- United Arab Emirates

- /

- Marine and Shipping

- /

- DFM:GULFNAV

Why Investors Shouldn't Be Surprised By Gulf Navigation Holding PJSC's (DFM:GULFNAV) 33% Share Price Surge

Despite an already strong run, Gulf Navigation Holding PJSC (DFM:GULFNAV) shares have been powering on, with a gain of 33% in the last thirty days. The last 30 days were the cherry on top of the stock's 322% gain in the last year, which is nothing short of spectacular.

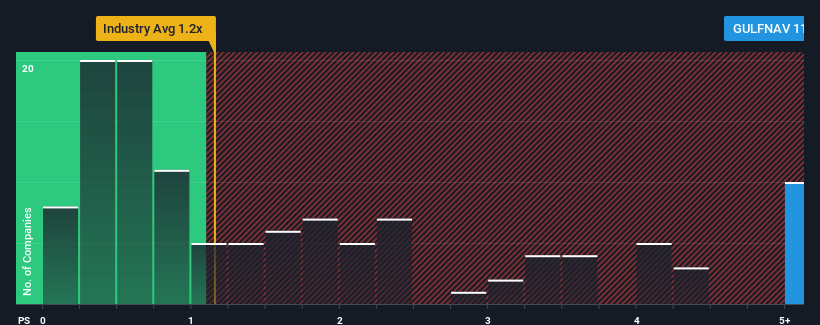

Following the firm bounce in price, when almost half of the companies in the United Arab Emirates' Shipping industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Gulf Navigation Holding PJSC as a stock not worth researching with its 11.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Gulf Navigation Holding PJSC

What Does Gulf Navigation Holding PJSC's P/S Mean For Shareholders?

The revenue growth achieved at Gulf Navigation Holding PJSC over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying to much for the stock.

Although there are no analyst estimates available for Gulf Navigation Holding PJSC, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Gulf Navigation Holding PJSC?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Gulf Navigation Holding PJSC's to be considered reasonable.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 17% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 29% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

In light of this, it's understandable that Gulf Navigation Holding PJSC's P/S sits above the majority of other companies. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Shares in Gulf Navigation Holding PJSC have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Gulf Navigation Holding PJSC confirms that the company's less severe contraction in revenue over the past three-year years is a major contributor to its higher than industry P/S, given the industry is set to decline even more. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under any additional threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. At least if the company's outlook remains more positive than its peers, it is unlikely that the share price will experience a significant decline in the near future.

Plus, you should also learn about these 4 warning signs we've spotted with Gulf Navigation Holding PJSC (including 1 which makes us a bit uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:GULFNAV

Gulf Navigation Holding PJSC

Operates as a shipping and maritime company in the United Arab Emirates.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives