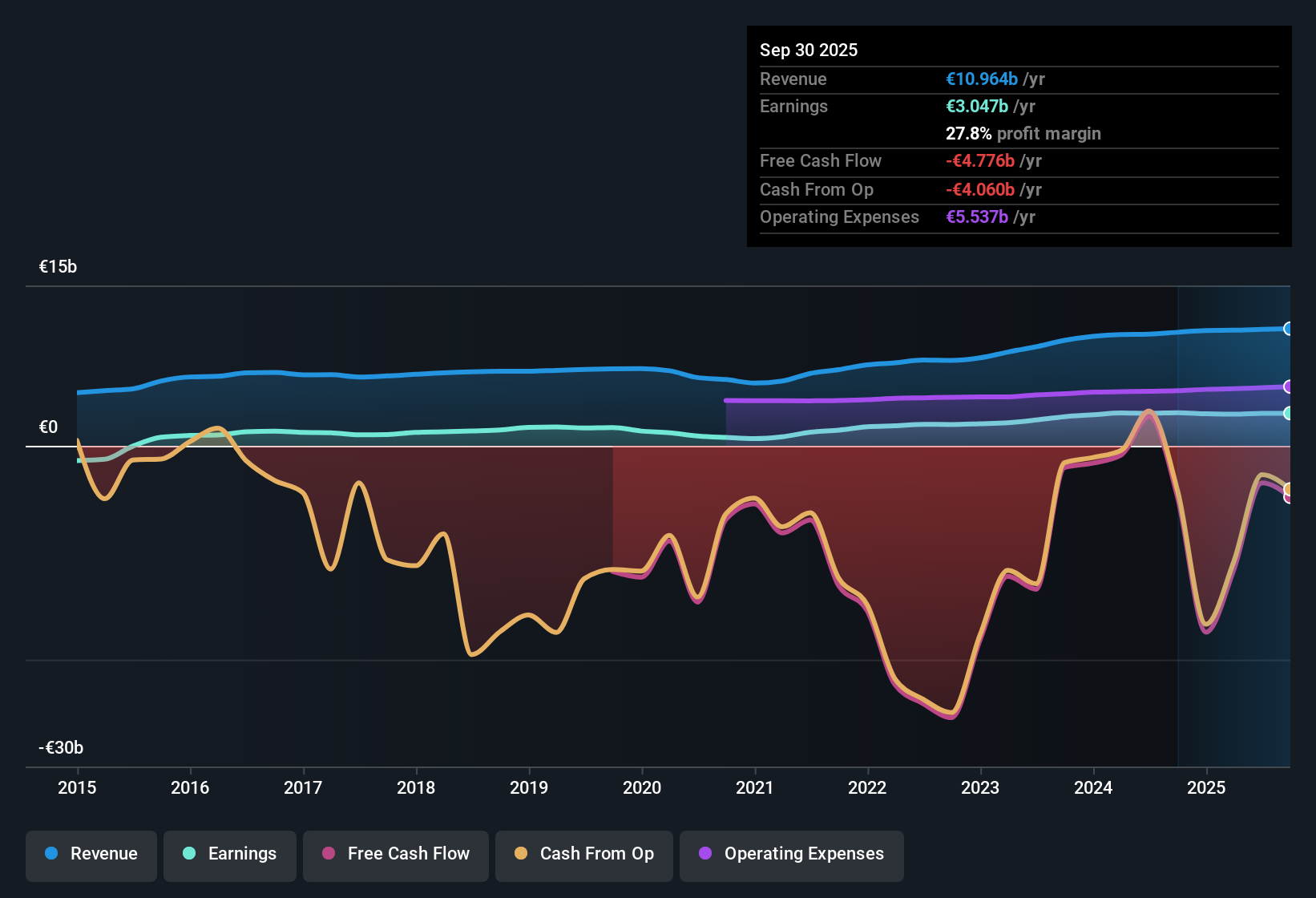

Erste Group Bank (WBAG:EBS) is expected to grow earnings at 9.15% per year and revenue at 8.8% per year, both outpacing the Austrian market’s forecasts of 8.8% and 3.2% respectively. Despite flat earnings growth over the past year and net profit margins dipping to 27.9% from last year’s 29%, the bank maintains an above-industry-average P/E ratio and continues to offer high-quality earnings and good value compared to peers. Investors are weighing these strong growth projections against recent margin pressure and mixed valuation signals.

See our full analysis for Erste Group Bank.The next section puts these results up against the market’s prevailing narratives, exploring how the data aligns or clashes with what investors expect.

See what the community is saying about Erste Group Bank

Analyst Price Target Sits at Market Level

- At a current share price of €89.75, Erste Group Bank trades nearly in line with the consensus analyst price target of €89.67, revealing little disconnect between actual market valuation and analyst forecasts.

- Analysts’ consensus view points to a fair market value, as the €89.67 target is underpinned by assumptions of €3.9 billion in 2028 earnings, revenues of €14.9 billion, and a price-to-earnings ratio of 8.8x. This suggests that future profit growth is already reflected in today’s share price.

- What is notable is the narrow gap between the share price and target, especially given the 9.15% annual forecasted earnings growth rate and expected margin compression from 27.9% to 26.2% by 2028.

- Consensus narrative highlights that, despite management’s ambitious growth initiatives, the market appears to have fully factored in both operational strengths and medium-term risks in its current valuation.

- See what long-term thematic investors think about Erste Group Bank in the full consensus viewpoint. 📊 Read the full Erste Group Bank Consensus Narrative.

Rapid Polish Expansion Raises New Integration Risks

- The acquisition and consolidation of Santander Bank Polska makes Erste Group Bank a top player in Poland, Central and Eastern Europe’s largest banking market. This instantly increases regional exposure but also introduces significant operational complexity.

- Consensus narrative notes key integration risks as the bank ramps up operations in a new country, emphasizing that legacy branch costs, regulatory hurdles, and unfamiliar market dynamics could counteract much of the projected revenue growth.

- Bears argue that macroeconomic and policy volatility in the region, alongside persistent windfall banking taxes and higher labor costs, may reduce profitability more than current forecasts assume.

- Critics highlight that if anticipated digital gains do not materialize or integration falters, margin pressure could worsen, even as expansion drives short-term top-line growth.

Digital Platform Boosts Fee Income, But Margin Pressure Lingers

- Analysts expect the enhanced George digital banking platform and asset management initiatives to drive a shift toward fee-based revenues, with revenue projected to grow 11.1% annually over the next three years even as profit margins edge down to 26.2%.

- Consensus narrative underscores a major strategic tension: while digitalization offers efficiency and growth in customer banking activity, it may not offset structural cost challenges from legacy networks and competition from fintech innovators.

- Consensus points out that the group’s dominant CEE retail and SME position gives it a long runway for growth, but operational execution on digital transformation is critical if rising labor and regulatory costs are to be contained.

- While capital strength supports both organic and acquisition-driven growth, sustainably defending net interest margins remains a challenge as the industry rapidly evolves.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Erste Group Bank on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? In just a few minutes, you can shape the narrative your way with Do it your way.

A great starting point for your Erste Group Bank research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite robust revenue and earnings forecasts, Erste Group Bank faces ongoing margin compression and increasing cost pressures that may strain future profitability.

If you want to avoid companies vulnerable to shrinking margins, discover more consistent performers in our stable growth stocks screener (2103 results). These offer steadier earnings and resilience through market changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erste Group Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:EBS

Erste Group Bank

Provides a range of banking and other financial services to retail, corporate, and public sector customers.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives