- Austria

- /

- Auto Components

- /

- WBAG:PYT

The Polytec Holding Share Price Is Down 45% So Some Shareholders Are Getting Worried

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Polytec Holding AG (VIE:PYT) share price slid 45% over twelve months. That contrasts poorly with the market return of -2.9%. The silver lining (for longer term investors) is that the stock is still 17% higher than it was three years ago. Even worse, it's down 8.8% in about a month, which isn't fun at all.

Check out our latest analysis for Polytec Holding

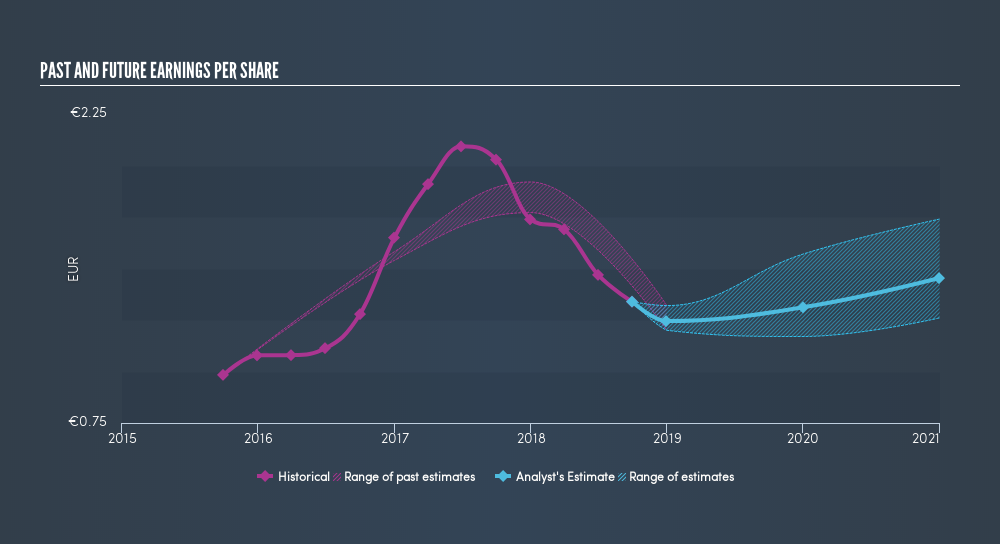

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unhappily, Polytec Holding had to report a 34% decline in EPS over the last year. The share price decline of 45% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The P/E ratio of 6.57 also points to the negative market sentiment.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Polytec Holding's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) and any discounted capital raisings offered to shareholders. Polytec Holding's TSR of was a loss of 43% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 2.9% in the twelve months, Polytec Holding shareholders did even worse, losing 43% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 5.4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Keeping this in mind, a solid next step might be to take a look at Polytec Holding's dividend track record. This freeinteractive graph is a great place to start.

We will like Polytec Holding better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AT exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WBAG:PYT

Polytec Holding

Develops and manufactures plastic solutions for passenger cars and light commercial vehicles, commercial vehicles, and smart plastic and industrial applications.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives