Only Four Days Left To Cash In On Bank für Tirol und Vorarlberg's (VIE:BTS) Dividend

Bank für Tirol und Vorarlberg AG (VIE:BTS) stock is about to trade ex-dividend in four days. You can purchase shares before the 14th of January in order to receive the dividend, which the company will pay on the 18th of January.

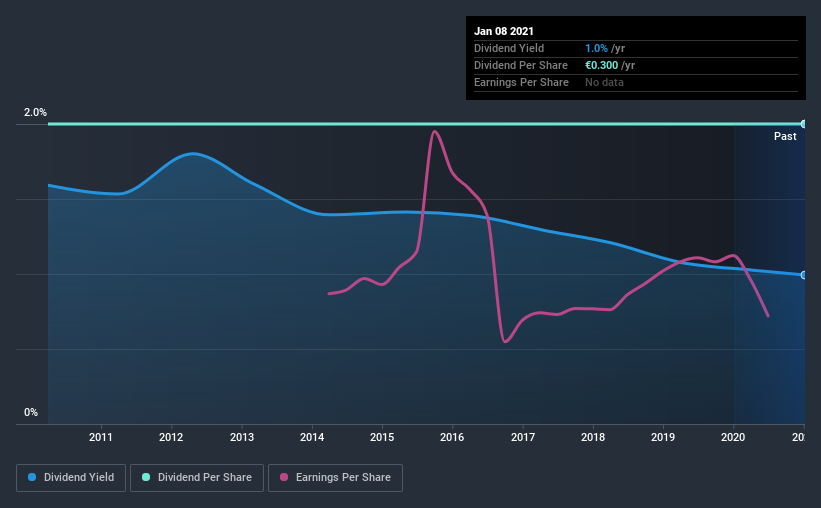

Bank für Tirol und Vorarlberg's next dividend payment will be €0.12 per share. Last year, in total, the company distributed €0.30 to shareholders. Last year's total dividend payments show that Bank für Tirol und Vorarlberg has a trailing yield of 1.0% on the current share price of €30.2. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Bank für Tirol und Vorarlberg has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Bank für Tirol und Vorarlberg

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Bank für Tirol und Vorarlberg paid out just 13% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit Bank für Tirol und Vorarlberg paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's not ideal to see Bank für Tirol und Vorarlberg's earnings per share have been shrinking at 5.0% a year over the previous five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Bank für Tirol und Vorarlberg's dividend payments are broadly unchanged compared to where they were 10 years ago. When earnings are declining yet the dividends are flat, typically the company is either paying out a higher portion of its earnings, or paying out of cash or debt on the balance sheet, neither of which is ideal.

The Bottom Line

Has Bank für Tirol und Vorarlberg got what it takes to maintain its dividend payments? Bank für Tirol und Vorarlberg's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. It doesn't appear an outstanding opportunity, but could be worth a closer look.

If you want to look further into Bank für Tirol und Vorarlberg, it's worth knowing the risks this business faces. For example, we've found 1 warning sign for Bank für Tirol und Vorarlberg that we recommend you consider before investing in the business.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Bank für Tirol und Vorarlberg, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BTV Vier Länder Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WBAG:BTS

BTV Vier Länder Bank

Provides corporate and retail banking products and services in Austria and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.