We Think That There Are Issues Underlying PIERER Mobility's (VIE:PMAG) Earnings

Despite posting some strong earnings, the market for PIERER Mobility AG's (VIE:PMAG) stock hasn't moved much. We did some digging, and we found some concerning factors in the details.

See our latest analysis for PIERER Mobility

A Closer Look At PIERER Mobility's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

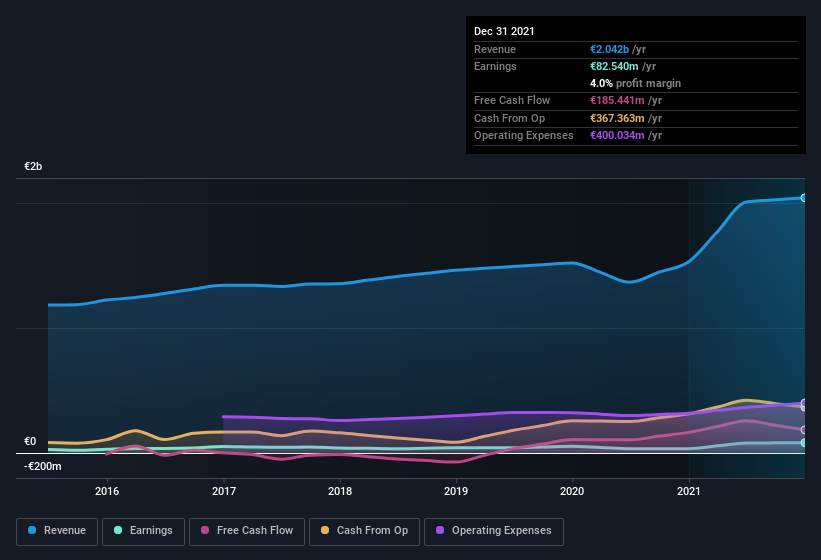

For the year to December 2021, PIERER Mobility had an accrual ratio of -0.12. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. Indeed, in the last twelve months it reported free cash flow of €185m, well over the €82.5m it reported in profit. PIERER Mobility's free cash flow improved over the last year, which is generally good to see. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, PIERER Mobility increased the number of shares on issue by 51% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out PIERER Mobility's historical EPS growth by clicking on this link.

How Is Dilution Impacting PIERER Mobility's Earnings Per Share? (EPS)

As you can see above, PIERER Mobility has been growing its net income over the last few years, with an annualized gain of 101% over three years. But EPS was only up 83% per year, in the exact same period. And the 136% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 113% in that time. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if PIERER Mobility can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On PIERER Mobility's Profit Performance

At the end of the day, PIERER Mobility is diluting shareholders which will dampen earnings per share growth, but its accrual ratio showed it can back up its profits with free cash flow. Based on these factors, we think it's very unlikely that PIERER Mobility's statutory profits make it seem much weaker than it is. If you'd like to know more about PIERER Mobility as a business, it's important to be aware of any risks it's facing. In terms of investment risks, we've identified 1 warning sign with PIERER Mobility, and understanding it should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:PKTM

PIERER Mobility

Operates as a motorcycle manufacturer in Europe, North America, Mexico, and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion