- Argentina

- /

- Renewable Energy

- /

- BASE:CEPU

Undiscovered Gems with Strong Fundamentals for August 2024

Reviewed by Simply Wall St

As global markets face heightened volatility and economic uncertainties, the rotation toward value stocks and small-caps has stalled. Despite this backdrop, investors can still find opportunities by focusing on companies with strong fundamentals that are well-positioned to weather market fluctuations. In this article, we will explore three undiscovered gems with robust financial health and promising growth potential for August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 15.65% | 24.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| M+S Hydraulic AD | NA | 19.76% | 26.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 4.12% | 8.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Central Puerto (BASE:CEPU)

Simply Wall St Value Rating: ★★★★☆☆

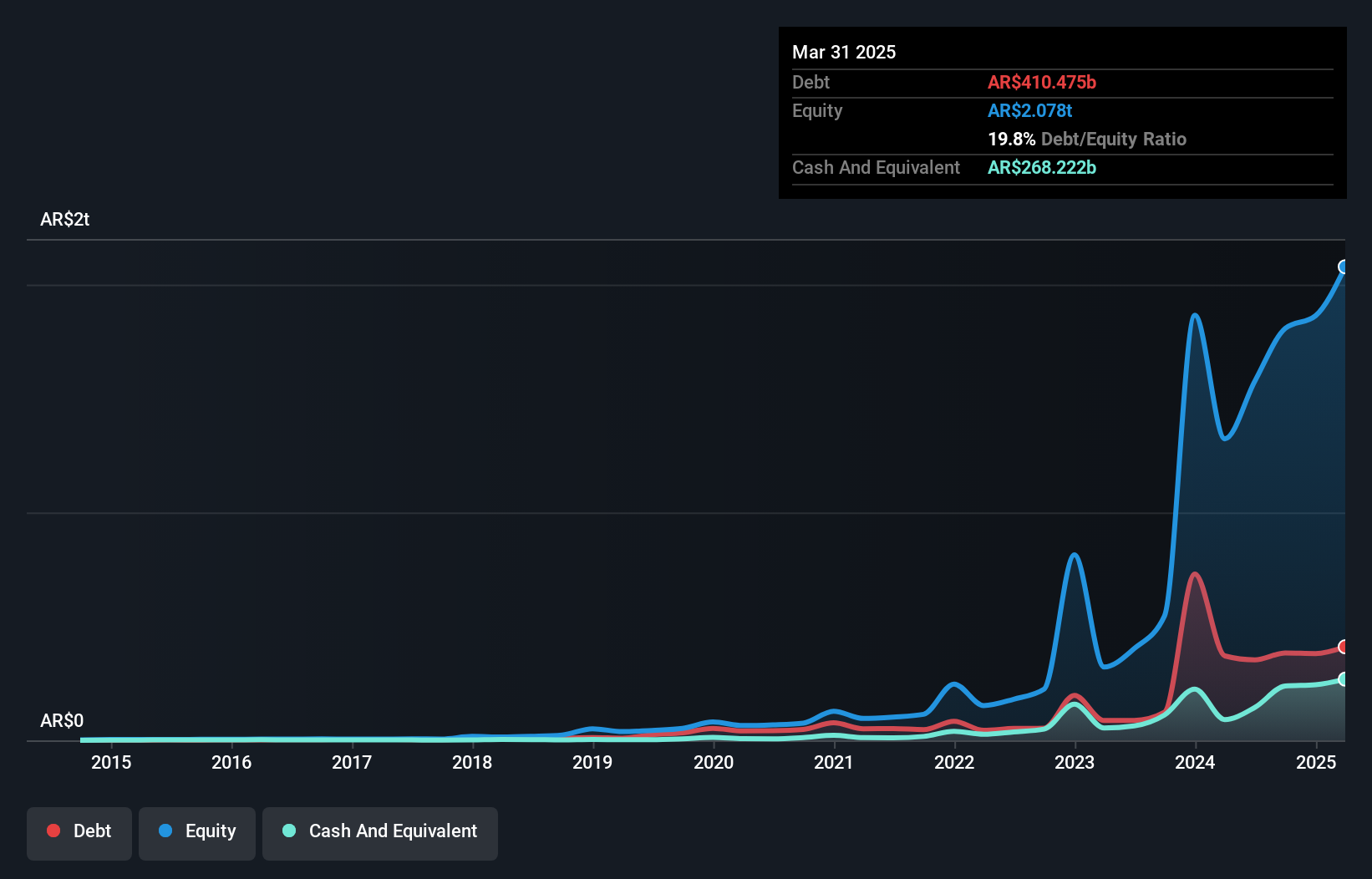

Overview: Central Puerto S.A. engages in electric power generation in Argentina and has a market cap of ARS1.57 trillion.

Operations: Central Puerto S.A. generates revenue primarily from electric power generation, with ARS259.72 billion from conventional sources and ARS62.64 billion from renewable sources, as well as ARS134.94 billion from natural gas transport, commercialization, and distribution. The company also earns a smaller portion of its revenue from forest activities amounting to ARS8.40 billion.

Central Puerto has shown remarkable growth, with earnings up 258.4% over the past year, outpacing the Renewable Energy industry’s 0.3%. The company reported first-quarter sales of ARS 128.71 billion and net income of ARS 23.7 billion, a significant jump from ARS 577.77 million last year. Its price-to-earnings ratio stands at a favorable 9.4x compared to the Argentine market's 16.7x, indicating good value among peers and industry standards.

- Unlock comprehensive insights into our analysis of Central Puerto stock in this health report.

Explore historical data to track Central Puerto's performance over time in our Past section.

Molinos Agro (BASE:MOLA)

Simply Wall St Value Rating: ★★★★★☆

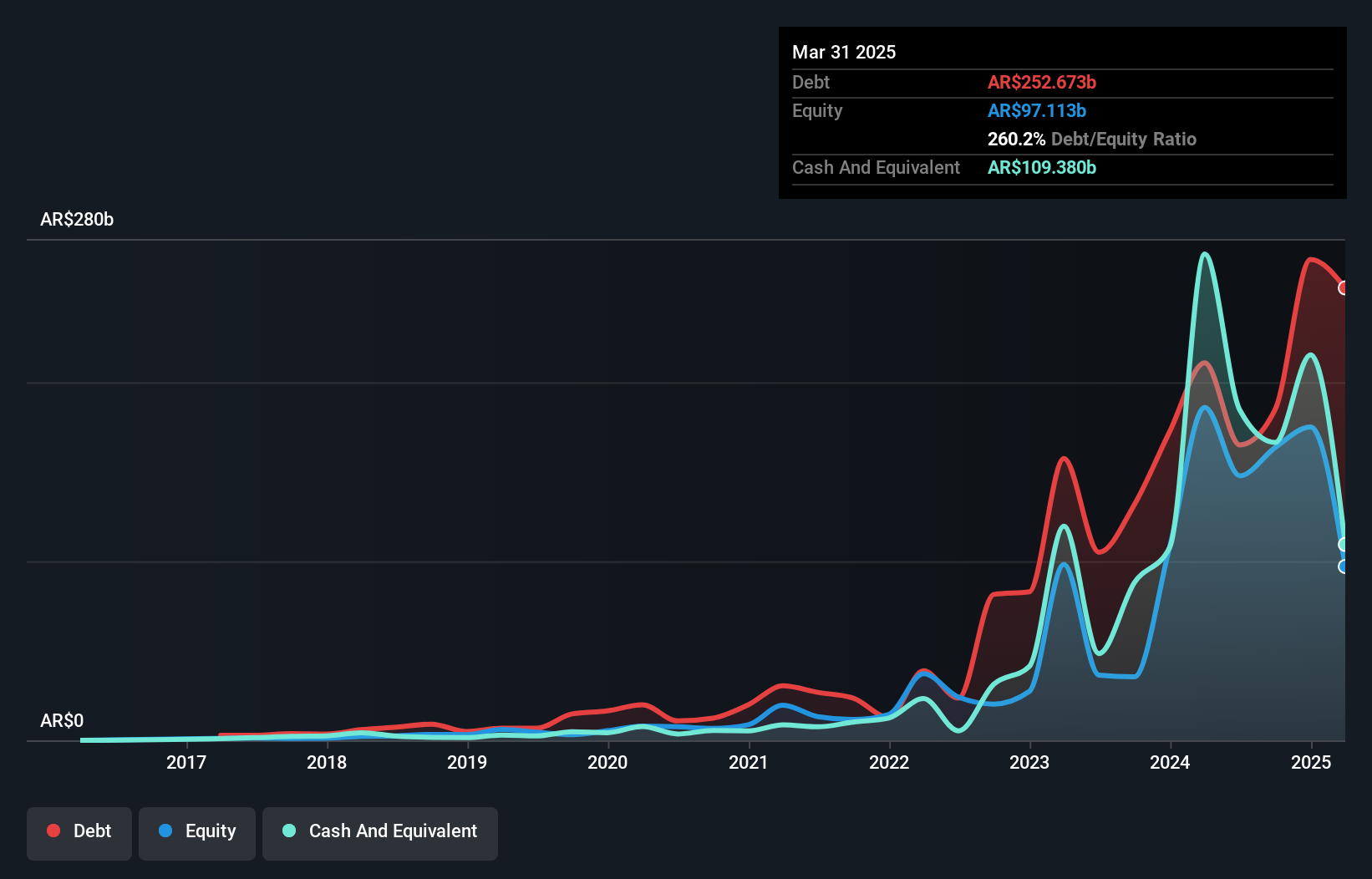

Overview: Molinos Agro S.A. is engaged in the production and sale of grain, soybean, and cereal products with a market capitalization of ARS883.66 billion.

Operations: Molinos Agro generates revenue primarily from oilseeds and their industrial products (ARS1.39 billion) and cereals (ARS275.50 million). The company's net profit margin is a key indicator of its profitability.

Molinos Agro boasts a compelling profile with earnings growth of 25.9% over the past year, outpacing the food industry’s 9.8%. Despite a slight uptick in its debt-to-equity ratio from 111% to 113.3% over five years, it has more cash than total debt, indicating strong financial health. The company repurchased shares recently and reported net income of ARS 54.11 billion for the fiscal year ending March 31, 2024, up from ARS 42.97 billion last year.

- Click here to discover the nuances of Molinos Agro with our detailed analytical health report.

Gain insights into Molinos Agro's historical performance by reviewing our past performance report.

Zenith Bank (NGSE:ZENITHBANK)

Simply Wall St Value Rating: ★★★★★☆

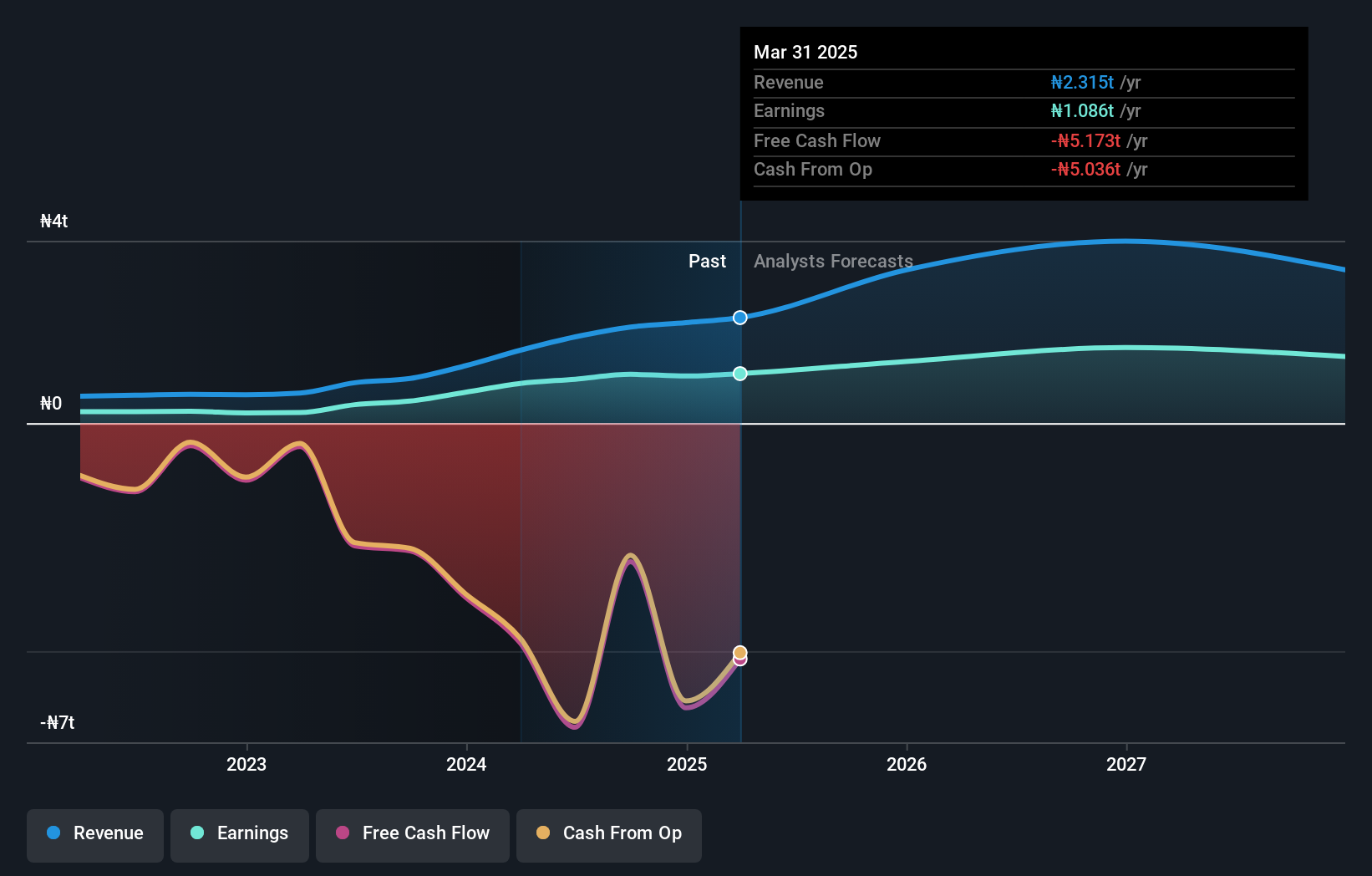

Overview: Zenith Bank Plc offers a range of banking and financial services to both corporate and individual clients across Nigeria, other parts of Africa, and internationally, with a market cap of NGN1.15 trillion.

Operations: Zenith Bank Plc generates revenue primarily from its operations in Nigeria (NGN1.34 billion), with additional contributions from Africa (NGN174.30 million) and Europe (NGN92.41 million). The net profit margin is %.

Zenith Bank, with total assets of NGN24,280.8B and equity of NGN2,847.5B, has seen earnings soar by 274.7% in the past year, outpacing industry growth of 120%. The bank's sufficient allowance for bad loans stands at 140%, while non-performing loans are high at 4.1%. With customer deposits making up 78% of its liabilities, Zenith Bank's funding is primarily low-risk. The price-to-earnings ratio is attractively low at 1.3x compared to the market average of 6.1x.

- Delve into the full analysis health report here for a deeper understanding of Zenith Bank.

Understand Zenith Bank's track record by examining our Past report.

Seize The Opportunity

- Reveal the 4723 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BASE:CEPU

Central Puerto

Engages in the electric power generation activities in Argentina.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives