Why Investors Shouldn't Be Surprised By PIERER Mobility AG's (VIE:PKTM) 26% Share Price Surge

PIERER Mobility AG (VIE:PKTM) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

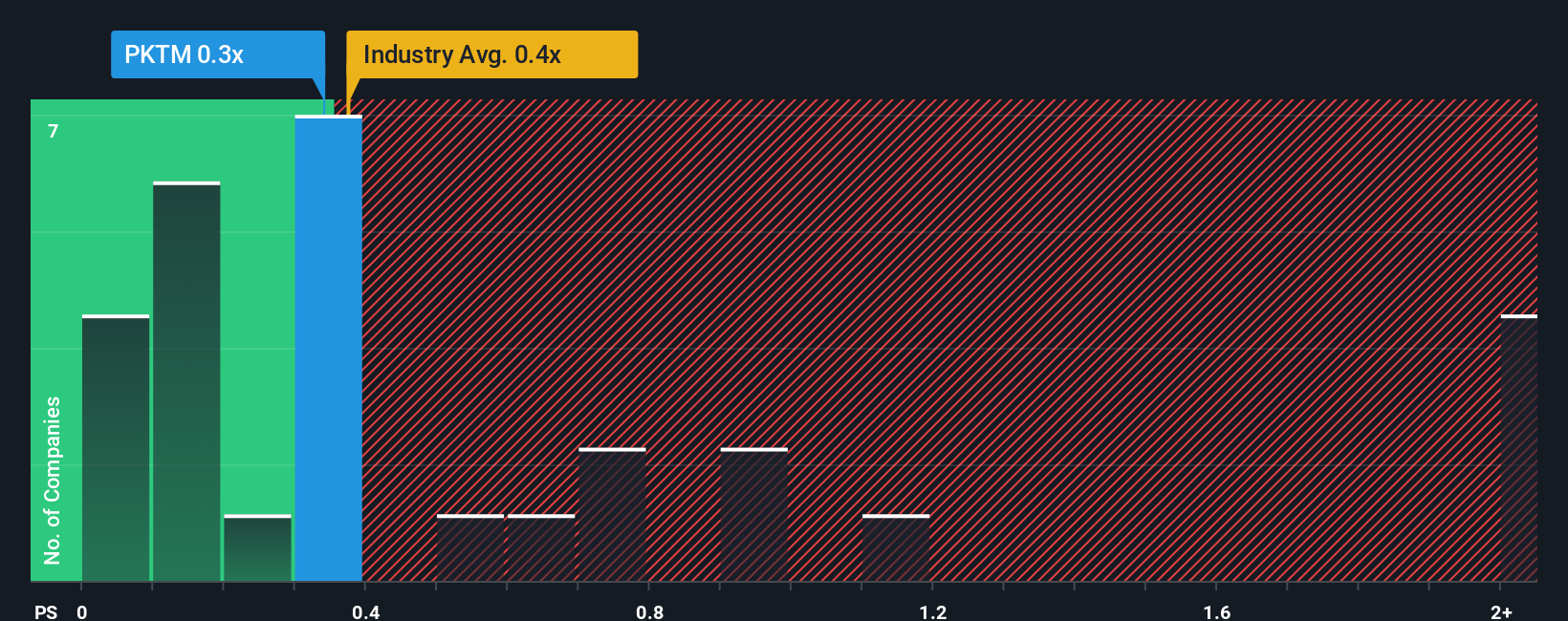

Even after such a large jump in price, you could still be forgiven for feeling indifferent about PIERER Mobility's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Auto industry in Austria is also close to 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for PIERER Mobility

How Has PIERER Mobility Performed Recently?

PIERER Mobility has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on PIERER Mobility will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like PIERER Mobility's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. This means it has also seen a slide in revenue over the longer-term as revenue is down 8.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 2.4% each year during the coming three years according to the only analyst following the company. That's shaping up to be similar to the 3.3% per year growth forecast for the broader industry.

With this in mind, it makes sense that PIERER Mobility's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does PIERER Mobility's P/S Mean For Investors?

PIERER Mobility's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A PIERER Mobility's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Auto industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Having said that, be aware PIERER Mobility is showing 3 warning signs in our investment analysis, and 2 of those are potentially serious.

If these risks are making you reconsider your opinion on PIERER Mobility, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:PKTM

PIERER Mobility

Operates as a motorcycle manufacturer in Europe, North America, Mexico, and internationally.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives